Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

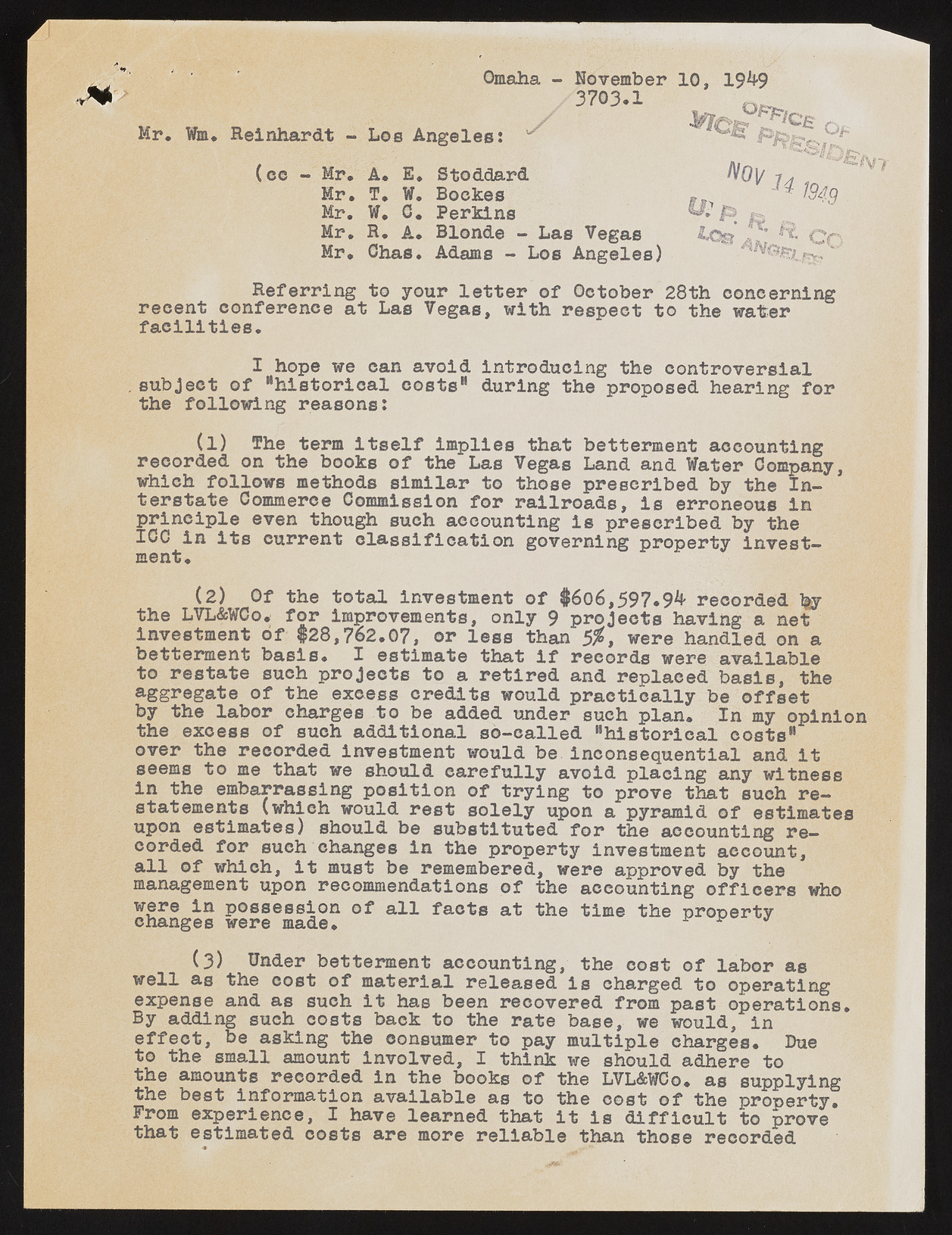

9 Omaha - November 10. 19^9 3 7 0 3 .1 Mr. Wm. Reinhardt - Los Angeles: ^ (ce - Mr. A. E. Stoddard Mr. T. W. Bockes Mr. W. G. Perkins Mr. R. A. Blonde - Las Vegas Mr. Ghas. Adams - Los Angeles) r , , * 0 V J4 y. & 1949 %Sic *C n Referring to your letter of October 28th concerning recent conference at Las Vegas, with respect to the water facilities. I hope we can avoid Introducing the controversial subject of "historical eosts" during the proposed hearing for the following reasons: (l) The term Itself implies that betterment accounting recorded on the books of the Lae Vegas Land and Water Company, which follows methods similar to those prescribed by the Interstate Commerce Commission for railroads, is erroneous in principle even though such accounting is prescribed by the ICC in its current classification governing property investment. (2) Of the total investment of $6o6,597.9A recorded W the LVL&WGo. for improvements, only 9 projects having a net Investment of $28,762.07, or less than 5#, were handled on a betterment basis. I estimate that if records were available to restate such projects to a retired and replaced basis, the aggregate of the excess credits would practically be offset by the labor charges to be added under such plan. In my opinion the excess of such additional so-called "historical costs" over the recorded investment would be inconsequential and it seems to me that we should carefully avoid placing any witness in the embarrassing position of trying to prove that such restatements (which would rest solely upon a pyramid of estimates upon estimates) should be substituted for the accounting recorded for such changes in the property investment account, all of which, it must be remembered, were approved by the management upon recommendations of the accounting officers who wcehraen geisn pwoerses emsasdieo.n of all faets at the time the *p royp ertyJ (3) Under betterment accounting, the cost of labor as well as the cost of material released is charged to operating expense and as such it has been recovered from past operations. By adding such costs back to the rate base, we would, in effect, be asking the consumer to pay multiple charges. Due to the small amount Involved, I think we should adhere to the amounts recorded in the books of the LVL&WCo. as supplying the best information available as to the cost of the property. From experience, I have learned that it is difficult to prove that estimated costs are more reliable than those recorded