Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

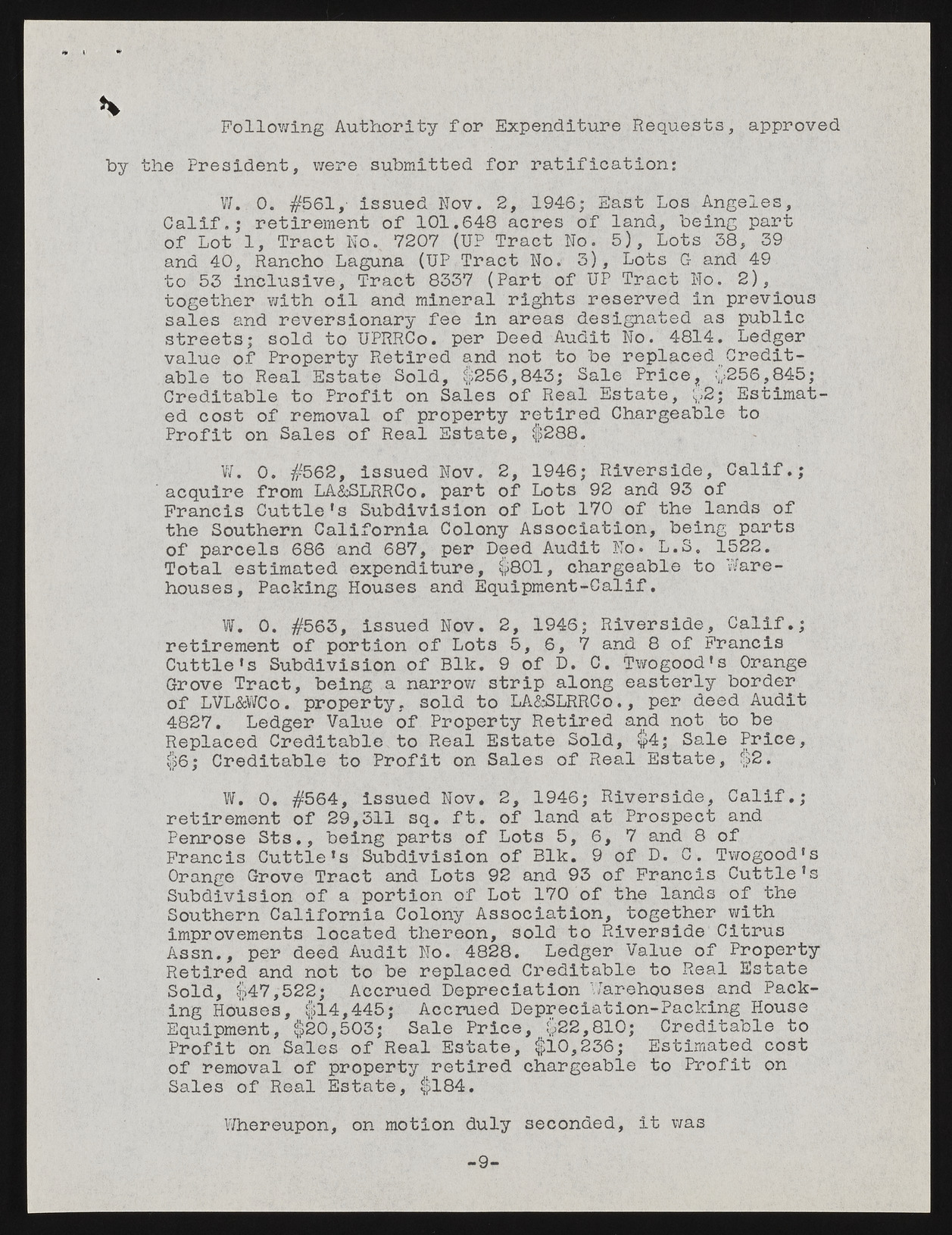

Following Authority for Expenditure Requests, approved by the President, were submitted for ratification: W. 0. #561,' issued Nov. 2, 1946; East Los Angeles, Calif.; retirement of 101.648 acres of land, being part of Lot 1, Tract No. 7207 (UP Tract No. 5), Lots 38, 39 and 40, Rancho Laguna (UP Tract No. 3), Lots G and 49 to 53 inclusive, Tract 8337 (Part of UP Tract No. 2), together with oil and mineral rights reserved in previous sales and reversionary fee in areas designated as public streets; sold to UPRRCo. per Deed Audit No. 4814. Ledger value of Property Retired and not to be replaced Creditable to Real Estate Sold, $256,843; Sale Price, y256,845; Creditable to Profit on Sales of Real Estate, $2; Estimated cost of removal of property retired Chargeable to Profit on Sales of Real Estate, $288. W. 0. #562, issued Nov. 2, 1946; Riverside, Calif.; acquire from LA&SLRRCo. part of Lots 92 and 93 of Francis Cuttle's Subdivision of Lot 170 of the lands of the Southern California Colony Association, being parts of parcels 686 and 687, per Deed Audit No* L.S, 1522. Total estimated expenditure, $801, chargeable to Warehouses, Packing Houses and Equipment-Calif. W. 0. #563, issued Nov. 2, 1946; Riverside, Calif.; retirement of portion of Lots 5, 6, 7 and 8 of Francis Cuttle's Subdivision of Blk. 9 of D. C. Twogood's Orange Grove Tract, being a narrow strip along easterly border of LVL&WCo. property, sold to LA&SLRRCo., per deed Audit 4827. Ledger Value of Property Retired and not to be Replaced Creditable to Real Estate Sold, $4; Sale Price, $6; Creditable to Profit on Sales of Real Estate, $2. W. 0. #564, issued Nov. 2, 1946; Riverside, Calif.; retirement of 29,311 sq. ft. of land at Prospect and Penrose Sts., being parts of Lots 5, 6, 7 and 8 of Francis Cuttle's Subdivision of Blk. 9 of D. C. Twogood' Orange Grove Tract and Lots 92 and 93 of Francis Cuttle' Subdivision of a portion of Lot 170 of the lands of the Southern California Colony Association, together with improvements located thereon, sold to Riverside Citrus Assn., per deed Audit No. 4828. Ledger Value of Property Retired and not to be replaced Creditable to Real Estate Sold, $47,522; Accrued Depreciation v/arehouses and Packing Houses, $14,445; Accrued Depreciation-Packing House Equipment, $20,503; Sale Price, $22,810; Creditable to Profit on Sales of Real Estate, $10,236; Estimated cost of removal of property retired chargeable to Profit on Sales of Real Estate, $184. Whereupon, on motion duly seconded, it was -9- ca ca