Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

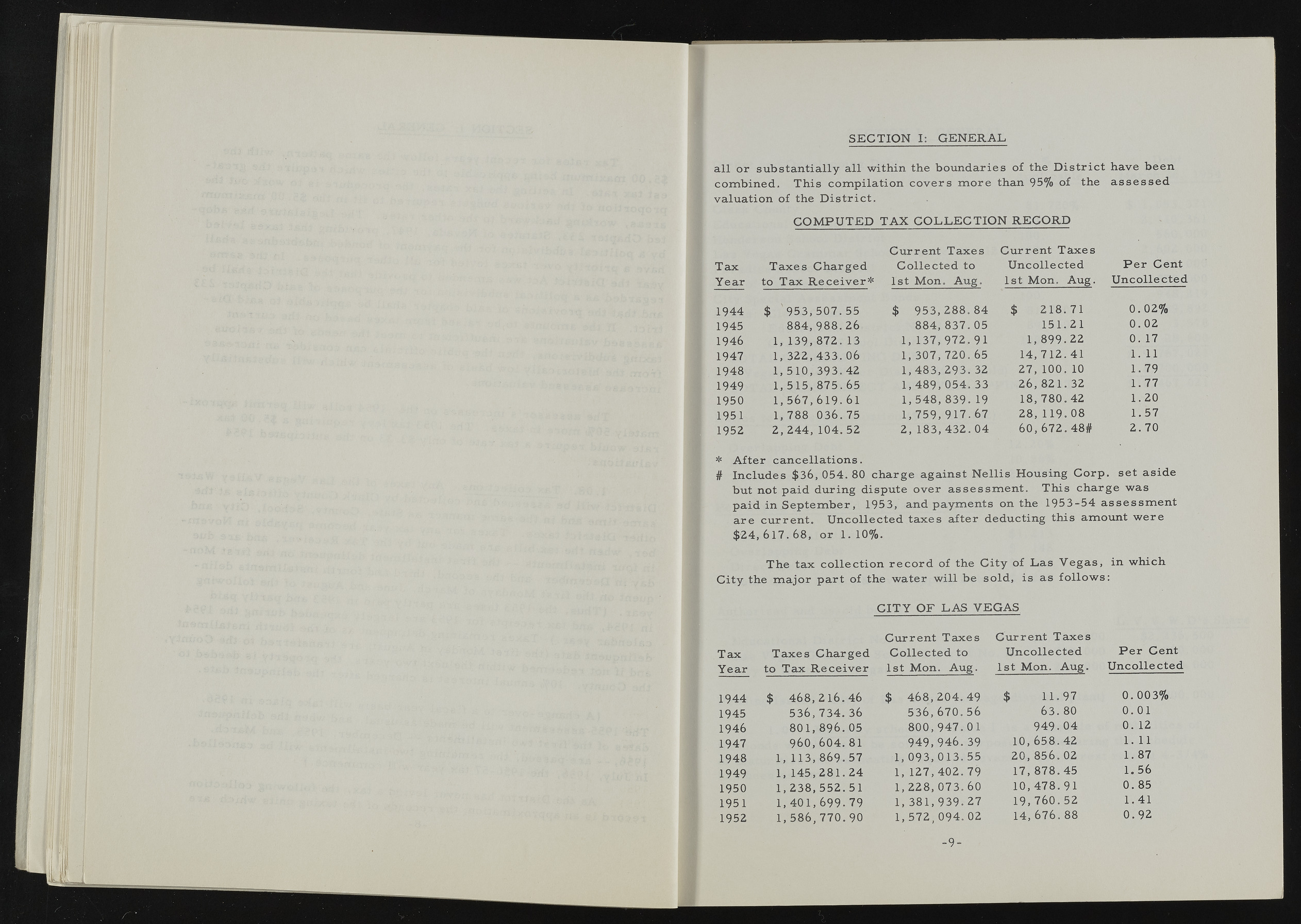

SECTION I: G EN ERAL all or su bstan tially all within the bou n d aries of the D is tr ic t have been com b in ed . This com p ila tion co v e rs m o re than 95% of the a s s e s s e d valuation of the D is tr ic t, C O M PU TED T A X C O LLE C T IO N RECO RD Tax T axes C harged C u rren t T axes C o lle cte d to C u rren t T axes U n collected P e r Cent Y ear to Tax R e c e iv e r * 1st M on. Aug. 1st M on. Aug. U n collected 1944 $ 9 5 3 ,5 0 7 .5 5 $ 9 5 3 ,2 8 8 .8 4 $ 2 1 8.7 1 0 . 02% 1945 884, 988. 26 8 8 4 ,8 3 7 .0 5 151.21 0 .0 2 1946 1 ,1 3 9 ,8 7 2 .1 3 1, 137, 9 7 2.9 1 1, 899.22 0. 17 1947 1, 3 2 2 ,4 3 3 . 06 1, 3 0 7 ,7 2 0 .6 5 1 4 ,7 1 2 .4 1 m m 1948 1 ,5 1 0 , 393.42 1 ,4 8 3 ,2 9 3 . 32 27, 100, 10 1.79 1949 1, 515, 8 75.65 1, 489, 054. 33 2 6 , 8 2 1.3 2 1.77 1950 1, 567, 619. 61 1, 5 4 8 ,8 3 9 .1 9 1 8 ,7 8 0 .4 2 1.20 1951 1, 788 036. 75 1, 7 5 9 ,9 1 7 .6 7 28, 119. 08 1.57 1952 2 ,2 4 4 ,1 0 4 .5 2 2 ,1 8 3 ,4 3 2 .0 4 60, 6 7 2.4 8# 2. 70 * A fter c a n ce lla tio n s . # Includes $ 3 6 ,0 5 4 .8 0 ch arge against N ellis H ousing C orp . set aside but not p aid during dispute ov er a sse ss m e n t. This ch arge was paid in S e p te m b e r, 1953, and paym ents on the 1953-54 a sse ss m e n t a re cu rren t. U n collected taxes after deducting this am ount w ere $24, 617. 6 8 , or 1. 10%. The tax c o lle c tio n r e c o r d of the C ity of L as V e g a s, in w hich C ity the m a jor part of the w ater w ill be sold , is as fo llo w s : C ITY OF LAS VEGAS C u rren t T axes C u rren t T axes Tax T axes C harged C o lle cte d to U n collected P e r Cent Y ear to Tax R e c e iv e r 1st M on. Aug. 1st M on. Aug. U n collected 1944 $ 4 6 8 ,2 1 6 .4 6 $ 4 6 8 ,2 0 4 .4 9 $ 11.97 0. 003% 1945 5 3 6 ,7 3 4 .3 6 5 3 6 ,6 7 0 .5 6 63. 80 0 .0 1 1946 801, 896. 05 800, 947. 01 9 4 9 .0 4 0 . 12 1947 9 6 0 ,6 0 4 .8 1 9 4 9 ,9 4 6 .3 9 10, 6 58.42 1.11 1948 1 ,1 1 3 ,8 6 9 .5 7 1, 093, 013. 55 2 0 ,8 5 6 .0 2 1.87 1949 1, 1 4 5 ,2 8 1 .2 4 1, 127,402. 79 17, 878.45 1. 56 1950 1 ,2 3 8 , 552.51 1, 228, 073. 60 10, 4 7 8 .9 1 0. 85 1951 1, 4 0 1 ,6 9 9 . 79 1, 381, 939. 27 19,7 6 0 .5 2 1.41 1952 1, 586, 770. 90 1, 5 7 2 ,0 9 4 . 02 14, 6 7 6 .88 0. 92 -9 -