Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

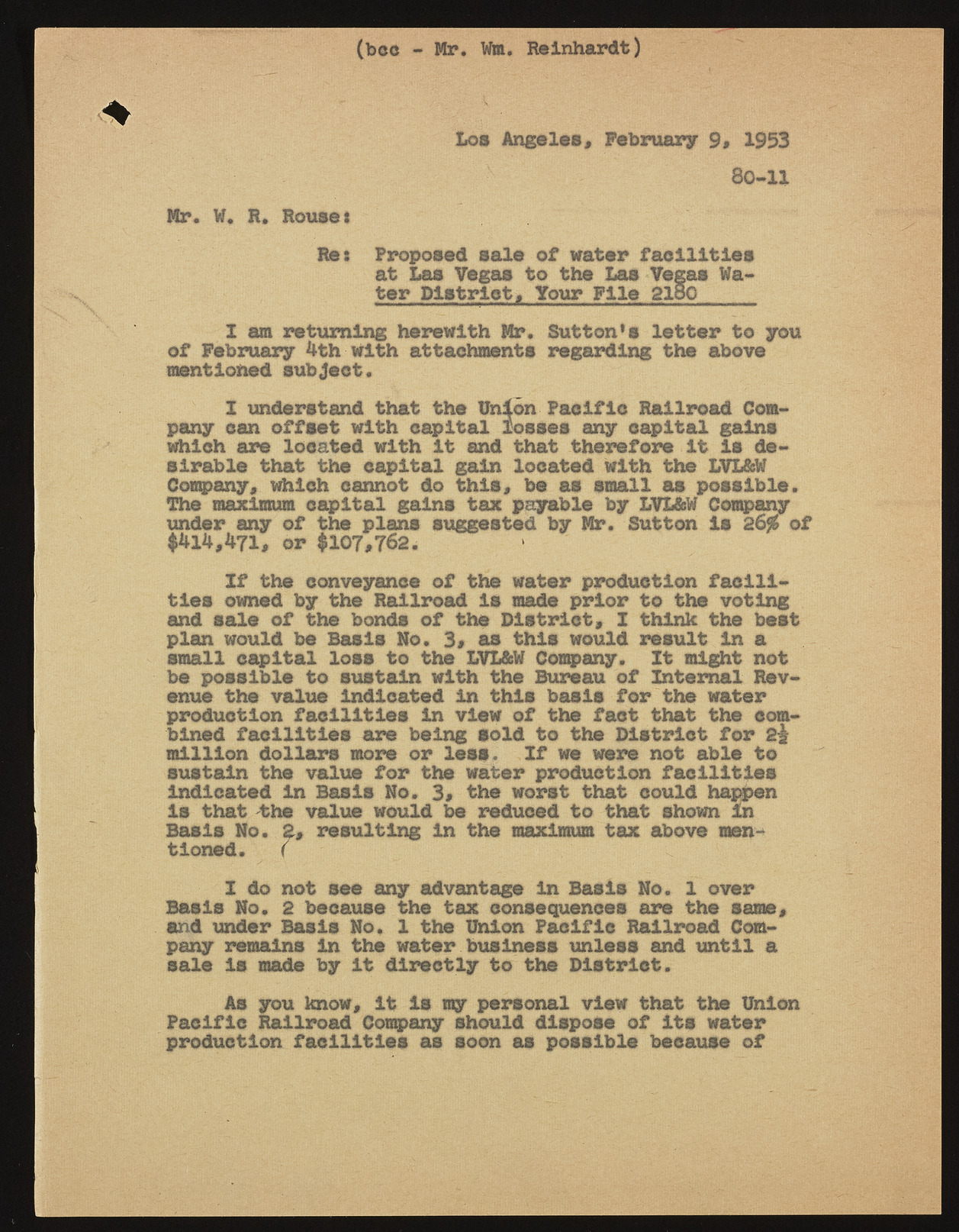

(bcc - Mr. Wm. Reinhardt) gE Los Angeles, February 9, 1953 80-11 Mr. W. R. Rouses Ret Proposed sale of water facilities at Las Vegas to the Las Vegas Wa~ ter Pistriot, Your File 2180 X am returning herewith Mr, Sutton’s letter to you of February 4th with attachments regarding the above mentioned subject, X understand that the Union Pacific Railroad Company can offset with capital losses any capital gains which are located with it and that therefore it is desirable that the capital gain located with the LVL&W Company, which cannot do this, be as small as possible. The maximum capital gains tax payable by LVL&W Company under any of the plans suggested by Mr. Sutton is 26$ of $414,471, or $107,762. If the conveyance of the water production facilities owned by the Railroad is made prior to the voting and sale of the bonds of the District, 1 think the best plan would be Basis No. 3, as this would result in a small capital loss to the LVL&W Company. It might not be possible to sustain with the Bureau of Internal Revenue the value indicated in this basis for the water production facilities in view of the fact that the combined facilities are being sold to the District for 2^ million dollars more or less. If we were not able to sustain the value for the water production facilities indicated in Basis No. 3, the worst that could happen is that -the value would be reduced to that shown in Basis No. 2, resulting in the maximum tax above mentioned. ( I do not see any advantage in Basis No. 1 over Basis No. 2 because the tax consequences are the same, and under Basis No, 1 the Union Pacific Railroad Company remains in the water business unless and until a sale is made by it directly to the District. As you know, It is my personal view that the Union Pacific Railroad Company should dispose of Its water production facilities as soon as possible because of