Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

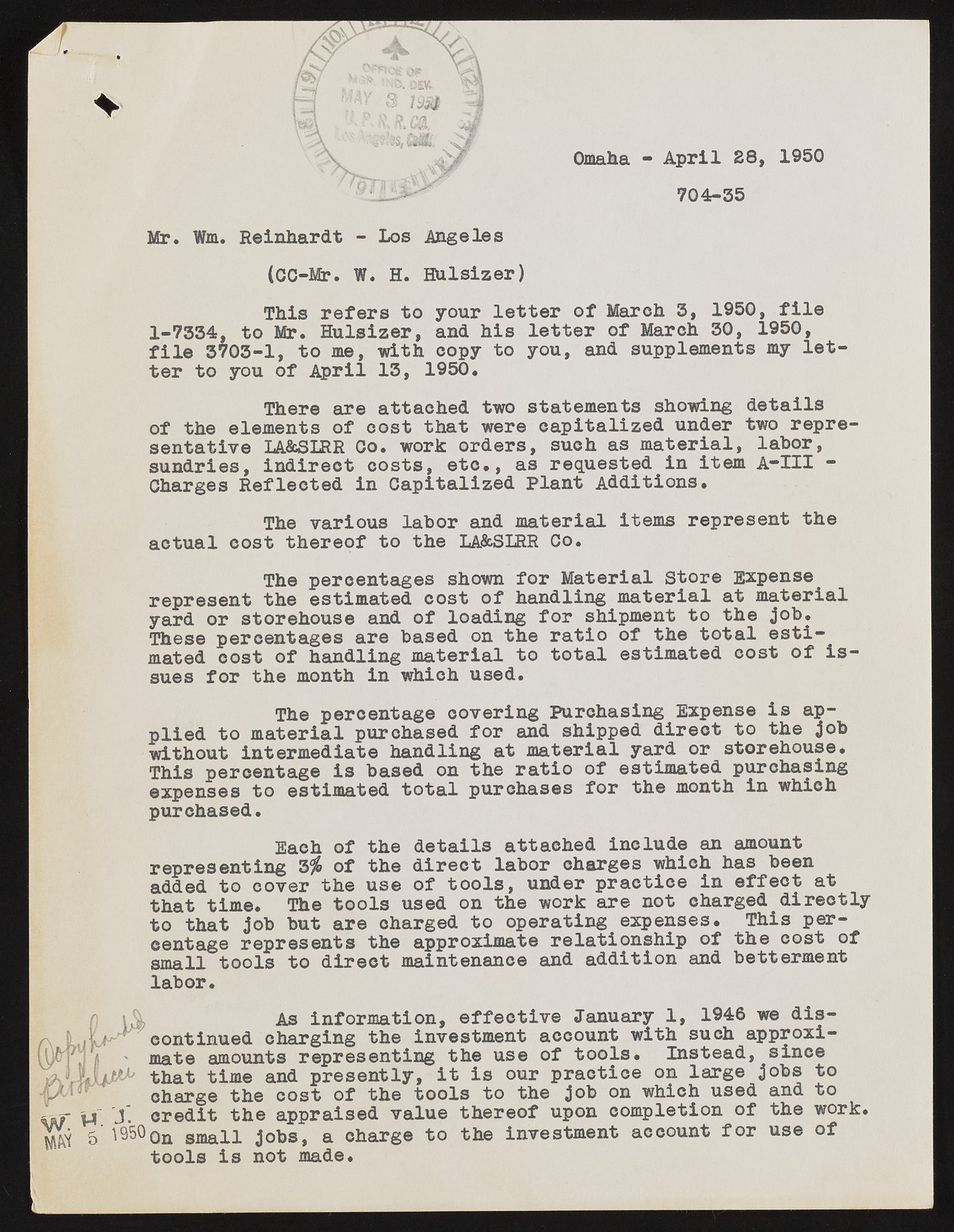

( w a m n Mi wna , “* fV {?, ff. C0r mS ?a3M>V fo&fs Omaha - April SS, 1950 704-35 Mr. Wm. Reinhardt - Los Angeles (CC-Mr. W. H. Hulsizer) This refers to your letter of March 3, 1950, file 1-7334, to MT. Hulsizer, and his letter of March 30, 1950, file 3703-1, to me, with copy to you, and supplements my letter to you of April 13, 1950. There are attached two statements showing details of the elements of cost that were capitalized under two representative LA&SLRR Go. work orders, such as material, labor, sundries, indirect costs, etc*, as requested in item A-IXI - Charges Reflected in Capitalized Plant Additions. The various labor and material items represent the actual cost thereof to the LA&SLRR Co. The percentages shown for Material Store Expense represent the estimated cost of handling material at material yard or storehouse and of loading for shipment to the job. These percentages are based on the ratio of the total estimated cost of handling material to total estimated cost of issues for the month in which used. The percentage covering Purchasing Expense is applied to material purchased for and shipped direct to the job without intermediate handling at material yard or storehouse. This percentage is based on the ratio of estimated purchasing expenses to estimated total purchases for the month in which purchased. Each of the details attached include an amount representing 3# of the direct labor charges which has been added to cover the use of tools, under practice in effect at that time. The tools used on the work are not charged directly to that job but are charged to operating expenses. This percentage represents the approximate relationship of the cost of «maii tools to direct maintenance and addition and betterment labor. As information, effective January 1, 1946 we discontinued charging the investment account with such approxi- » mate amounts representing the use of tools. Instead, since J jjt1' that time and presently, it is our practice on large jobs to charge the cost of the tools to the job on which used and to VT j'. credit the appraised value thereof upon completion of the work. 5’ 1950 0n sman jobs, a charge to the investment account for use of tools is not made.