Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

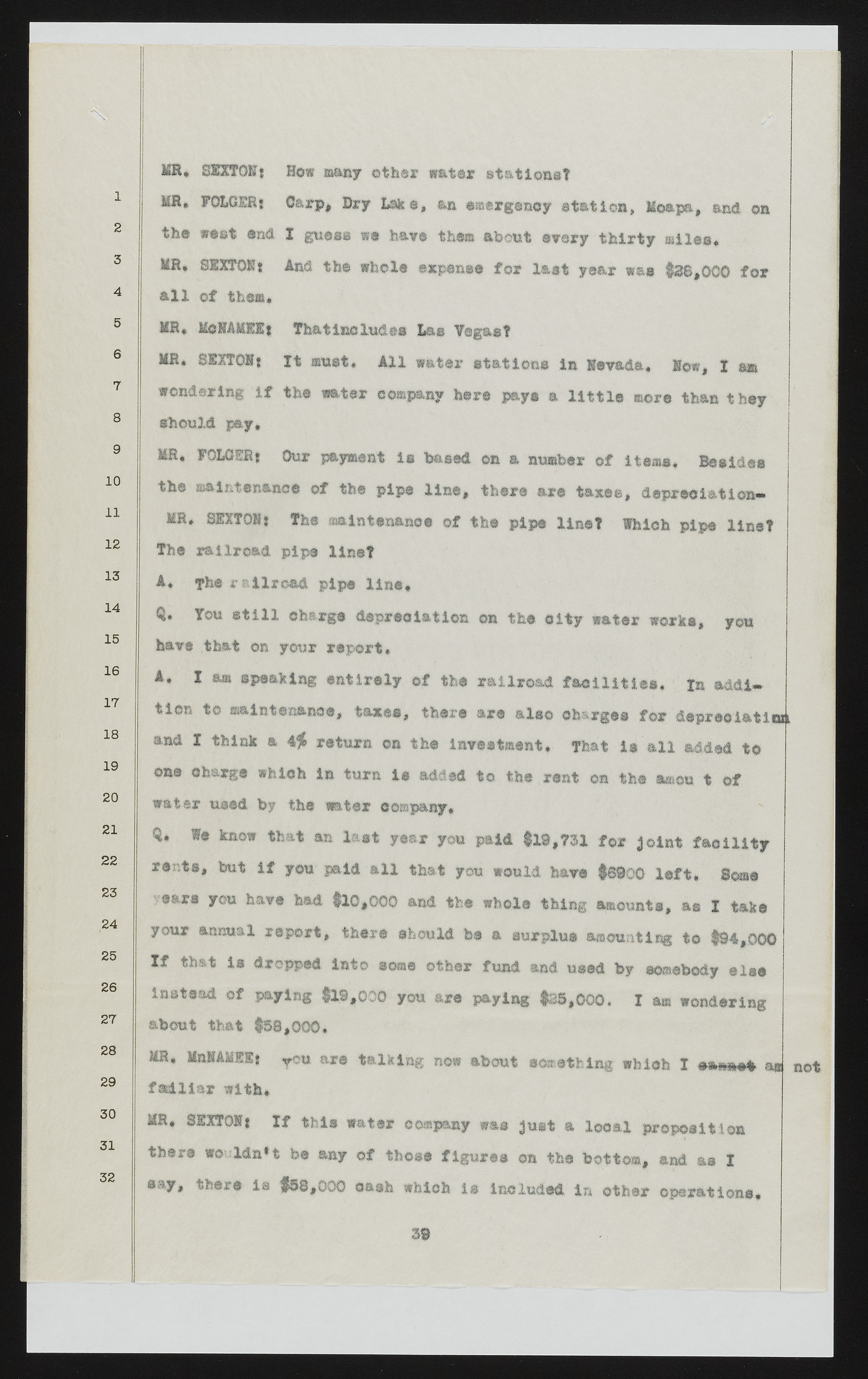

sgii i 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 MR* SX&TOMf Ho* many other water stations? IR* WOtQMRi &&rp-$ Dry tefce, an emergency a tat ion, Moapa, and ©a tfe© west end t gad as we have them about every thirty mil®®* MR. SXXTQSs And the whole expense for last year was $38*000 for all of them* MR* MoMMRIj That includes tee YogasT MR* SSXTOH? it must* All water station® in Hevada. Mow, 1 m wondering if the water company hers pays a llttl® mors than they Should pay, MR, YQMHER* Our payment is based on a number of items* Besides th® maintenance of the pipe line, there are tares, depreciation* MR, SEXTOSt the maintenance of the pipe line? Which pipe line? The railroad pipe line? A. yhe railroad pipe line* % still ©barge depreciation on the eity water works, yon hare .that on your report* A, 1 am speaking entirely of the railroad facilities* in addition to maintenance, taxes, there are also charges for depreciation, and I think & 4# return on the investment# that la all'added, to on® charge which in turn is added to the rent on the m m t of water meed by the water company, Q. 9* know that m teat year you paid lit,731 for Joint facility rents, but if you paid all that you would hare $8900 left. Some year# you hare had $10,000 and the whole thing amounts, as I take your annual report, there should be a surplus amounting to $94,000 If that is dropped into some other fund and used by somebody else instead of paying $19,000 you are paying $89,000. I am wondering about that |SS,000* MR* MnWAliSKt you are talking now about something which I m familiar with* MR* SEXTOSt If this water company was Just a local proposition there *©ulda9t tee any of those figures cm the bottom, and m X say, there is $88,000 ©ash which is included in other operations* 89