Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

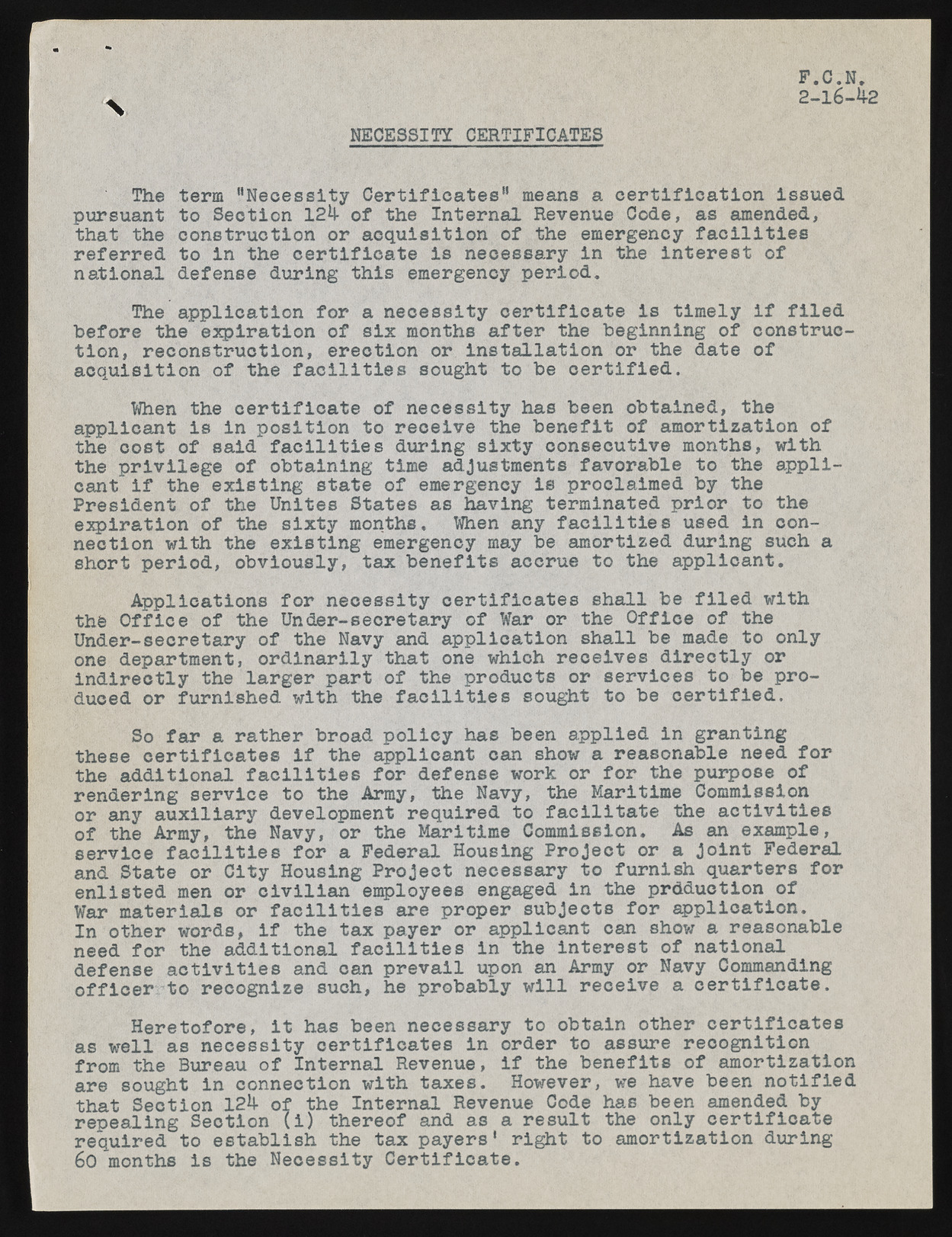

V NECESSITY CERTIFICATES F.C.N. 2 - l 6 - k 2 The term "Necessity Certificates" means a certification issued pursuant to Section 12 4 of the Internal Revenue Code, as amended, that the construction or acquisition of the emergency facilities referred to in the certificate is necessary in the interest of national defense during this emergency period. The application for a necessity certificate is timely if filed before the expiration of six months after the beginning of construction, reconstruction, erection or installation or the date of acquisition of the facilities sought to be certified. When the certificate of necessity has been obtained, the applicant is in position to receive the benefit of amortization of the cost of said facilities during sixty consecutive months, with the privilege of obtaining time adjustments favorable to the applicant if the existing state of emergency is proclaimed by the President of the Unites States as having terminated prior to the expiration of the sixty months. When any facilities used in connection with the existing emergency may be amortized during such a short period, obviously, tax benefits accrue to the applicant. Applications for necessity certificates shall be filed with thfe Office of the Under-secretary of War or the Office of the Under-secretary of the Navy and application shall be made to only one department, ordinarily that one which receives directly or indirectly the larger part of the products or services to be produced or furnished with the facilities sought to be certified. So far a rather broad policy has been applied in granting these certificates if the applicant can show a reasonable need for the additional facilities for defense work or for the purpose of rendering service to the Army, the Navy, the Maritime Commission or any auxiliary development required to facilitate the activities of the Army, the Navy, or the Maritime Commission. As an example, service facilities for a Federal Housing Project or a Joint Federal and State or City Housing Project necessary to furnish quarters for enlisted men or civilian employees engaged in the prdduction of War materials or facilities are proper subjects for application. In other words, if the tax payer or applicant can show a reasonable need for the additional facilities in the interest of national defense activities and can prevail upon an Army or Navy Commanding officer to recognize such, he probably will receive a certificate. Heretofore, it has been necessary to obtain other certificates as well as necessity certificates in order to assure recognition from the Bureau of Internal Revenue, if the benefits of amortization are sought in connection with taxes. However, we have been notified that Section 12*J- of the Internal repealing Section (i) thereof an d Reavs enau er esCuoldte htahes boenelny caemretnidfeidc abtye required to establish the tax payers' right to amortization during 60 months is the Necessity Certificate.