Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

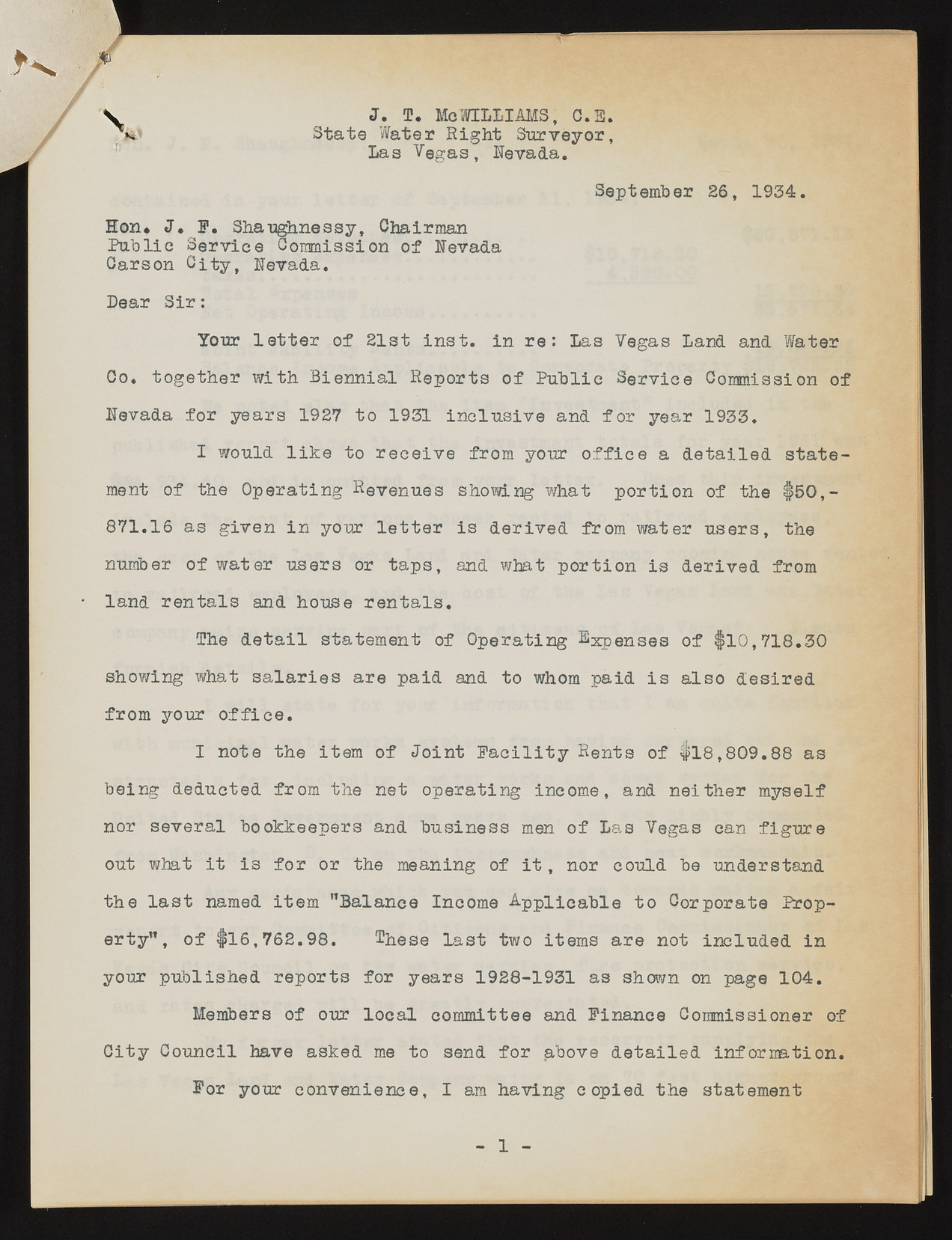

\ j. a?. McWilliams , o.e. State Water Right Surveyor, Las Vegas, Nevada. September 26, 1934. Hon* J. F. Shaughnessy, Chairman Public Service Commission of Nevada Carson City, Nevada. Dear Sir: Your letter of 21st inst. in re: Las Vegas Land and later Co. together with Biennial Reports of Public Service Commission of Nevada for years 1927 to 1931 inclusive and for year 1933. I would like to receive from your office a detailed statement of the Operating Revenues showing what portion of the $50,- 871.16 as given in your letter is derived from water users, the number of water users or taps, and what portion is derived from land rentals and house rentals. The detail statement of Operating Expenses of $10,718.30 showing what salaries are paid and to whom paid is also desired from your office. I note the item of Joint Facility Rents of $18,809.88 as being deducted from the net operating income, and neither myself nor several bookkeepers and business men of Las Vegas can figure out what it is for or the meaning of it, nor could be understand the last named item "Balance Income Applicable to Corporate Property”, of $16,762.98. These last two items are not included in your published reports for years 1928-1931 as shown on page 104. Members of our local committee and Finance Commissioner of City Council have asked me to send for ^bove detailed information. For your convenience, I am having copied the statement 1