Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

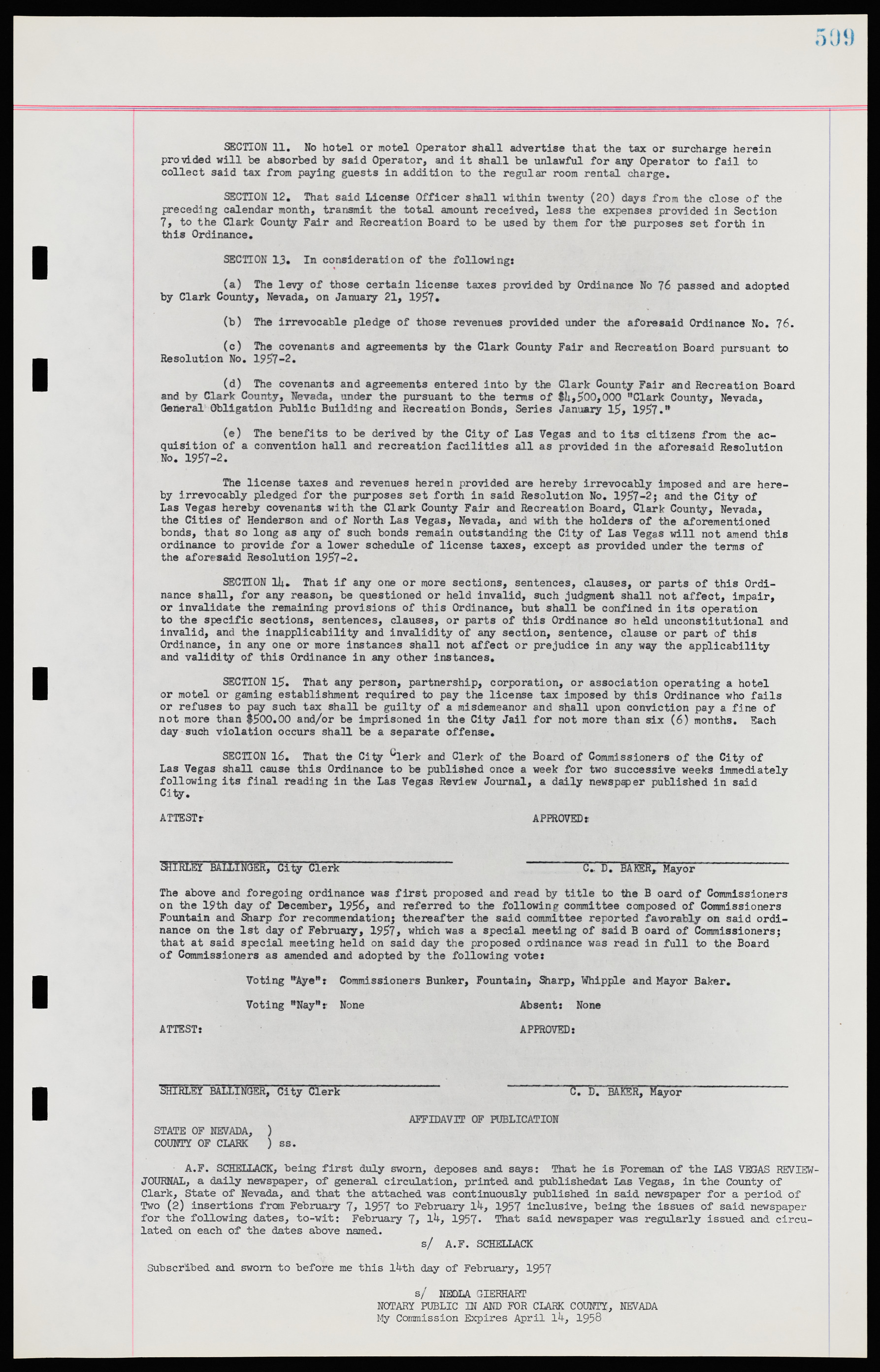

SECTION 11. No hotel or motel Operator shall advertise that the tax or surcharge herein provided will be absorbed by said Operator, and it shall be unlawful for any Operator to fail to collect said tax from paying guests in addition to the regular room rental charge. SECTION 12. That said License Officer shall within twenty (20) days from the close of the preceding calendar month, transmit the total amount received, less the expenses provided in Section 7, to the Clark County Fair and Recreation Board to be used by them for the purposes set forth in this Ordinance. SECTION 13. In consideration of the following: (a) The levy of those certain license taxes provided by Ordinance No 76 passed and adopted by Clark County, Nevada, on January 21, 1957. (b) The irrevocable pledge of those revenues provided under the aforesaid Ordinance No. 76. (c) The covenants and agreements by the Clark County Fair and Recreation Board pursuant to Resolution No. 1957-2. (d) The covenants and agreements entered into by the Clark County Fair and Recreation Board and by Clark County, Nevada, under the pursuant to the terms of $4,500,000 "Clark County, Nevada, General Obligation Public Building and Recreation Bonds, Series January 15, 1957." (e) The benefits to be derived by the City of Las Vegas and to its citizens from the acquisition of a convention hall and recreation facilities all as provided in the aforesaid Resolution No. 1957-2. The license taxes and revenues herein provided are hereby irrevocably imposed and are hereby irrevocably pledged for the purposes set forth in said Resolution No. 1957-2; and the City of Las Vegas hereby covenants with the Clark County Fair and Recreation Board, Clark County, Nevada, the Cities of Henderson and of North Las Vegas, Nevada, and with the holders of the aforementioned bonds, that so long as any of such bonds remain outstanding the City of Las Vegas will not amend this ordinance to provide for a lower schedule of license taxes, except as provided under the terms of the aforesaid Resolution 1957-2. SECTION l4. That if any one or more sections, sentences, clauses, or parts of this Ordinance shall, for any reason, be questioned or held invalid, such judgment shall not affect, impair, or invalidate the remaining provisions of this Ordinance, but shall be confined in its operation to the specific sections, sentences, clauses, or parts of this Ordinance so held unconstitutional and invalid, and the inapplicability and invalidity of any section, sentence, clause or part of this Ordinance, in any one or more instances shall not affect or prejudice in any way the applicability and validity of this Ordinance in any other instances. SECTION 15. That any person, partnership, corporation, or association operating a hotel or motel or gaming establishment required to pay the license tax imposed by this Ordinance who fails or refuses to pay such tax shall be guilty of a misdemeanor and shall upon conviction pay a fine of not more than $500.00 and/or be imprisoned in the City Jail for not more than six (6) months. Each day such violation occurs shall be a separate offense. SECTION 16. That the City Clerk and Clerk of the Board of Commissioners of the City of Las Vegas shall cause this Ordinance to be published once a week for two successive weeks immediately following its final reading in the Las Vegas Review Journal, a daily newspaper published in said City. ATTEST: APPROVED: SHIRLEY BALLINGER, City Clerk C. D. BAKER, Mayor The above and foregoing ordinance was first proposed and read by title to the Board of Commissioners on the 19th day of December, 1956, and referred to the following committee composed of Commissioners Fountain and Sharp for recommendation; thereafter the said committee reported favorably on said ordinance on the 1st day of February, 1957, which was a special meeting of said Board of Commissioners; that at said special meeting held on said day the proposed ordinance was read in full to the Board of Commissioners as amended and adopted by the following vote: Voting "Aye": Commissioners Bunker, Fountain, Sharp, Whipple and Mayor Baker. Voting "Nay": None Absent: None ATTEST: APPROVED: SHIRLEY BALLINGER, City Clerk C. D. BAKER, Mayor AFFIDAVIT OF PUBLICATION STATE OF NEVADA, ) COUNTY OF CLARK ) ss. A.F. SCHELLACK, being first duly sworn, deposes and says: That he is Foreman of the LAS VEGAS REVIEW- JOURNAL, a daily newspaper, of general circulation, printed and published at Las Vegas, in the County of Clark, State of Nevada, and that the attached was continuously published in said newspaper for a period of Two (2) insertions from February 7, 1957 to February 14, 1957 inclusive, being the issues of said newspaper for the following dates, to-wit: February 7, 14, 1957. That said newspaper was regularly issued and circulated on each of the dates above named. s/ A.F. SCHELLACK Subscribed and sworn to before me this l4th day of February, 1957 s/ NEOLA GIERHART NOTARY PUBLIC IN AND FOR CLARK COUNTY, NEVADA My Commission Expires April 14, 1958