Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

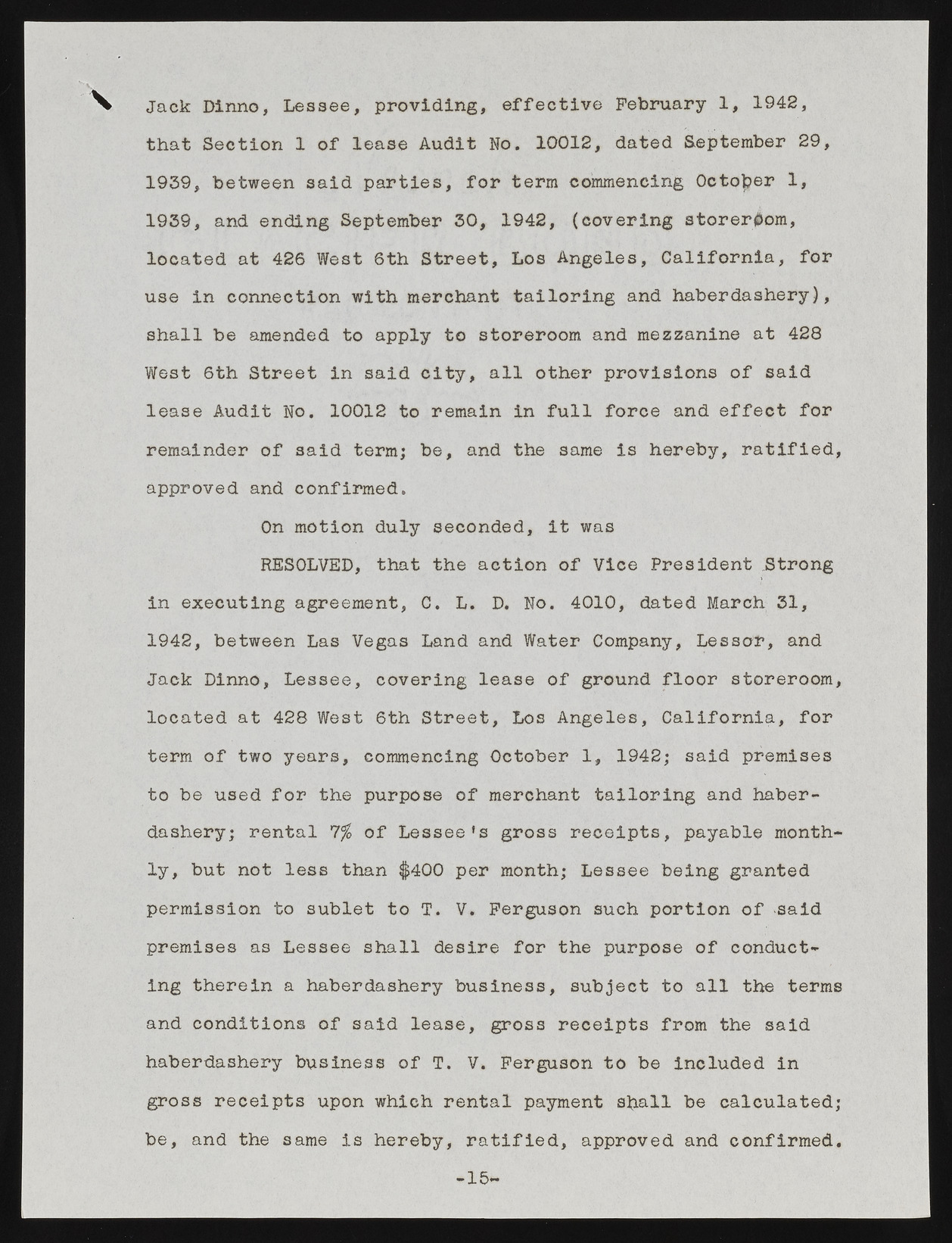

\ Jack Dinno, Lessee, providing, effective February 1, 1942, that Section 1 of lease Audit No. 10012, dated September 29, 1939, between said parties, for term commencing October 1, 1939, and ending September 30, 1942, (covering storeroom, located at 426 West 6th Street, Los Angeles, California, for use in connection with merchant tailoring and haberdashery), shall be amended to apply to storeroom and mezzanine at 428 West 6th Street in said city, all other provisions of said lease Audit No. 10012 to remain in full force and effect for remainder of said term; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Strong in executing agreement, C. L. D. No. 4010, dated March 31, 1942, between Las Vegas Land and Water Company, Lessor, and Jack Dinno, Lessee, covering lease of ground floor storeroom, located at 428 West 6th Street, Los Angeles, California, for term of two years, commencing October 1, 1942; said premises to be used for the purpose of merchant tailoring and haberdashery; rental 1% of Lessee’s gross receipts, payable monthly, but not less than $400 per month; Lessee being granted permission to sublet to T. V. Ferguson such portion of said premises as Lessee shall desire for the purpose of conducting therein a haberdashery business, subject to all the terms and conditions of said lease, gross receipts from the said haberdashery business of T. V. Ferguson to be included in gross receipts upon which rental payment shall be calculated; be, and the same is hereby, ratified, approved and confirmed. -15-