Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

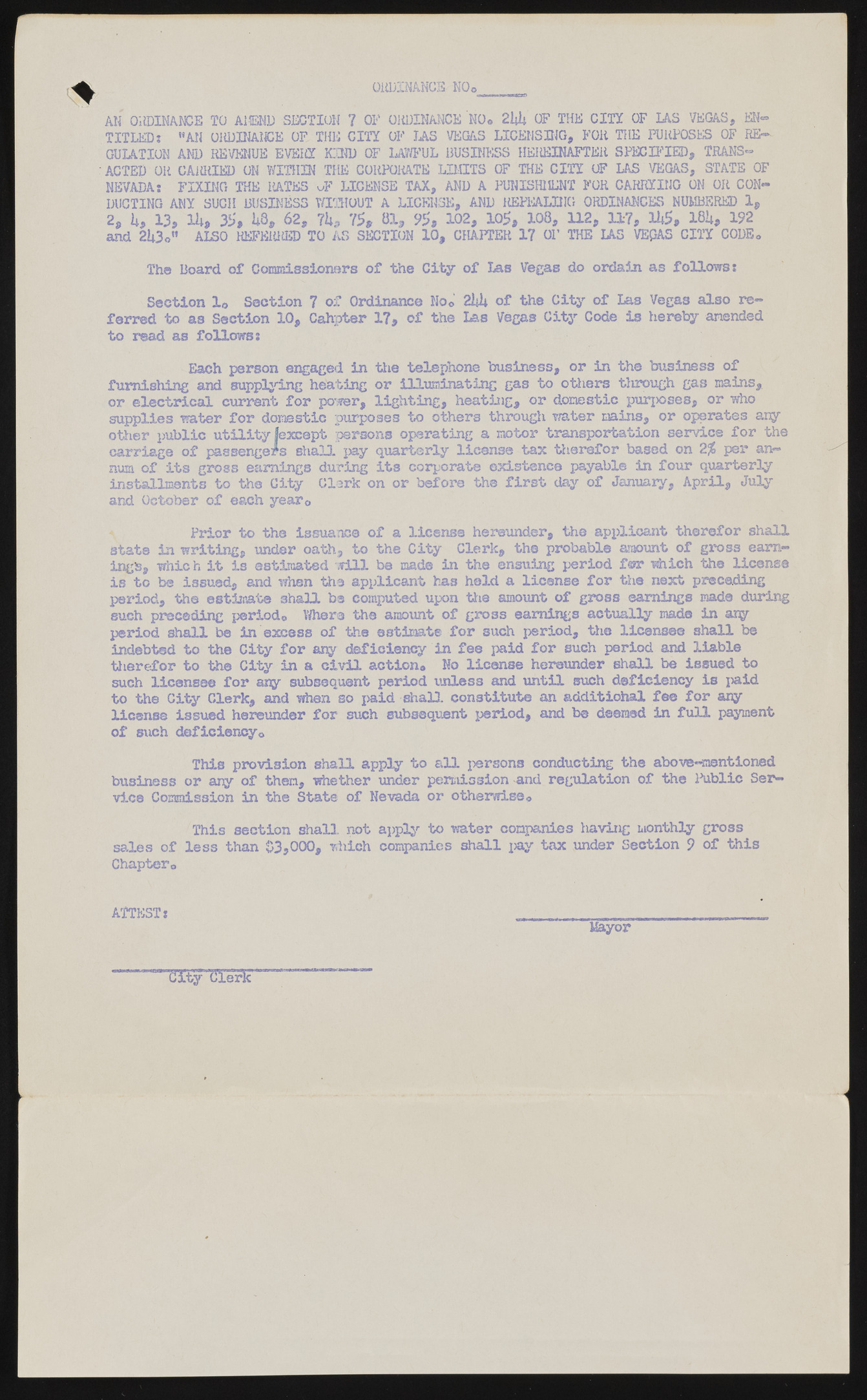

ORDINANCE N0o AN ORDINANCE TO AMEND SECTION ? OF OliDlNANCE NO® 2UU OF THE CITY OF IAS VEGAS, ENTITLED 5 "AN ORDINANCE OF THE CITY OF IAS VEGAS LICENSING, FOR THE PURPOSES OF REGULATION AND REVENUE EVERY KIND OF LAWFUL BUSINESS HEIiEINAFTER SPECIFIED, TRANS- : ACTED OR CARRIED ON WITHIN THE CORPORATE LIMITS OF THE CITY OF LAS VEGAS, STATE OF NEVADA; FIXING THE RATES uF LICENSE TAX, AND A PUNISHMENT FOR CARRYING ON OR CONDUCTING ANY SUCH BUSINESS WITHOUT A LICENSE, AND REPEALING ORDINANCES NUMBERED 1, 2, k9 13, lit, 35, U8, 62, ?ks 75, 81, 95, 102, 105, 108, 112, 117, 1U5, 18U, 192 and 2U3o" ALSO HEFEiUiED TO AS SECTION 10, CHAPTER 17 OF THE US VEpAS CITY CODE, The Board of Commissioners of the City of Las Vegas do ordain as follows: Section 1® Section 7 of Ordinance No« 2itU of the City of Las Vegas also referred to as Section 10, Cahpter 17, of the Las Vegas City Code is hereby amended to read as follows: Each person engaged in the telephone business, or in the business of furnishing and supplying heating or illuminating gas to others tlirough gas mains, or electrical current for power, lighting, heating, or domestic purposes, or who supplies water for domestic purposes to others through water mains, or operates any other public utility (except persons operating a motor transportation service for the carriage of passengers shall pay quarterly license tax therefor based on 2% per annum of its gross earnings during its corporate existence payable in four quarterly installments to the City Clark on or before the first day of January, April, July and October of each year0 Prior to the issuance of a license hereunder, the applicant therefor shall state in writing, under oath, to the City Clerk, the probable amount of gross earnings, which it is estimated will be made in the ensuing period fsr which the license is to be issued, and when the applicant has held a license for the next preceding period, the estimate shall be computed upon the amount of gross earnings made during such preceding periodo Where the amount of gross earnings actually made in ary period shall be in excess of the estimate for such period, the licensee shall be indebted to the City for any deficiency in fee paid for such period and liable therefor to the City in a civil actiono No license hereunder shall be issued to such licensee for any subsequent period unless and until such deficiency is paid to the City Clerk, and when so paid shall, constitute an additiohal fee for any license issued hereunder for such subsequent period, and be deemed in full payment of such deficiencyo This provision shall apply to all persons conducting the above-mentioned business or any of then, whether under permission and regulation of the Public Service Commission in the State of Nevada or otherwise o This section shall, not apply to water companies having monthly gross sales of less than 03,000, which companies shall jay tax under Section 9 of this Chapter,, ATTEST: . _______ Mayor City clerk