Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

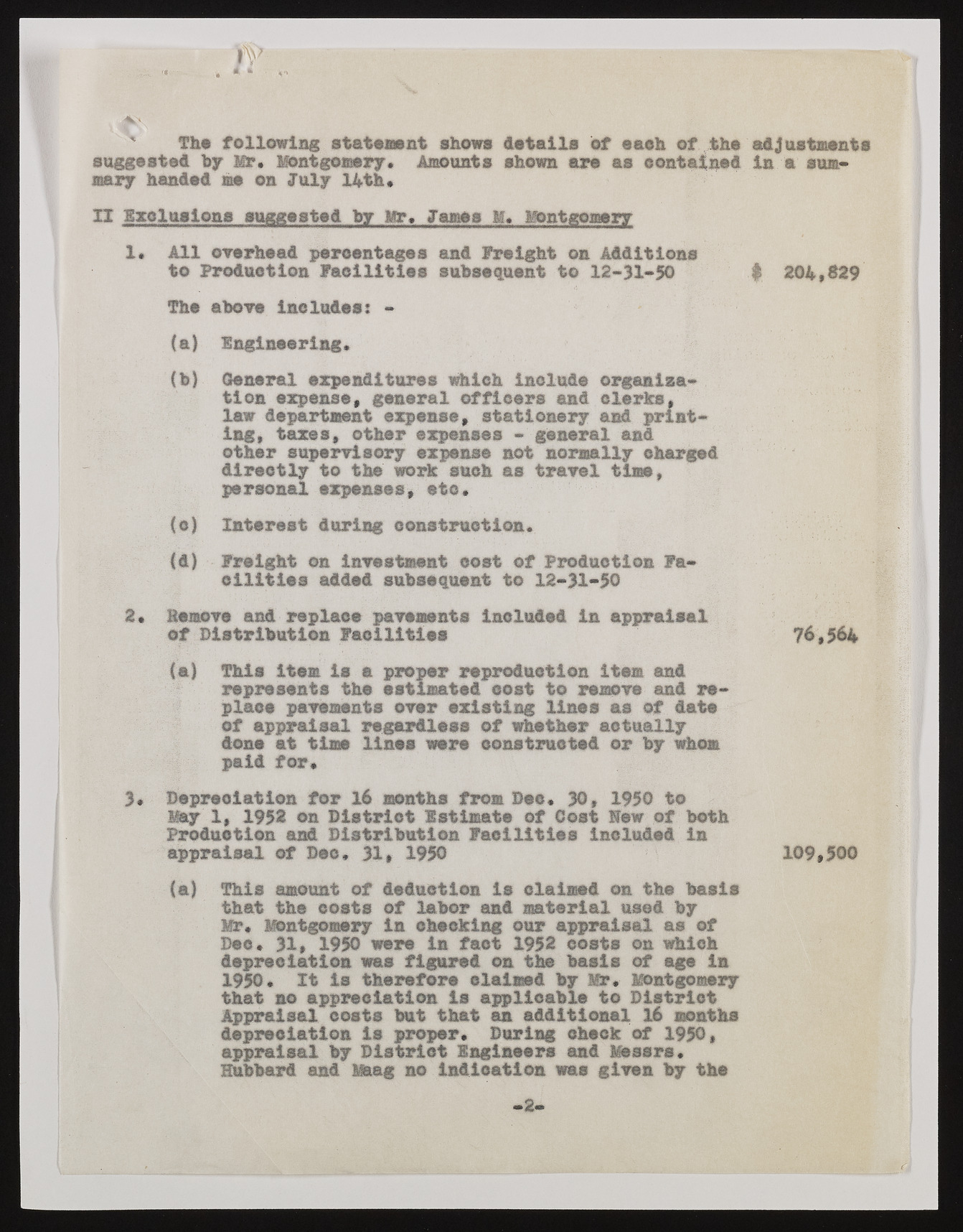

The following statement shows details of e&eh of the suggested by Mr. Montgomery. Amounts shown ere as contained mary handed os on July 14th. II Exclusions suggested by Mr, James M. Montgomery 1. All overhead percentages and freight on Additions to Production Facilities subsequent to 12-31-50 The above includes: - (a) Engineering. (b) General expenditures which include organization expense, general officers and clerks, law department expense, stationery and printing, taxes, other expenses - general and other supervisory expense not normally charged directly to the work such as travel time, personal expenses, etc. (c) Interest during construction. (d) Freight on Investment cost of Production Facilities added subsequent to 12-31-50 2. Remove and replace pavements Included in appraisal of Distribution Facilities (a) This item is a proper reproduction item and represents the estimated cost to remove and replace pavements over existing lines as of date of appraisal regardless of whether actually done at time lines were constructed or by whom paid for. 3. Depreciation for 16 months from Dec. 30, 1950 to May 1, 1952 on District Estimate of Cost Hew of both Production and Distribution Facilities included in appraisal of Dec. 31, 1950 (a) This amount of deduction is claimed on the basis that the costs of labor and material used by Mr. Montgomery in checking our appraisal as of Dec. 31, 1950 were in faot 1952 costs on which depreciation was figured on the basis of age in 1950. It is therefore claimed by Mr. Montgomery that no appreciation Is applicable to District Appraisal costs but that an additional Id months depreciation is proper. During eheGk of 1950, appraisal by District Engineers and Messrs. Hubbard and Maag no indication was given by the -2- adjustments in a sum- 11 204,829 76,564 109,500