Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

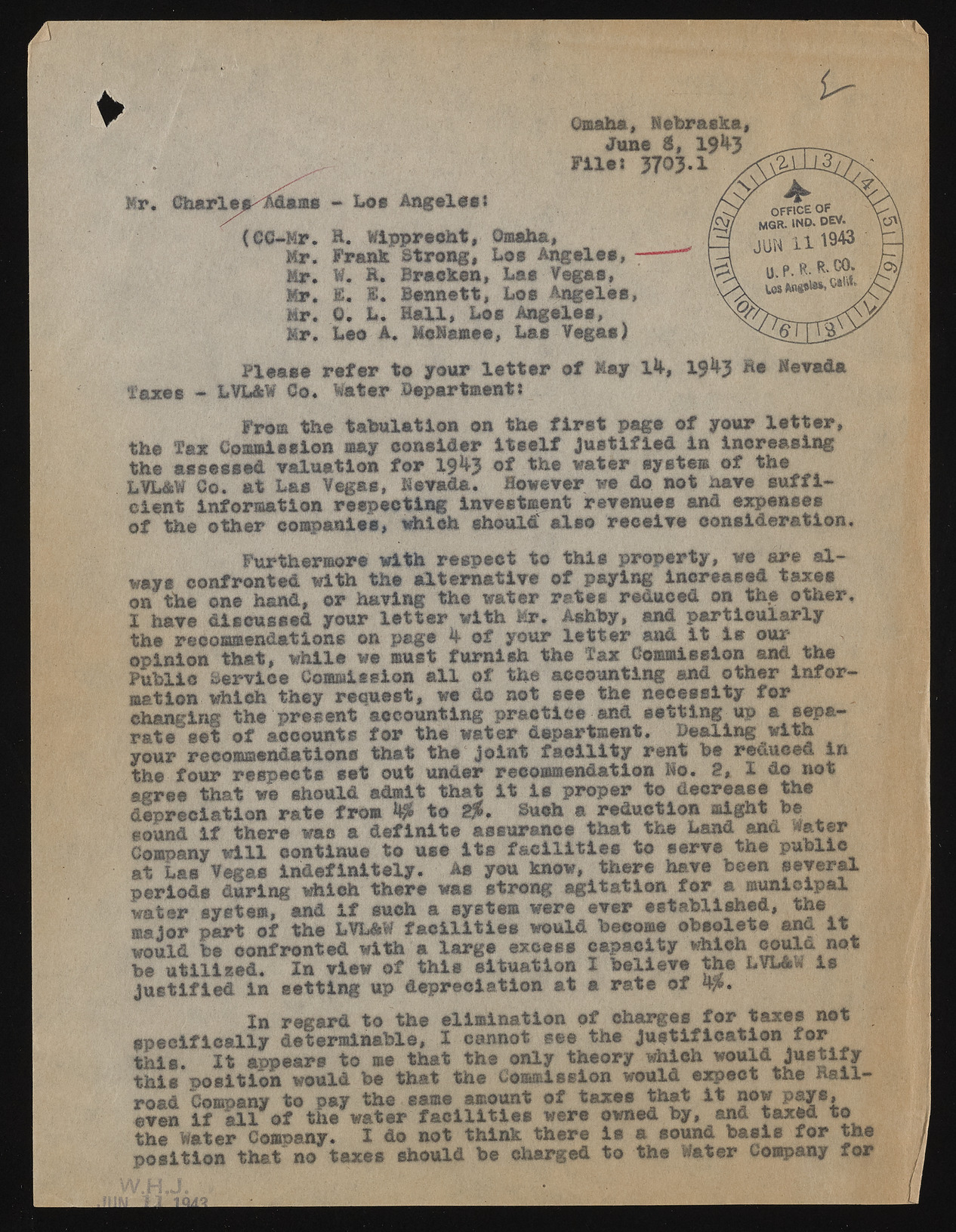

Offiah*, Nebraska, June S, 19^3 m * i 3 7 0 3 . 1 'lejk-Adami (€C-M r. 1. Wippreoht, Omaha, Mr. Frank Strong, Los Angeles, Mr. W. p Bracken, Las Vegas, Mr. K« I . Bennett, Los Angeles, Mr. 0. L. H a ll, Los Angeles, Mr. Leo A. Mcliamee, Las Vegas) P le a se r e f e r t© your l e t t e r o f May Ife, 1 9 A3 He Nevada f a r e s - LVL&W Co. Water Department* Prom the ta b u la tio n on the f i r s t pags o f your l a t t e r , the fa x Coffiffilaslon stay con sid er I t s e l f J u s t ifie d in in crea sin g the a sse ssed v a lu a tio n f o r i| f| o f the water system o f the LVL&W Co. a t Las Vegas, Nevada. However we do not have s u f f i c ien t in form ation re sp e ctin g investment revenues and expenses o f the oth er companies, which should a ls o rs c e iv e c on sid eration . Furthermore w ith re sp e ct to t h is p rop erty , we are a l ways confronted with the a lt e r n a t iv e o f paying in creased taxes on the one hand, o r having the w ater r a te s reduced on the other. I have d iscu ssed your l e t t e r w ith Mr. Ashby, and p a r t ic u la r ly the recommendations on page A o f your l e t t e r and i t i s our opinion th at, w h ile we must fu rn ish the fa x Commission and the P u b lic S ervice Commission a l l o f the accounting and oth er in fo r mation which they req u est, we do not see the n ec essity f o r changing the present accounting p ra c tic e and s e ttin g 'u p a separ a t e set o f accounts f o r the w ater department. D ealing with your recommendations that the jo in t f a c i l i t y ren t fee reduced In the fo u r resp ecte eat out under recommendation Mo. 2, X do not agree that we should admit th at I t i s proper to decrease the d ep re c iatio n r a t e from ¥ to 2$. Such a reduction might fee sound i f th ere was a d e fin it e assurance th at the Land and Water Company w i l l continue to use i t s f a c i l i t i e s to serve the p u b lic at Las Vegas in d e f in it e ly . As you know, there have been se v e ra l p e rio d s durin g which th ere was strong a g it a t io n f o r a m unicipal w ater system, and i f such a system were ever e sta b lish e d , the major p a rt o f the LVL&W f a c i l i t i e s would become o b so le te and I t would be confronted with a la r g e excess capacity which could not be u t i li s e d . In view o f t h is s itu a tio n I b e lie v e the LVL&W i s J u s t ifie d in s e ttin g up d e p re c ia tio n a t a ra te o f dp* In re g a rd to the elim in atio n o f charges f o r taxes not s p e c i f i c a lly determ inable, S cannot see the j u s t if i c a t io n f o r t h is . I t appears to me that the only theory which would j u s t i f y t h is p o s itio n would be that the Commission would expect the H a ll-road Company to pay the same amount o f taxes that i t now pays, even i f a l l o f the w ater f a c i l i t i e s wers owned by, and taxed to the Hater Company. I do not think there i s a sound b a s is f o r the p o s itio n that no taxes should be charged to the Mater Company fo r