Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

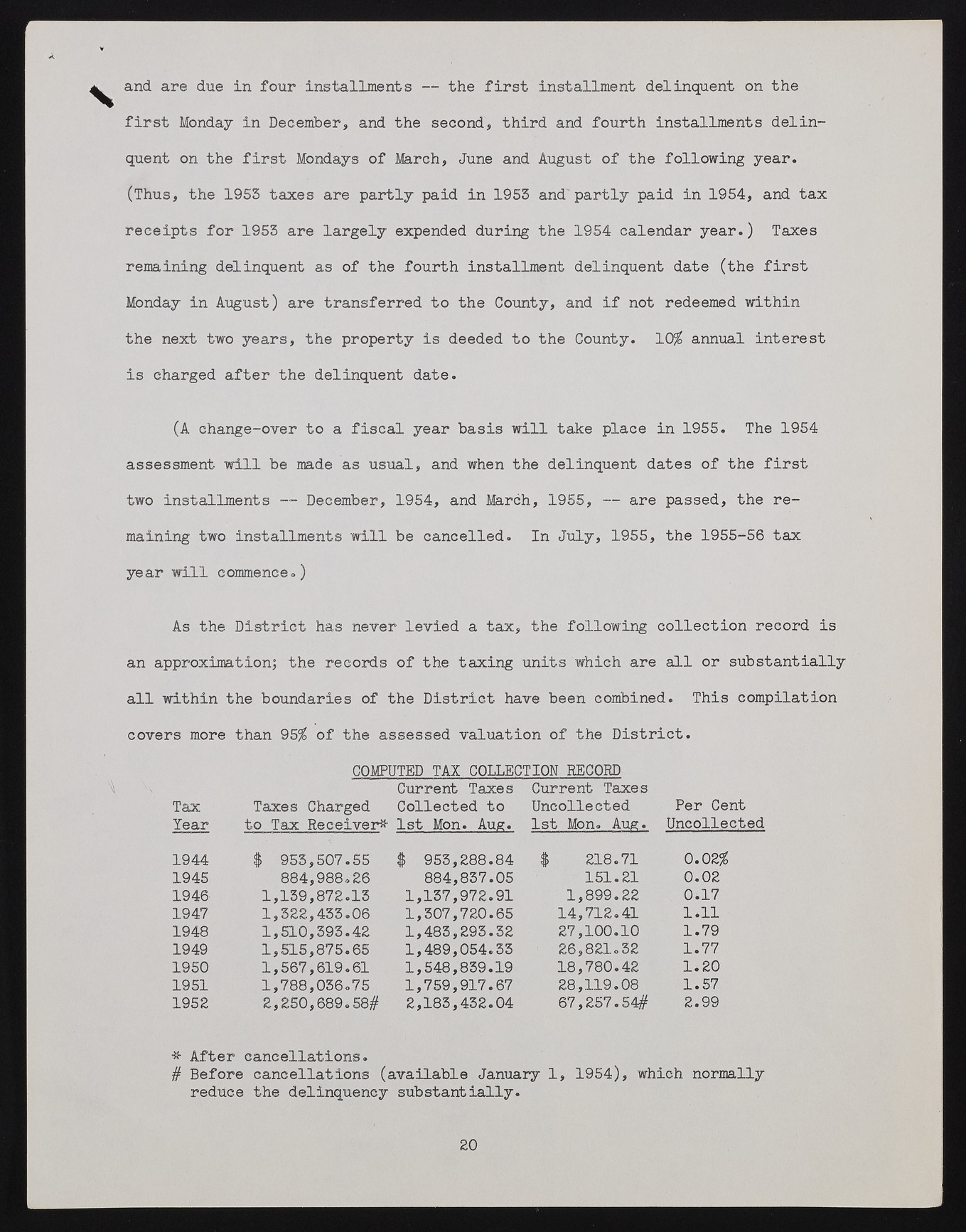

and are due in four installments — the first installment delinquent on the first Monday in December, and the second, third and fourth installments delinquent on the first Mondays of March, June and August of the following year. (Thus, the 1953 taxes are partly paid in 1953 and'partly paid in 1954, and tax receipts for 1953 are largely expended during the 1954 calendar year.) Taxes remaining delinquent as of the fourth installment delinquent date (the first Monday in August) are transferred to the County, and if not redeemed within the next two years, the property is deeded to the County. 10$ annual interest is charged after the delinquent date. (A change-over to a fiscal year basis will take place in 1955. The 1954 assessment will be made as usual, and when the delinquent dates of the first two installments -- December, 1954, and March, 1955, — are passed, the remaining two installments will be cancelled. In July, 1955, the 1955-56 tax year will commence.) As the District has never levied a tax, the following collection record is an approximation; the records of the taxing units which are all or substantially all within the boundaries of the District have been combined. This compilation covers more than 95$ of the assessed valuation of the District. Tax Year COMPUTED TAX COLLECTION RECORD Current Taxes Current Taxes Taxes Charged Collected to Uncollected to Tax Receiver* 1st Mon. Aug. 1st Mon. Aug. Per Cent Uncollected 1944 1945 1946 1947 1948 1949 1950 1951 1952 $ 953,507.55 $ 953,288.84 $ 218.71 0.02$ 884,988.26 884,837.05 151.21 0.02 1,139,872.13 1,137,972.91 1,899.22 0.17 1,322,433.06 1,307,720.65 14,712.41 1.11 1,510,393.42 1,483,293.32 27,100.10 1.79 1,515,875.65 1,489,054.33 26,821.32 1.77 1,567,619.61 1,548,839.19 18,780.42 1.20 1,788,036.75 1,759,917.67 28,119.08 1.57 2,250,689.58# 2,183,432.04 67,257.54# 2.99 * After cancellations. # Before cancellations (available January 1, 1954), which normally reduce the delinquency substantially. 20