Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

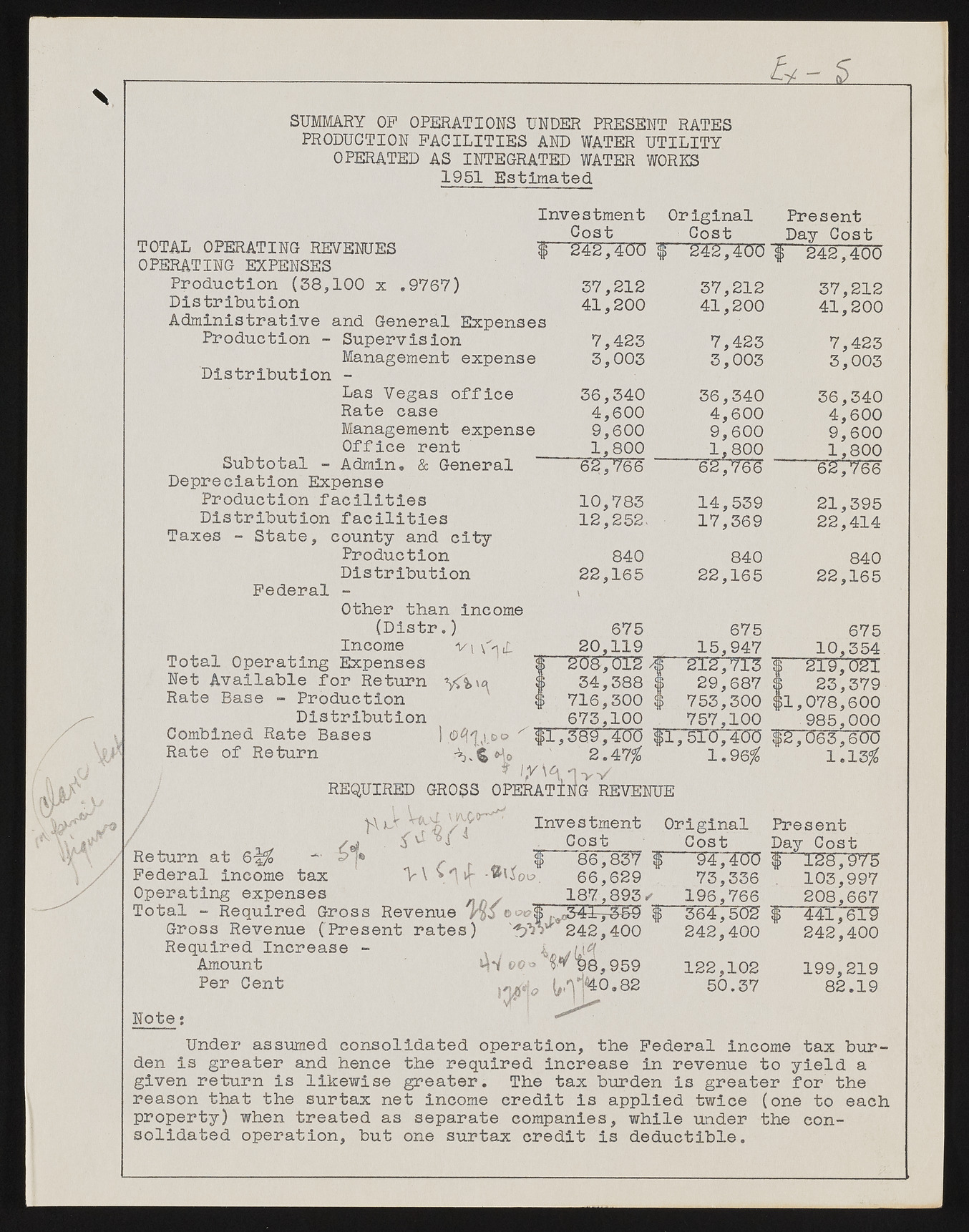

& - 5 SUMMARY OP OPERATIONS UNDER PRESENT RATES PRODUCTION FACILITIES AND WATER UTILITY OPERATED AS INTEGRATED WATER WORKS 1951 Estimated Investment Original Present TOTAL OPERATING REVENUES OPERATING EXPENSES Production (58,100 x .9767) Distribution Administrative and General Expens Production - Supervision Management expens Distribution - Las Vegas office Rate case Management expense Office rent Subtotal - Admin. & General Depreciation Expense Production facilities Distribution facilities Taxes - State, county and city Production Distribution Federal - Other than income (Distr.) Income Total Operating Expenses Net Available for Return Rate Base - Production Distribution Combined Rate Bases Rate of Return Cost Cost Day Cost 1 "242,400 #“ ~2"4~2",40o f 242,400 37,212 37,212 37,212 3S 41,200 41,200 41,200 7,423 7,423 7,423 | 3,003 3,003 3,003 36,340 36,340 36,340 4,600 4,600 4,600 | 9,600 9,600 9,600 1,800 1,800 1,800 " 62,766 62,766 " 62,766 10,783 14,539 21,395 12,252, 17,369 22,414 840 840 840 22,165 22,165 22,165 675 675 675 20,119 15,947 10,354 20&, 012 GtXCt 9 (lO || 219,021 ^3- % Ho 54,388 716,300 673,100 29,687 753,300 757,100 ^ #1,389,400 #1,510,400 2.47$ 1. f 23,379 |l,078,600 985,000 "#2,063,600 1.13$ / REQUIRED GROSS OPERATING REVENUE ?Ii/T >\ SfiH Investment Cost Original Cost ~T4,’400 73,336 196,766 "364,502 242,400 122,102 50.37 Present Day Cost I2S79T5 H m i|ii Return at 6^$ * |* , # 86,837 i Federal income tax > \ if W. 66,629 Operating expenses „ || 187,893 ? Total - Required Gross Revenue ,.oj0344-r3¥9 l Gross Revenue (Present rates) 242,400 Required Increase - ( i Amount 9** 98,959 Per Cent L^^0.82 ’?vT LU* Note •. Under assumed consolidated operation, the Federal income tax burden is greater and hence the required increase in revenue to yield a given return is likewise greater. The tax burden is greater for the reason that the surtax net income credit is applied twice (one to each property) when treated as separate companies, while under the consolidated operation, but one surtax credit is deductible. 103,997 208,667 ""441,619 242,400 199,219 82.19