Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

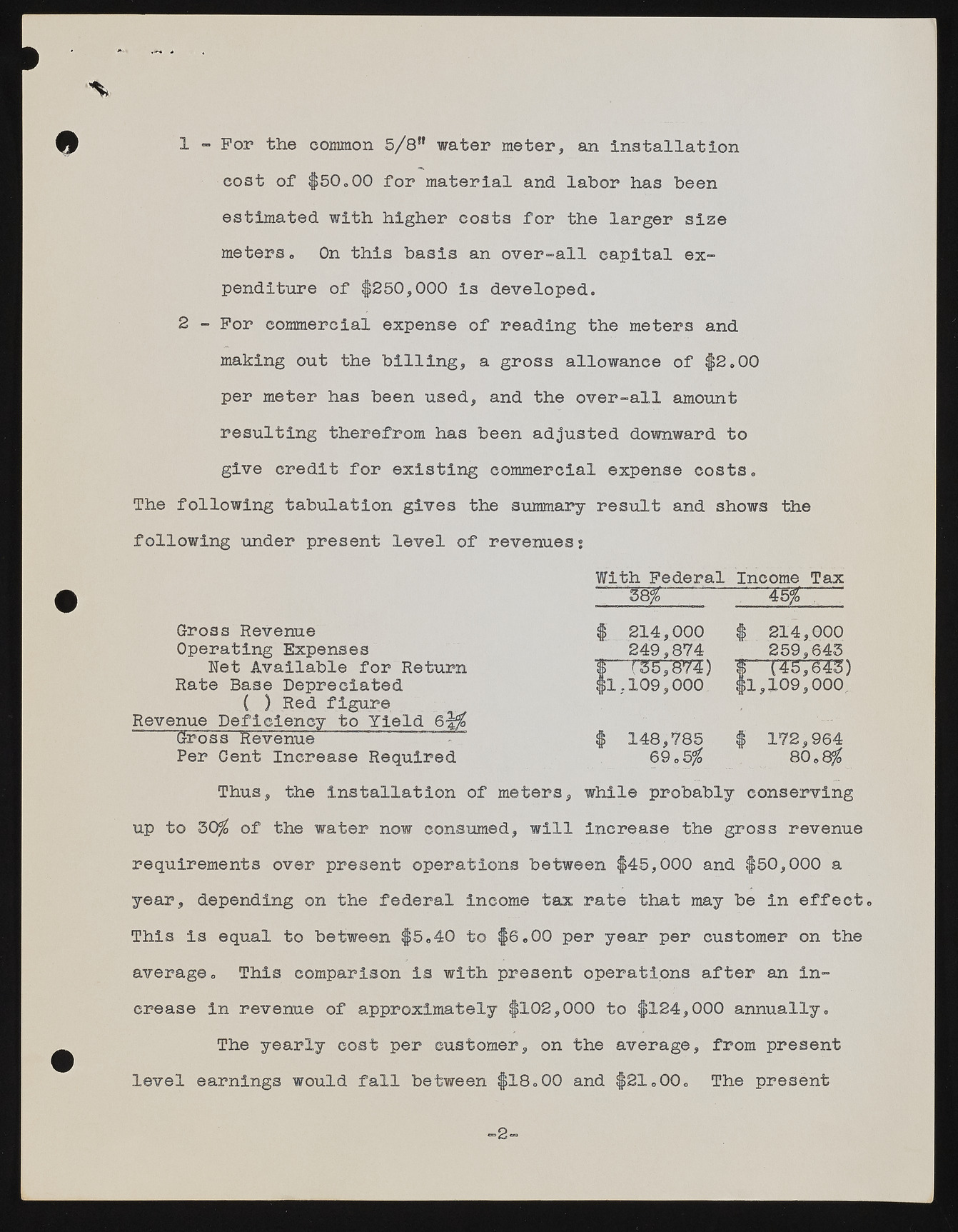

% 1 - F op the common 5/8” water meter, an installation cost of $50.00 for material and labor has been estimated with higher costs for the larger size meters. On this basis an over-all capital expenditure of $250,000 is developed. 2 - For commercial expense of reading the meters and making out the billing, a gross allowance of $2 .0 0 per meter has been used, and the over-all amount resulting therefrom has been adjusted downward to give credit for existing commercial expense costs. The following tabulation gives the summary result and shows the following under present level of revenuesj With Federal Income Tax Gross Revenue 58$ $ 214,000 $ 45$ , 214,000 Operating Expenses 249,874 259,645 Net Available for Return |— $ Rate Base Depreciated $1,109,000 $1 T,14059,,0-60'403.: ( ) Red figure Revenue Deficiency to Yield 6 l$ Gross Revenue $ 148,785 $ 172,964 Per Cent Increase Required 69.5$ 80.8$ Thus, the installation of meters, while probably conserving up to 50$ of the water now consumed, will increase the gross revenue requirements over present operations between $45,000 and $50,000 a year, depending on the federal Income tax rate that may be in effect. This is equal to between $5.40 to $6.00 per year per customer on the average. This comparison is with present operations after an in-crease in revenue of approximately $102,000 to $124,000 annually. The yearly cost per customer, on the average, from present level earnings would fall between $18.00 and $21.00. The present 2