Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

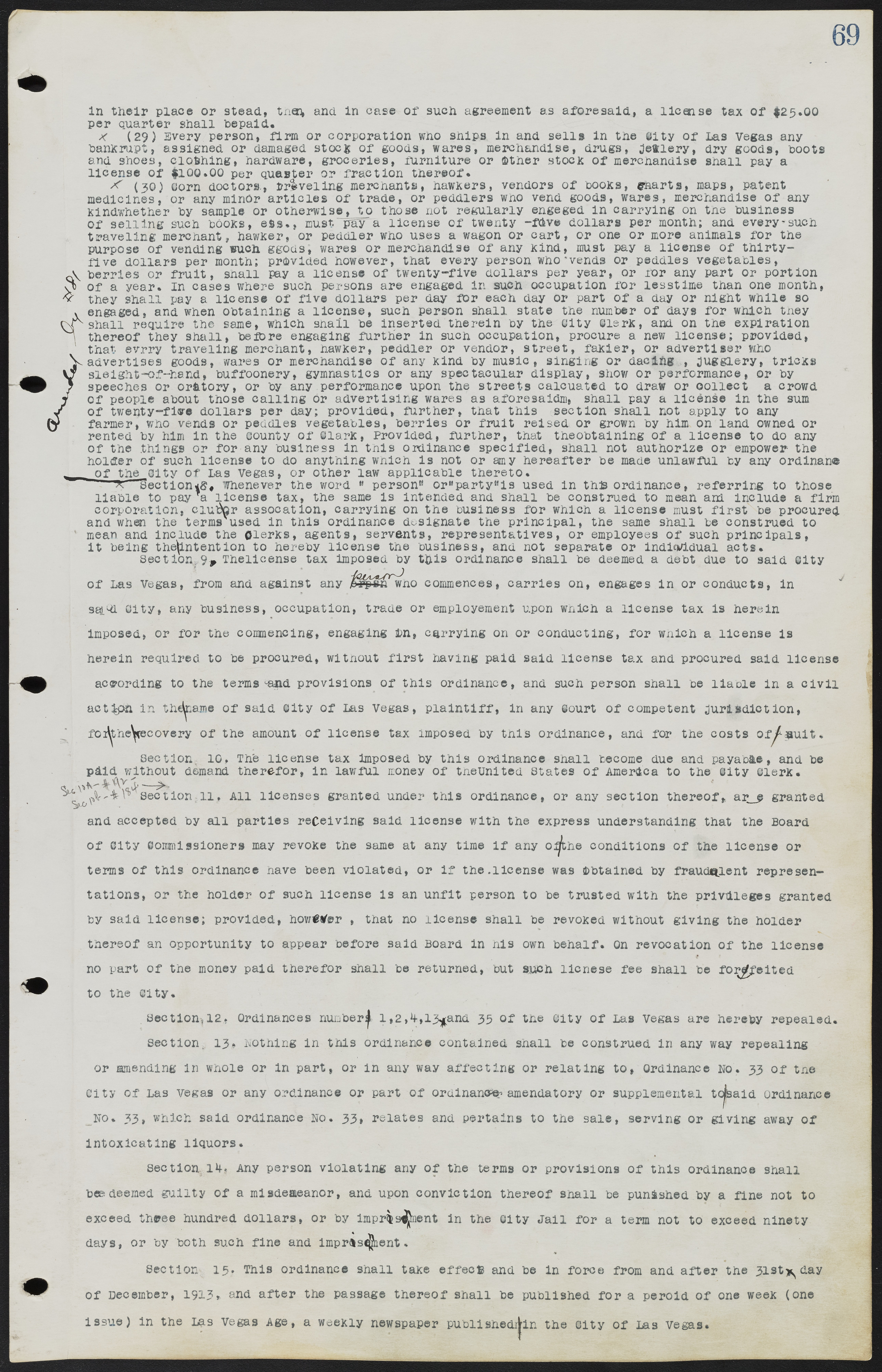

in their place or stead, then, and in case of such agreement as aforesaid, a license tax of $25.00 per quarter shall be paid. (29) Every person, firm or corporation who ships in and sells in the City of Las Vegas any bankrupt, assigned or damaged stock of goods, wares, merchandise, drugs, jewelry, dry goods, boots and shoes, clothing, hardware, groceries, furniture or other stock of merchandise shall pay a license of $100.00 per quarter or fraction thereof. (30) Corn doctors, traveling merchants, hawkers, vendors of books, charts, maps, patent medicines, or any minor articles of trade, or peddlers who vend goods, wares, merchandise of any kind whether by sample or otherwise, to those not regularly engaged in carrying on the business of selling such books, etc., must pay a license of twenty-five dollars per month; and every such traveling merchant, hawker, or peddler who uses a wagon or cart, or one or more animals for the purpose of vending such goods, wares or merchandise of any kind, must pay a license of thirty- five dollars per month; provided however, that every person who vends or peddles vegetables, berries or fruit, shall pay a license of twenty-five dollars per year, or for any part or portion of a year. In cases where such persons are engaged in such occupation for less time than one month, they shall pay a license of five dollars per day for each day or part of a day or night while so engaged, and when obtaining a license, such person shall state the number of days for which they shall require the same, which shall be inserted therein by the City Clerk, and on the expiration thereof they shall, before engaging further in such occupation, procure a new license; provided, that every traveling merchant, hawker, peddler or vendor, street, faker, or advertiser who advertises goods, wares or merchandise of any kind by music, singing or dancing, jugglery, tricks sleight-of-hand, buffoonery, gymnastics or any spectacular display, show or performance, or by speeches or oratory, or by any performance upon the streets calculated to draw or collect a crowd of people about those calling or advertising wares as aforesaid, shall pay a license in the sum of twenty-five dollars per day; provided, further, that this section shall not apply to any farmer, who vends or peddles vegetables, berries or fruit raised or grown by him on land owned or rented by him in the County of Clark, Provided, further, that the obtaining of a license to do any of the things or for any business in this ordinance specified, shall not authorize or empower the holder of such license to do anything which is not or may hereafter be made unlawful by any ordinance of the City of Las Vegas, or other law applicable thereto. Section 8. Whenever the word "person" or "party" is used in this ordinance, referring to those liable to pay a license tax, the same is intended and shall be construed to mean and include a firm corporation, club, or association, carrying on the business for which a license must first be procured and when the terms used in this ordinance designate the principal, the same shall be construed to mean and include the clerks, agents, servants, representatives, or employees of such principals, it being the intention to hereby license the business, and not separate or individual acts. Section, 9. The license tax imposed by this ordinance shall be deemed a debt due to said City of Las Vegas, from and against any person commences, carries on, engages in or conducts, in said City, any business, occupation, trade or employment upon which a license tax is herein imposed, or for the commencing, engaging in, carrying on or conducting, for which a license is herein required to be procured, without first having paid said license tax and procured said license according to the terms and provisions of this ordinance, and such person shall be liable in a civil action in the name of said City of Las Vegas, plaintiff, in any court of competent jurisdiction, for the recovery of the amount of license tax imposed by this ordinance, and for the costs of suit. Section 10. The license tax imposed by this ordinance shall become due and payable, and be paid without demand therefor, in lawful money of the United States of America to the City Clerk. Section 11. All licenses granted under this ordinance, or any section thereof, are granted and accepted by all parties receiving said license with the express understanding that the Board of City Commissioners may revoke the same at any time if any of the conditions of the license or terms of this ordinance have been violated, or if the license was obtained by fraudulent representations, or the holder of such license is an unfit person to be trusted with the privileges granted by said license; provided, however, that no license shall be revoked without giving the holder thereof an opportunity to appear before said Board in his own behalf. On revocation of the license no part of the money paid therefor shall be returned, but such license fee shall be forfeited to the City. Section 12. Ordinances numbers l, 2, 4, 13, and 35 of the City of Las Vegas are hereby repealed. Section 13. Nothing in this ordinance contained shall be construed in any way repealing or amending in whole or in part, or in any way affecting or relating to, Ordinance No. 33 of tne City of Las Vegas or any ordinance or part of ordinance amendatory or supplemental to said ordinance No. 33, which said ordinance No. 33, relates and pertains to the sale, serving or giving away of intoxicating liquors. Section 14. Any person violating any of the terms or provisions of this ordinance shall be deemed guilty of a misdemeanor, and upon conviction thereof shall be punished by a fine not to exceed three hundred dollars, or by imprisonment in the City Jail for a term not to exceed ninety days, or by both such fine and imprisonment. Section 15. This ordinance shall take effect and be in force from and after the 31st day of December, 1913, and after the passage thereof shall be published for a period of one week (one issue in the Las Vegas Age, a weekly newspaper published in the City of Las Vegas.