Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

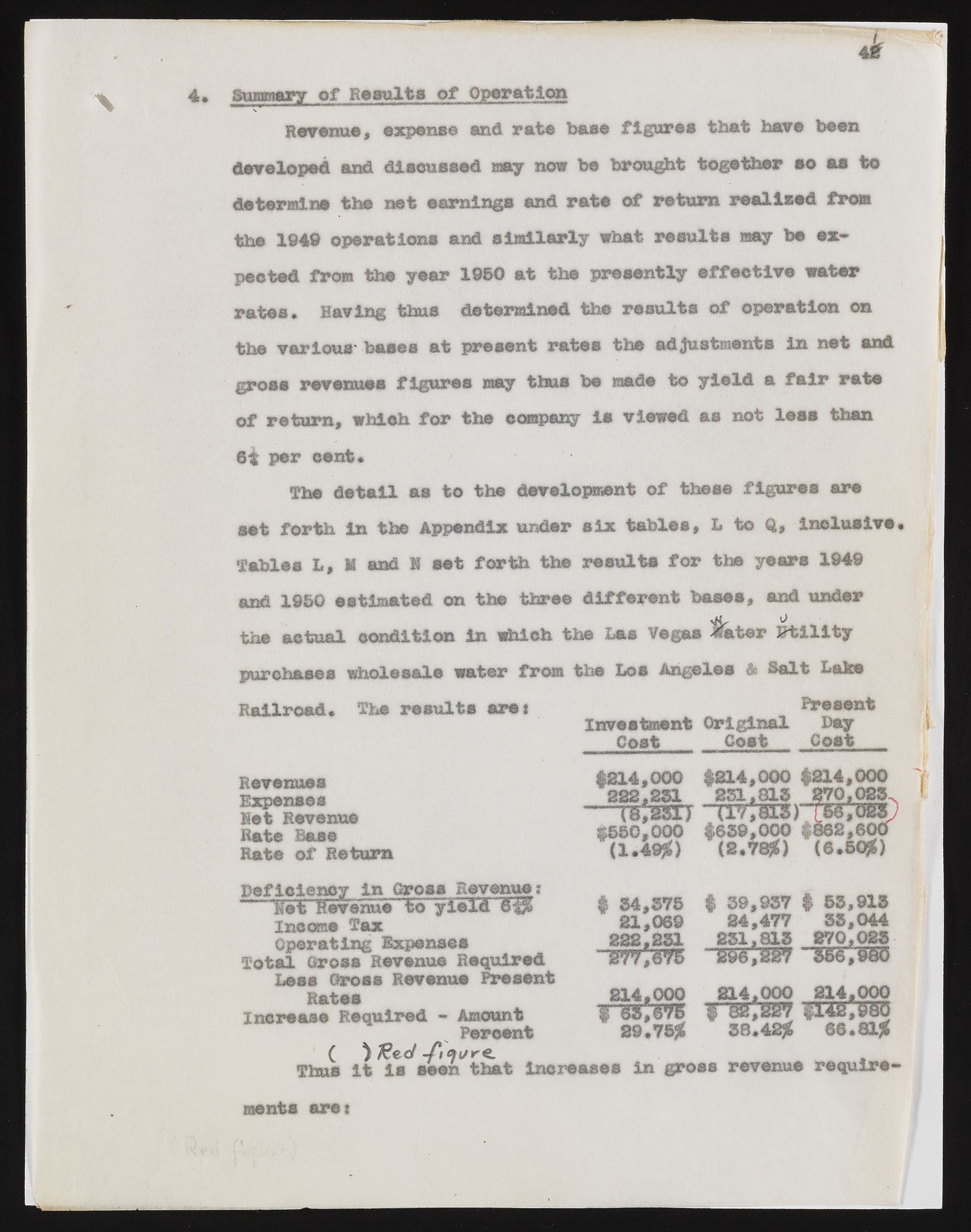

\ 4. Summary of Results of Operation Revenue, expense and rate base figures that Imre been developed and discussed may now be brought together so as to determine the net earnings and rate of return realised from the 1849 operation# and similarly what result# may be expected from the year 1950 at the presently effective water rates. Having thus determined the results of operation on th** various' bases at present rates the adjustments in net and gross revenues figures may thus be made to yield a fair rate of return, which for the company is viewed as not less than 6$ par cant* The detail as to the development of these figures iu?e set forth in tbs Appendix under six tables, L to ft, inclusive, Tables L, H and 1 set forth the results for the years 1949 and 1950 estimated on the three different bases, and under the actual condition in which the Las Vegas later Utility purchases wholesale water from the Los Angeles A Salt Lake Thu(s i)t ^ies< /se/e<nw rthea t increases in gross revenue requi*re- Railroad, The results are* Present Investment Original Lay C o s t _____ Cost Cost Revenues Expenses Met Revenue Rate Base Rate of Return Deficiency in Gross Revenue: Met Revenue to yield 6i* Income Tax Operating Expenses Total dross Revenue Required Less Gross Revenue Present | 34,375 | 39,937 | 53,913 Increase Required - Amount Hates Percent 2299..7755** 38.4231 66.81* ments arei