Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

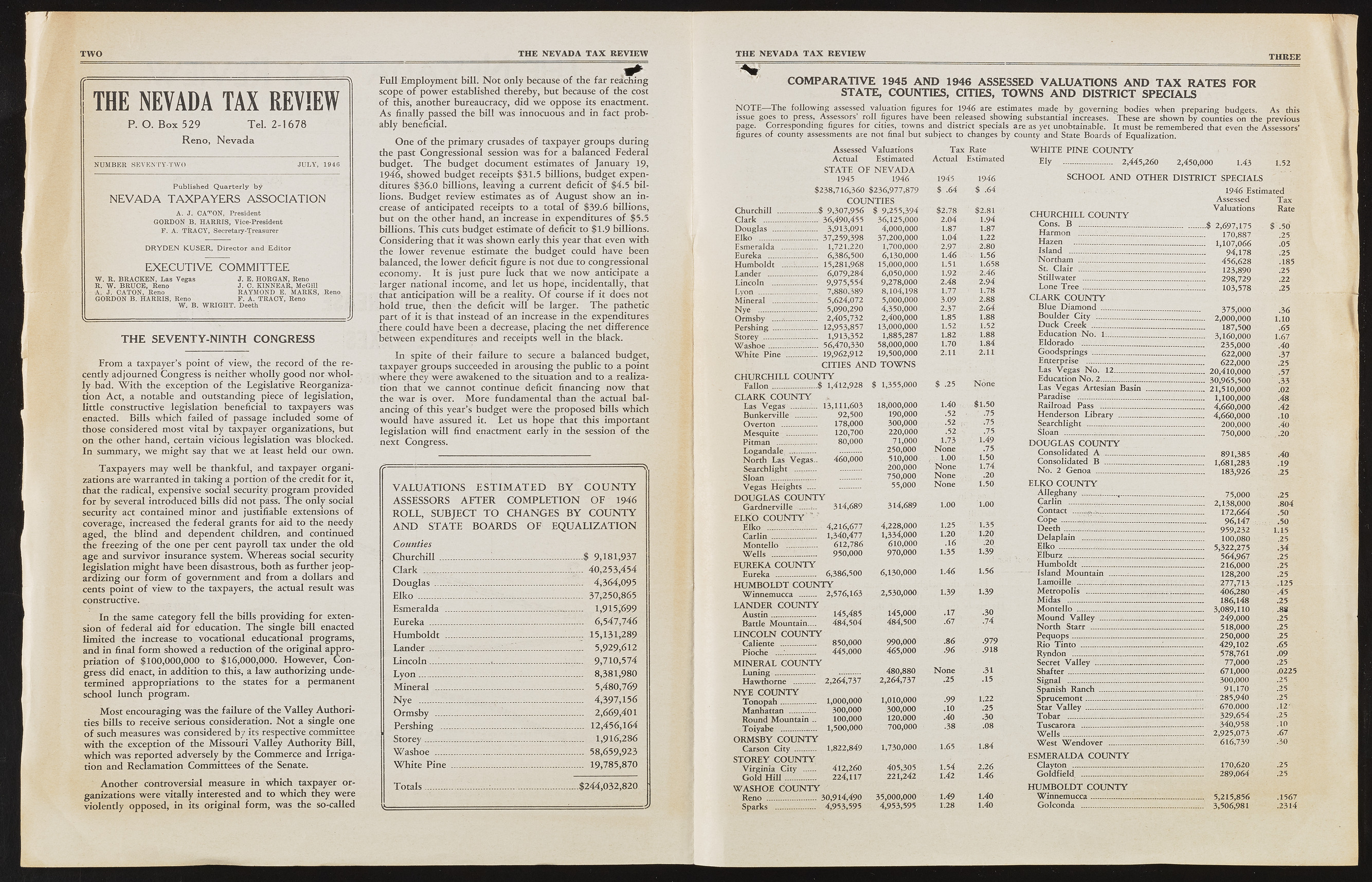

TWO THE NEVADA TAX REVIEW f THE NEVADA TAX REVIEW P . O . B o x 5 2 9 T e l. 2 -1 6 7 8 R e n o , N e v a d a NUMBER SEVENTY TWO JULY, 1946 Published Quarterly by N E V A D A T A X P A Y E R S A S S O C I A T I O N A. J. CA^ON, President GORDON B. HARRIS, Vice-President F. A. TRACY, Secretary-Treasurer DRYDEN KUSER, Director and Editor E X E C U T I V E C O M M I T T E E W. E. BRACKEN, Las Vegas J. E. HORGAN, Reno R. W. BRUCE, Reno J. C. KINNEAR, McGill A, J. CATON, Reno RAYMOND E. MARKS, Reno GORDON B. HARRIS, Reno F. A. TRACY, Reno W. B. WRIGHT. Deeth L - ?? ' " THE SEVENTY-NINTH CONGRESS F rom a taxpayer’s point o f view , the record o f the recently adjourn ed Congress is neither w h o lly g o o d nor w h o l-ly bad. W i t h the exception o f the Legislative R eorgan ization A ct, a notable and outstanding piece o f legislation, little constructive legislation beneficial to taxpayers was enacted. B ills which failed o f passage included some o f those considered most vital by taxpayer organizations, but on the other hand, certain vicious legislation w as blocked. In summary, w e m ight say that w e at least held our own. T axpayers may w e ll be thankful, and taxpayer organ izations are w arranted in taking a portion, o f the credit fo r it, that the radical, expensive social security p rogram provided fo r by several introduced bills did not pass. T h e only social security act contained m inor and justifiable extensions o f coverage, increased the federal grants fo r aid to the needy aged, the blin d and dependent children, and continued the freezin g o f the one per cent p ay ro ll tax u nder the old age an d survivor insurance system. W h e re a s social security legislation m igh t have been disastrous, both as further jeo p ardizin g our fo rm o f governm ent and from a dollars and cents point o f v iew to the taxpayers, the actual result was constructive. In th e same category fe ll the bills p ro v id in g fo r extension o f federal aid fo r education. T h e single b ill enacted lim ited the increase to vocational educational program s, an d in final fo rm show ed a reduction o f the origin al ap p ropriation o f $100,000,000 to $16,000,000. H o w e v e r, C on gress d id enact, in addition to this, a la w authorizing undeterm ined appropriations to the states fo r a permanent school lunch program . M o st encouraging w as the failu re o f the V a lle y A u th o rities bills to receive serious consideration. N o t a single one o f such measures w as considered by its respective committee w ith the exception o f the M issou ri V a lle y A u th ority B ill, w h ich w as reported adversely by the Com m erce and Irrig a tion and Reclam ation Committees o f the Senate. A n o th er controversial measure in w hich taxpayer o rganizations w ere vitally interested an d to w hich they w ere violently opposed, in its o rigin al form , w as the so-called F u ll Em ploym ent bill. N o t only because o f the fa r reaching scope o f p o w e r established thereby, bu t because o f the cost o f this, another bureaucracy, did w e oppose its enactment. A s finally passed the b ill w as innocuous and in fact p ro b ably beneficial. O n e o f the prim ary crusades o f taxpayer grou ps du rin g the past Congressional session w as fo r a balanced Federal budget. T h e budget document estimates o f January 19, 1946, show ed budget receipts $31.5 billions, budget expenditures $36.0 billions, leavin g a current deficit o f $4.5 b illions. B u dget review estimates as o f A u g u st show an in crease o f anticipated receipts to a total o f $39.6 billions, but on the other hand, an increase in expenditures o f $5.5 billions. T h is cuts budget estimate o f deficit to $1.9 billions. Considering that it was show n early this year that even with the lo w e r revenue estimate the budget could have been balanced, the lo w e r deficit figure is not due to congressional economy. It is just pure luck that w e n o w anticipate a larger national income, and let us hope, incidentally, that that anticipation w ill be a reality. O f course i f it does not h o ld true, then the deficit w ill be larger. T h e pathetic part o f it is that instead o f an increase in the expenditures there could have been a decrease, placing the net difference between expenditures and receipts w e ll in the black. In spite o f their failure to secure a balanced budget, taxpayer grou ps succeeded in arousing the pu blic to a point w h ere th ey'w ere awakened to the situation and to a realization that w e cannot continue deficit financing n o w that the w a r is over. M o r e fundam ental than the actual b a lancing o f this year’s budget w ere the proposed bills which w o u ld have assured it. Let us hope that this im portant legislation w ill find enactment early in the session o f the next Congress. /p---------- :-------------------------------- -----------------------------------| V A L U A T I O N S E S T I M A T E D B Y C O U N T Y A S S E S S O R S A F T E R C O M P L E T I O N O F 1946 R O L L , S U B J E C T T O C H A N G E S B Y C O U N T Y A N D S T A T E B O A R D S O F Counties E Q U A L I Z A T I O N C hurchill ...................... . ............$ 9,181,937 C lark ............... ............... _____ ..... 40,253,454 D o u g la s ______ ___________ .........— 4,364,095 E lk o ...................... I ........ ............. 37,250,865 Esm eralda ................. H ............. 1,915,7)99 Eureka ............................ ____ :..... 6,547,746 H u m b o ld t ..................... ..... ......... 15,131,289 Lander ......___................ - ......... 5,929,612 Lincoln M l................... M ..... ....... 9,710,574 L y o n ................... ............ ............. 8,381,980 M in eral ......................... 1 ............. 5,480,769 N y e ................ —.......... ............. 4,397,156 O rm sby .......................... ............ 2,669,401 Pershing ........................ ......1..... 12,456,164 S to re y ...................... ............. 1,916,286 W a sh o e ............ ............. ............. 58,659,923 W h it e P in e ............... . .... ........ 19,785,870 T otals ................ ........ ....:: . ..........$244,032,820 ----------------- ------- —----- THE NEVADA TAX REVIEW THREE COMPARATIVE 1945 AND 1946 ASSESSED VALUATIONS AND TAX RATES FOR STATE, COUNTIES, CITIES, TOWNS AND DISTRICT SPECIALS NOTE—The following assessed valuation figures for 1946 are estimates made by governing bodies when preparing budgets. As this issue goes to press, Assessors’ roll figures have been released showing substantial increases. These are shown by counties on the previous page. Corresponding figures for cities, towns and district specials are as yet unobtainable. It must be remembered that even the Assessors’ figures of county assessments are not final but subject to changes by county and State Boards of Equalization. Assessed Valuations Tax Rate Actual Estimated Actual Estimated STATE OF NEVADA 1945 1946 1945 1946 $238,716,360 $236,977,879 $ .64 $ .64 COUNTIES Churchill ........... $ 9,307,956 $ 9,255,394 $2.78 $2.81 Clark 36,490,455 36,125,000 2.04 1.94 Douglas ... 3,913,091 4,000,000 1.87 1.87 Elko .................. 37,259,398 37,200,000 1.04 1.22 Esmeralda .......... 1,721,220 1,700,000 2.97 . 2.80 Eureka .... ......6,386,500 6,130,000 1.46 1.56 Humboldt M M ... 15,281,968 15,000,000 1.51 1.658 Lander ............... 6,079,284 6,050,000 1.92 2.46 Lincoln ..........:.... 9,975,554 9,278,000 2.48 2.94 Lyon ................. 7,880,389 8,104,198 1.77 ' 1.78 Mineral ............. 5,624,072 5,000,000 3.09 2.88 Nye ........ 5,090,290 4,350,000 2.37 2.64 Orinsby 2,405,732 2,400,000 1.85 1.88 Pershing .............. 12,953,857 13,000,000 1.52 1.52 Storey ......--M M . 1,913,352 1,885,287 1.82 1.88 Washoe............. 56,470,330 58,000,000 1.70 1.84 White Pine .......... 19,962,912 19,500,000 2.11 2.11 CITIES AND TOWNS CHURCHILL COUNTY Fallon.............$ 1,412,928 $ 1,355,000 $ .25 None CLARK COUNTY „ Las Vegas 13,111,603 18,000,000 1.40 $1.50 Bunkerville ...... 92,500 190,000 .52 ’ .75 Overton .......... 178,000 300,000 .52 ,, .75 Mesquite ......... 120,700 220,000 .52 ,75. Pitman 80,000 71,000 1.73 1.49 Logandaie. ................... 250,000 None .75 North Las Vegas-- 460,000 - 510,000-. -.1.00 - 1.50 Searchlight ................. 200,000 None 1.74 Sloan ...................................750,000 None .20 Vegas Heights .... 55,000 None 1.50 DOUGLAS COUNTY ’ Gardnerville _ 314,689 314,689 1.00 1.00 ELKO COUNTY ’ \ Elko 4,216,677 4,228,000 1.25 1.35 Carlin ............. 1,340,477 1,334,000 1.20 1.20 Montello ......... 612,786 610,000 .16 .20 Wells v ; " 950,000 970,000 1.35 1.39 EUREKA COUNTY I I Eureka ...... 6,386,500 6,130,000 1.46 1.56 HUMBOLDT COUNTY I Winnemucca ..... 2,576,163 2,530,000 1.39 1.39 LANDER COUNTY Austin 145,485 145,000 ,17 .30 Batde Mountain.... 484,504 484,500 .67 .74 LINCOLN COUNTY Caliente ...;...... 850,000 990,000 .86 .979 Pioche • lttyr- 445,000 465,000 .96 -918 MINERAL COUNTY Luning 480,880 NTone .31 Hawthorne ...... 2,264,737 2,264,737 .25 -15 NYE COUNTY Tonopah 1,000,000 1,010,000 .99 1.22 Manhattan ..... 300,000 300,000 .10 .25 Round Mountain .. 100,000 120.000 .40 .30 Toiyabe 1,500,000 700,000 .38 .08 ORMSBY COUNTY Carson City .......... 1,822,849 1,730,000 1.65 1.84 STOREY COUNTY Virginia City ... 412,260 405,305 : 1.54 2.26 Gold Hill......... 224,117 221,242 1.42 1.46 WASHOE COUNTY Reno .......J5IS5i.... 30,914,490 35,000,000 1.49 1.40 Sparks ............ 4,953,595 4,953,595 1.28 1.40 WHITE PINE COUNTY Ely 2,445,260 2,450,000 1.43 1.52 SCHOOL AND OTHER DISTRICT SPECTATE CHURCHILL COUNTY Cons. B ... N... Harmon .... ....... Hazen Island _..tfeg&MBpafPl Northam ................... St. Clair .......... Stillwater _ ItfwMM Lone Tree CLARK COUNTY Blue Diamond ........ ..2 Boulder City - Duck Creek ............ Education No. 1..... Eldorado ....... Goodsprings ............. . Enterprise- Las Vegas No. 12.......-.L... Education No. 2...;....... . Las Vegas Artesian Basin Paradise _’ ..'2 Railroad Pass Henderson Library ....... Searchlight -.'IfcSWwIISBss Sloan _ DOUGLAS COUNTY Consolidated A ................. Consolidated B ................. No. 2 Genoa .... ELJCO COUNTY Alleghany ............ ..._ Carlin ... Contact ...L.2l«..-_.......... . Cope _ . Deeth Mv'-jl' MBk.’wl flelaplain -....----- Eiko Elburz ? §,-•- -jr—-fi ’ Humboldr ~ Island Mountain .....: Lamoille MHarj , Metropolis _I.... Midas ... . -... . Montello Mound Valley __;. North Starr —----- Pequops . jgcjWfjjy .... Rio Tinto ...........__ Ryndon Secret Valley gygjja..:,..;_1 Shafter .... .'Signal BBfcjra..... .-...JjJ,*, Spanish Ranch ... Sprucemont.... -...... Star Valley iilli.... Tobar Tusearora ........... . Wells... ESMERALDA COUNTY Clayton ..................... Goldfield. _,_........ . HUMBOLDT COUNTY WinneffluCca ....... Golconda .................. 1946 Estimated Assessed Tax Valuations Rate 1 2,697,175 $ .50 170,887 .25 1,107,066 .05 94,178 .25 456,628 .185 123,890 .25 298,729 .22 . 103,578 .25 375,000 .36 2,000,000 1.10 187,500 .65 3,160,000 1.67 235,000 .40 622,000 .37 622,000 .25 20,410,000 .57 30,965,500 .33 21,510,000 .02 1,100,000 .48 4,660,000 .42 4,660,000 .10 200,000 .40 750,000 .20 891,385 .40 1,681,283 .19 183,926 .25 75,000 .25 2,138,000 .804 172,664 .50 96,147 .50 959,232 1.15 100,080 .25 5,322,275 .34 564,967 .25 216,000 .25 128,200 .25 277,713 .125 406,280 .45 186,148 .25 3,089,110 , .88 249,000 .25 518,000 .25 250,000 .25 429,102 .65 578,761 .09 77,000 .25 671,000 .0225 300,000 .25 91,170 .25 285,940 .25 670,000 .12' 329,654 .25 340,958 .10 2,925,073 .67 616,739 .30 170,620 .25 289,064 .25 5,215,856 .1567 3,506,981 .2314