Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

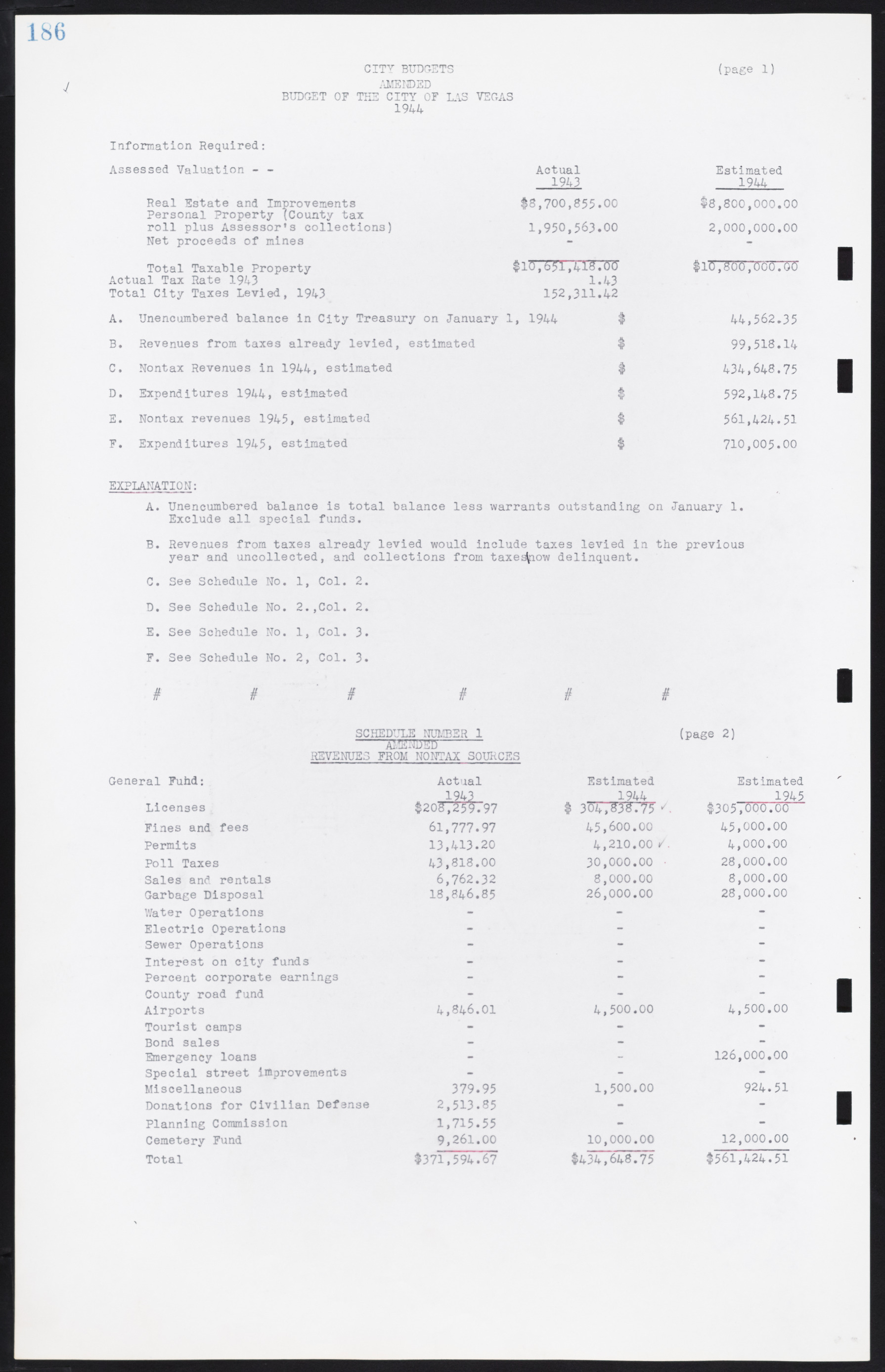

CITY BUDGETS (page 1) AMENDED BUDGET OF THE CITY OF LAS VEGAS 1944 Information Required: Assessed Valuation - - Actual Estimated 1943 1944 Real Estate and Improvements $8,700,855.00 $8,800,000.00 Personal Property (County tax roll plus Assessor's collections) 1,950,563.00 2,000,000.00 Net proceeds of mines Total Taxable Property $l0,65l,418.00 $10,800,000.00 Actual Tax Rate 1943 1.43 Total City Taxes Levied, 1943 152,311.42 A. Unencumbered balance in City Treasury on January 1, 1944 $ 44,562.35 B. Revenues from taxes already levied, estimated $ 99,518.14 C. Nontax Revenues in 1944, estimated $ 434,648.75 D. Expenditures 1944, estimated $ 592,148.75 E. Nontax revenues 1945, estimated $ 561,424.51 F. Expenditures 1945, estimated $ 710,005.00 EXPLANATION: A. Unencumbered balance is total balance less warrants outstanding on January 1. Exclude all special funds. B. Revenues from taxes already levied would include taxes levied in the previous year and uncollected, and collections from taxes now delinquent. C. See Schedule No. 1, Col. 2. D. See Schedule No. 2.,Col. 2. E. See Schedule No. 1, Col. 3. F. See Schedule No. 2, Col. 3. # # # # # # SCHEDULE NUMBER 1 (page 2) ----AMENDED------ REVENUES FROM NONTAX SOURCES General Fund: Actual Estimated Estimated _1943 1944 1945 Licenses $208,259.97 $ 304,838.75 $305,000.00 Fines and fees 61,777.97 45,600.00 45,000.00 Permits 13,413.20 4,210.00 4,000.00 Poll Taxes 43,818.00 30,000.00 28,000.00 Sales and rentals 6,762.32 8,000.00 8,000.00 Garbage Disposal 18,846.85 26,000.00 28,000.00 Water Operations - Electric Operations - - Sewer Operations - - Interest on city funds - - Percent corporate earnings - - County road fund - - Airports 4,846.01 4,500.00 4,500.00 Tourist camps - - Bond sales - - Emergency loans - 126,000.00 Special street Improvements - - Miscellaneous 379.95 1,500.00 924.51 Donations for Civilian Defense 2,513.85 Planning Commission 1,715.55 Cemetery Fund 9,261.00 10,000.00 12,000.00 Total $371,594.67 $434,648.75 $561,424.51