Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

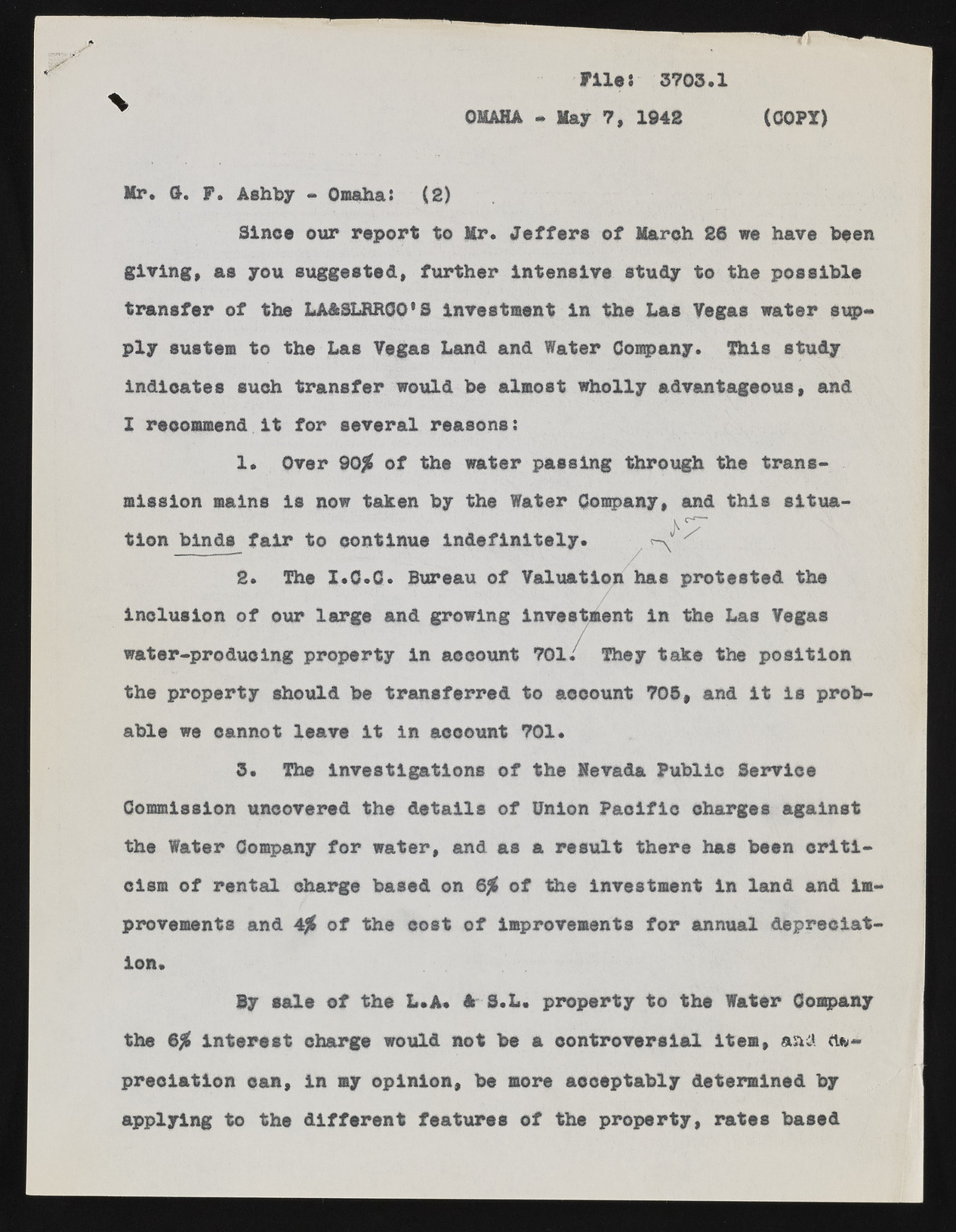

File: 3703.1 OMAHA - May 7, 1942 (COPY) Mr. 0. F. Ashby - Omaha: (2) Sines our report to Mr. Jeffers of Marsh 26 we have been giving, as you suggested, further intensive study to the possible transfer of the LAASLRRCO1S investment in the Las Vegas water supply suetem to the Las Vegas Land and Water Company. This study indieates eueh transfer would be almost wholly advantageous, and 1 recommend it for several reasons: 1* Over 90j£ of the water passing through the transmission mains is now taken by the Water Company, and this situa-tion binds^ fair to continue indefinitely. ? ^ H xH 2. The I.O.C. Bureau of Valuation has protested the inclusion of our large and growing investment in the Las Vegas water-producing property in account 70l/ They take the position the property should be transferred to account 705, and it is probable we cannot leave it in account 701. 3. The investigations of the Mevada Public Service Commission uncovered the details of Onion Pacific charges against the Water Company for water, and as a result there has been criticism of rental charge based on 6% of the investment in land and improvements and 4% of the cost of improvements for annual depreciation. By sale of the L.A. H . L . property to the Water Company the 6/6 Interest charge would not be a controversial item, and depreciation can, in my opinion, be more acceptably determined by applying to the different features of the property, rates based