Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

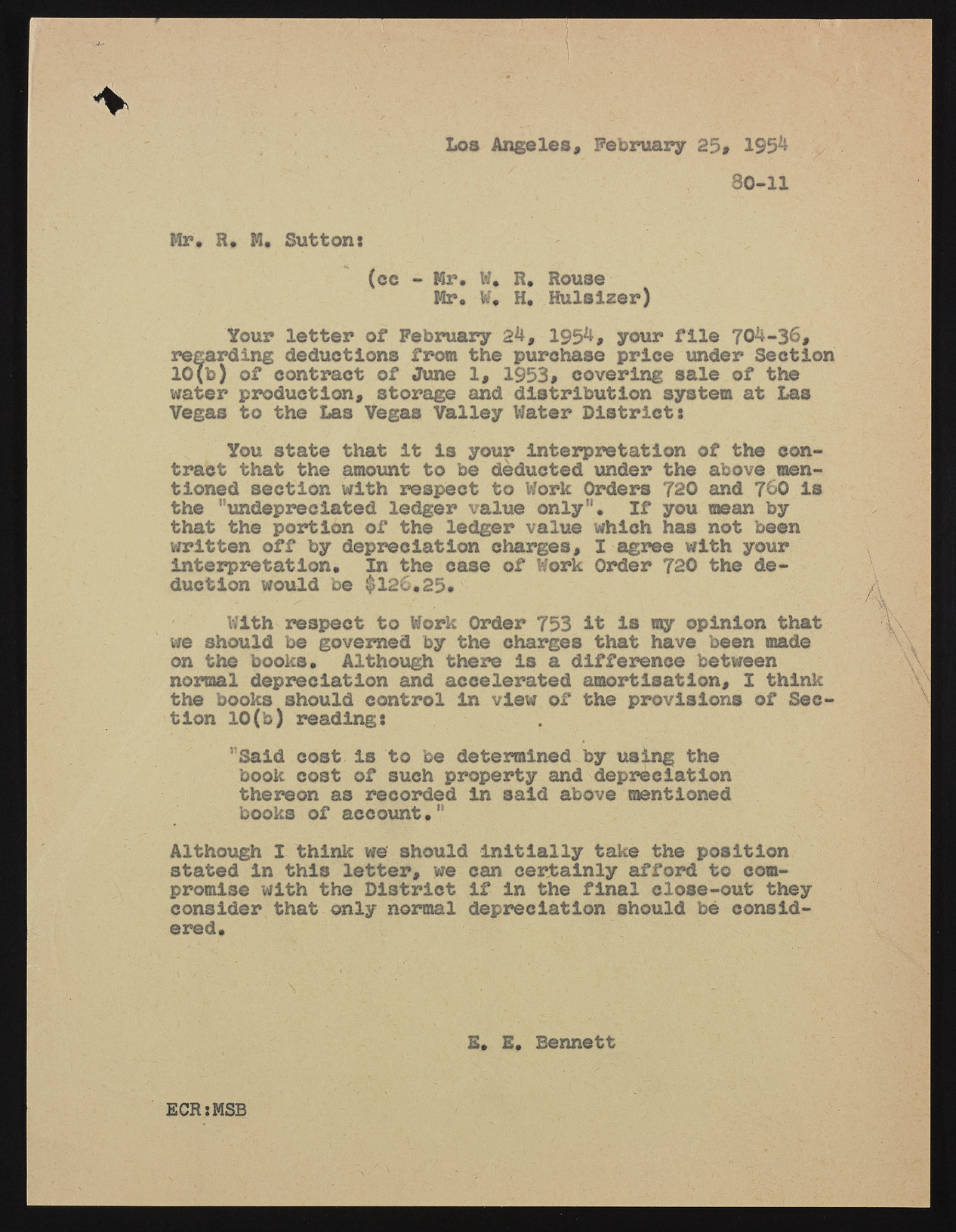

Los Angeles, February 25» 1954 80-11 Mr, R. M. Suttons (ec - Mr. W. R. Rouse Mr. W. H. Hulslzer) ?Your letter of February 24, 1954, your file 704-36, regarding deductions from the purchase price under Section 10(b) of contract of June 1, 1953* covering sale of the water production, storage and distribution system at Las Vegas to the Las Vegas Valley Water Districts You state that it is your interpretation of the contract that the amount to be deducted under the above mentioned section with respect to Work Orders 720 and 760 is the ’’undepreciated ledger value only". If you mean by that the portion of the ledger value which has not been written off by depreciation charges, I agree with your interpretation. In the case of Work Order 720 the deduction would be $126.25. With respect to Work Order 753 it is my opinion that we should be governed by the charges that have been made on the books. Although there is a difference between normal depreciation and accelerated amortisation, I think the books should control in view of the provisions of Section 10(b) readings . 'Said cost is to be determined by using the book cost of such property and depreciation thereon as recorded in said above mentioned books of account," Although I think we' should initially take the position stated in this letter, we can certainly afford to compromise with the District if in the final close-out they consider that only normal depreciation should be considered. E. E, Bennett ECRtMSB