Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

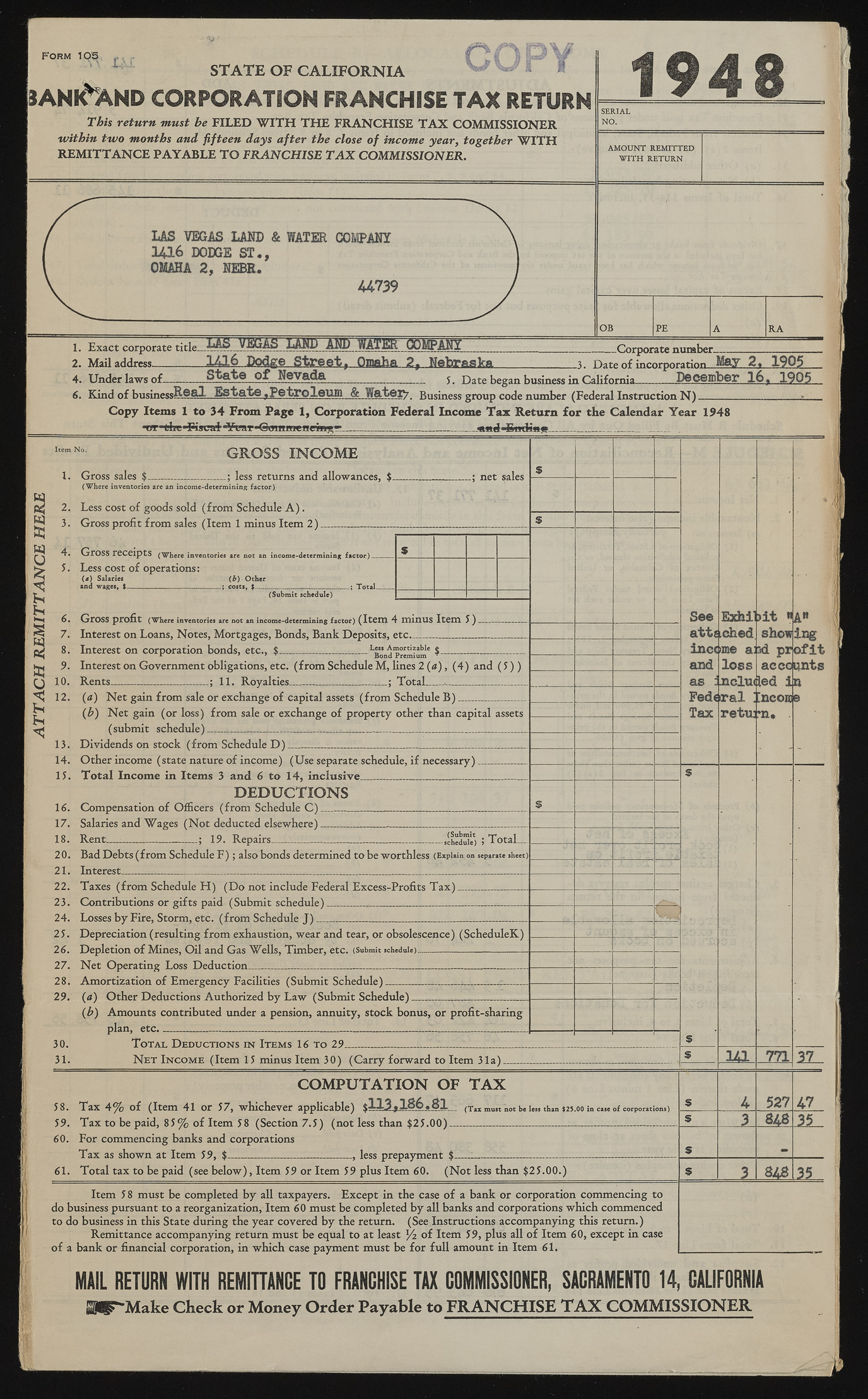

A T T A C H R E M IT T A N C E H ERE F o r m 105 STATE OF CALIFORNIA 3ANIOVND CORPORATION FRANCHISE TAX RETURN This return must be FILED W IT H TH E FRANCHISE T A X COMMISSIONER within two months and fifteen days after the close of income year, together W IT H REM ITTAN CE PAYABLE T O FRANCHISE T A X COMMISSIONER. LAS VEGAS LAND & WATER COMPANY 1416 DODGE ST., OMAHA 2 , NEBR. -44-739 1948 SERIAL NO. AMOUNT REMITTED W ITH RETURN OB PE RA i las vkgas land and water company^ -Corporate number- 2. Mail address_________ 143-6 JDodge Street, Omaha 9 , WabrafiVa 4. Under laws o f_______ State of Nevada____________ 6. Kind o f husinessR.Sa l Estate , PetroIqTJJH & WateiV Business group code number (Federal Instruction N) 3. Date o f incorporation_May 2 ._1 9 0 5 5. Date began business in California_______ D ecem ber 1 6 , 1 9 0 5 Copy Items 1 to 34 From Page 1, Corporation Federal Income Tax Return for the Calendar Year 1948 ?or" the-Fiscal ?Yvar*<g<7iH<TTewe4n£- _______ __________ -<md‘Ending- — MMMI -il-U'-. tcmNo GROSS INCOME 1. Gross sales $______less returns and allowances, $. (Where inventories are an income-determining factor) 2. Less cost of goods sold (from Schedule A ) . 3. Gross profit from sales (Item 1 minus Item 2) —___________ _ net sales 4- GrOSS receipts (Where inventories are not an income-determining factor)__ 5. Less cost of operations: (a) Salaries and wages, $_ ( b) Other ; costs, $_. (Submit schedule) ; T otal- G rO S S profit (Where inventories are not an income-determining factor) (ItCITl 4 m in U S I t e m 5 ) _ Interest on Loans, Notes, Mortgages, Bonds, Bank Deposits, etc— ._________ Interest on corporation bonds, etc., $........... ....... _____...L'“ $_______ Interest on Government obligations, etc. (from Schedule M, lines 2 (a) , (4) and (5 ) ) Rents________ _________; 11. Royalties___ ___________ __; Total : ...... 1 (a) Net gain from sale or exchange of capital assets (from Schedule B) SM lljjli (b) Net gain (or loss) from sale or exchange of property other than capital assets (submit schedule) — - . _ __p 4 .... >*; Dividends on stock (from Schedule D)SSi^iii..L_——___ _ ____ j ^ Other income (state nature of income) (Use separate schedule, if necessary) Total Income in Items 3 and 6 to 14, inclusive_____________________ DEDUCTIONS Compensation of Officers (from Schedule C) _„i_______________ .? ______ Salaries and Wages (Not deducted elsewhere)_____ ______ _____ _ Rent— ---------------- ; 19. Repairs— — B!G2!a2E*il^---------------- ,_J------schedule) Bad Debts (from Schedule F ) ; also bonds determined to be worthless (Expiein on separate sheet) Interest— _______ J, ........................................................ ... ... . "" Taxes (from Schedule H ) (Do not include Federal Excess-Profits Tax). Contributions or gifts paid (Submit schedule) ___ ___ _______ Losses by Fire, Storm, etc. (from Schedule J ) ________ ____ __ (Submit . T ( ) t a L Depreciation (resulting from exhaustion, wear and tear, or obsolescence) (ScheduleK) Depletion o f Mines, Oil and Gas Wells, Timber, etc. (Submit schedule)— — -------------------------------- Net Operating Loss Deduction_____ ______t ___________________ _________ _ Amortization of Emergency Facilities (Submit Schedule) Jp__ — ___ aJ___L_f.___ (a) Other Deductions Authorized by Law (Submit Schedule)__________-_________ (b) Amounts contributed under a pension, annuity, stock bonus, or profit-sharing plan, etc. — __________________________! _________ — L__2______ T otal Deductions in Items 16 To 29____________ —I — * N et Income (Item 15 minus Item 30) (Carry forward to Item 31a)_ Exhip ched me a: loss tnclu<jh sral retuir m jcu: in Bcomje n. "aw i lug ofit nts 7 7 1 37- COMPUTATION OF TAX 58. Tax 4% of (Item 41 or 57, whichever applicable) $1 1 3 ,1 8 6 .8 1 (Tax must not be less than $25.00 in case o f corporations) 59. Tax to be paid, 85% of Item 58 (Section 7.5) (not less than $25.00)_____ — ___ ig 60. For commencing banks and corporations Tax as shown at Item 59, $________________ ______, less prepayment $_—:____ ___ —-____ — 61. Total tax to be paid (see below), Item 59 or Item 59 plus Item 60. (N ot less than $25.00.) 5 27 47 848 35. 8 4 8 31 Item 5 8 must be completed by all taxpayers. Except in the case of a bank or corporation commencing to do business pursuant to a reorganization, Item 60 must be completed by all banks and corporations which commenced to do business in this State during the year covered by the return. (See Instructions accompanying this return.) Remittance accompanying return must be equal to at least % of Item 59, plus all of Item 60, except in case o f a bank or financial corporation, in which case payment must be for full amount in Item 61. MAIL RETURN WITH REMITTANCE TO FRANCHISE TAX COMMISSIONER, SACRAMENT014, CALIFORNIA SI|S Make Check or Money Order Payable to FR AN CH ISE T A X COM M ISSIONER