Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

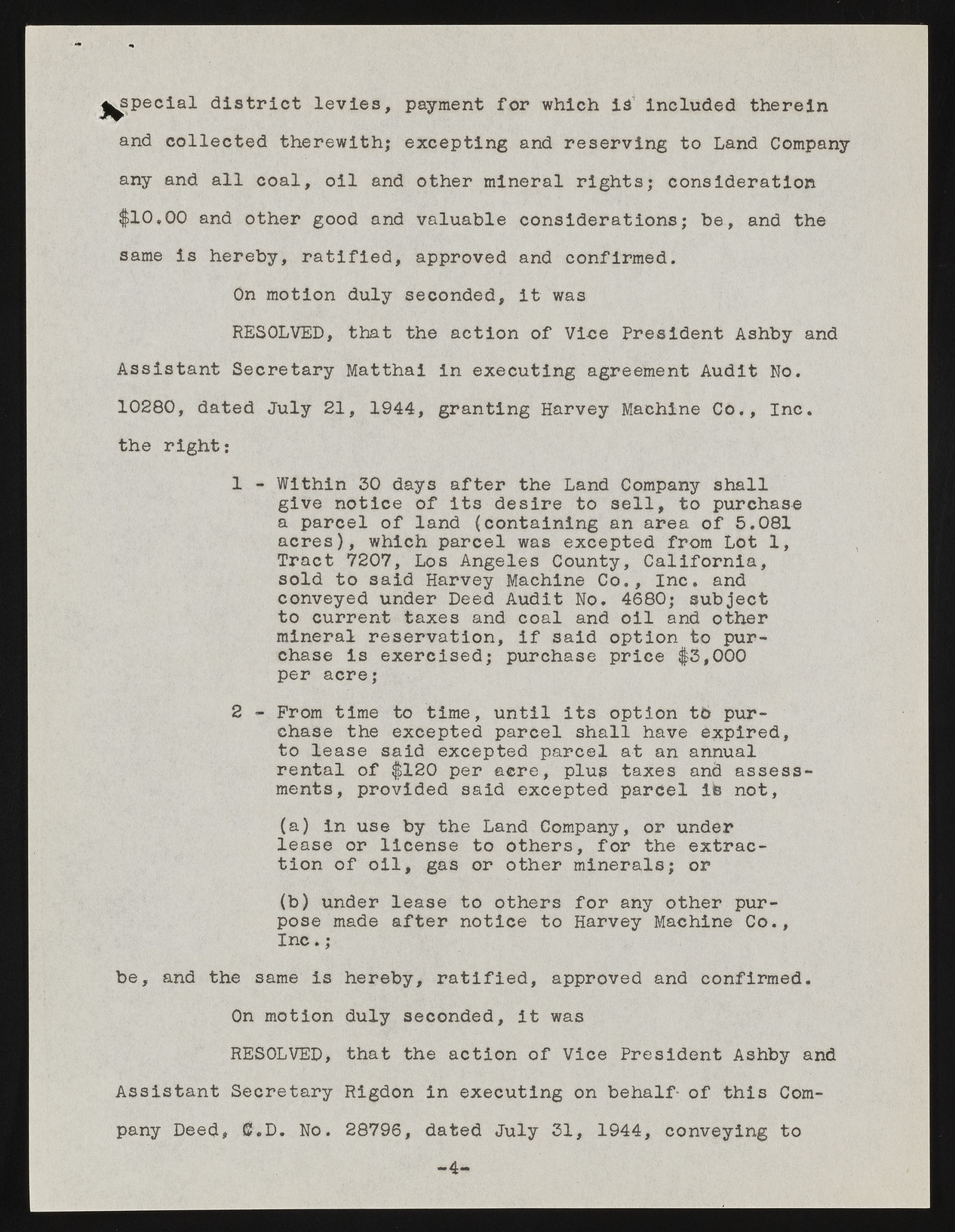

jyspecial district levies, payment for which is included therein and collected therewith; excepting and reserving to Land Company any and all coal, oil and other mineral rights; consideration $10,00 and other good and valuable considerations; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Ashby and Assistant Secretary Matthai in executing agreement Audit No. 10280, dated July 21, 1944, granting Harvey Machine Co., Inc. the right: 1 - Within 30 days after the Land Company shall give notice of its desire to sell, to purchase a parcel of land (containing an area of 5.081 acres), which parcel was excepted from Lot 1, Tract 7207, Los Angeles County, California, sold to said Harvey Machine Co., Inc. and conveyed under Deed Audit No. 4680; subject to current taxes and coal and oil and other mineral reservation, if said option to purchase is exercised; purchase price $3,000 per acre; 2 - Prom time to time, until its option tt> purchase the excepted parcel shall have expired, to lease said excepted parcel at an annual rental of $120 per acre, plus taxes and assessments, provided said excepted parcel ife not, (a) in use by the Land Company, or under lease or license to others, for the extraction of oil, gas or other minerals; or (b) under lease to others for any other purpose made after notice to Harvey Machine Co., Inc.; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Ashby and Assistant Secretary Rigdon in executing on behalf- of this Company Deed, fi'.D. No. 28796, dated July 31, 1944, conveying to 4-