Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

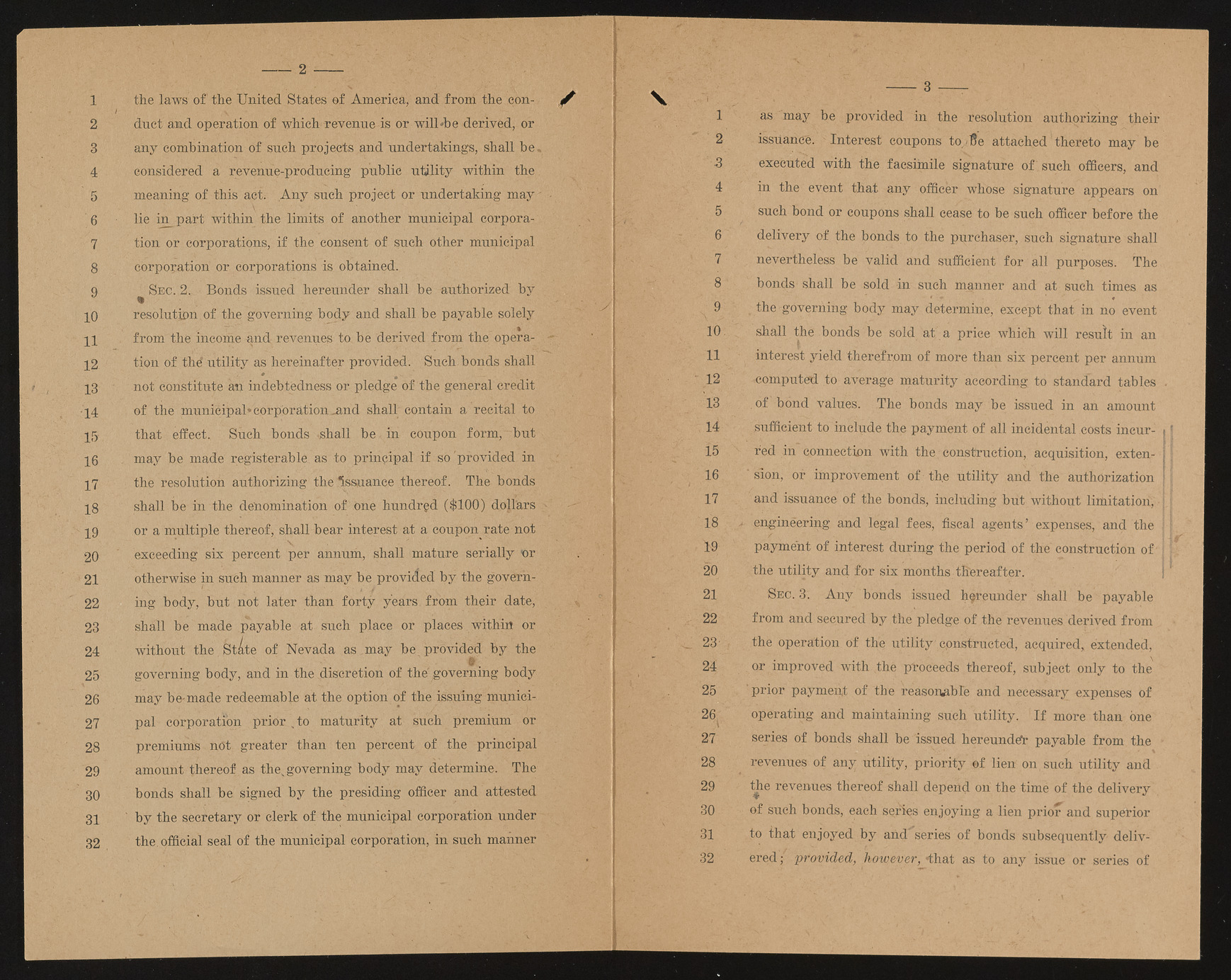

1 the laws of the United States ef America, and from the eon- f 2 duct and operation of which-revenue is or will*be derived, or 3 any combination of such projects and undertakings, shall be, 4 considered a revenue-producing public utility within the 5 meaning of this act, Any such project or undertaking may' 6 lie in part within the limits of another municipal corpora-’ 7 tion or corporations, if the consent of snch other municipal 8 corporation or corporations is obtained. 9 Sec; 2. Bonds issued hereunder shall be -authorized by pjl p) resolution of the governing body and shall be payable solely H from the income and revenues to be derived from the opera- ? 12 tion of th(futility as hereinafter provided. Such.bonds shall 13 not constitute an indebtedness or pledge of the general credit 14 of the municipal* corporation _nnd shall contain a recital to 15 that effect., Such bonds .shall be- in coupon form, "but 16 may be made registerable. as to principal if so provided in 17 the resolution authorizing the "issuance thereof. The bonds 18 shall be in the denomination of one hundred ($100) dollars | 19 or a multiple thereof, shall bear interest at a coupon rate not 20 exceeding six percent per annum, shall mature serially nr 21 otherwise in such manner as may be provided by the govern- 22 ing body, but not later than forty years from their date, 23 shall be made payable at such place or places within or 24 without the fetate of Nevada as may be provided by the V. 25 governing body, and in the discretion of the' governing body 26 may be-made redeemable at the option of the issuing munici- 27 pal corporation prior . to maturity at such premium or 28 premiums not greater than ten percent of the principal 29 amount thereof as the,governing body may determine. The 30 bonds shall be signed by the presiding officer and attested 31 >? by the secretary or clerk of the municipal corporation under 32 the. official seal of the municipal corporation, in such manner ---2 --- V 3 1 as may be provided in the resolution authorizing their 2 issuance. Interest coupons to,,Be attached thereto may be •3 executed with the facsimile signature of such officers, and 4 in the event that any officer whose signature appears on 5 such bond or coupons shall cease to be such officer before the 6 delivery of the bonds to the purchaser, such signature shall 7 nevertheless be valid and sufficient for all purposes. The 8 bonds1 shall be sold in such manner and at such times as ^9 the governing body may determine, except that in no event 10. shall the bonds be sold at a price which will result in an 11 interest yield therefrom of more than six percent per annum 12 -computed to average maturity according to standard tables 13 . of bond values. The bonds may be issued in an amount 14 sufficient to include the payment of all incidental costs incur- 15 red in connection with the construction, acquisition, exten- 16 ' sion, or improvement of-the utility and the authorization 17 and issuance of the bonds, including but without limitation, 18 > engineering and legal fees, fiscal agents’ expenses, and the 19 payment of interest during the period of the construction of- 20 the utility and for six months thereafter. 21 Sec. 3. Any bonds issued hereunder shall be payable 22 from and secured by the pledge of the revenues derived from 23- j the operation of the utility-constructed, acquired, extended, 24 or improved with the proceeds thereof, subject only to the' 25 prior payment of the reasonable and necessary expenses of 26, operating and maintaining such utility. If more than one 27 series of bonds shall be issued hereundefr payable from the 28 revenues of any; utility, priority of lien on such utility and 29 the revenues thereof shall depend on the time of the delivery 30 of such bonds, each series enjoying a lien prior" and superior 31 to that enjoyed by and series of bonds subsequently deliv- 32 ered | provided, however, -that as to any issue or series of