Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

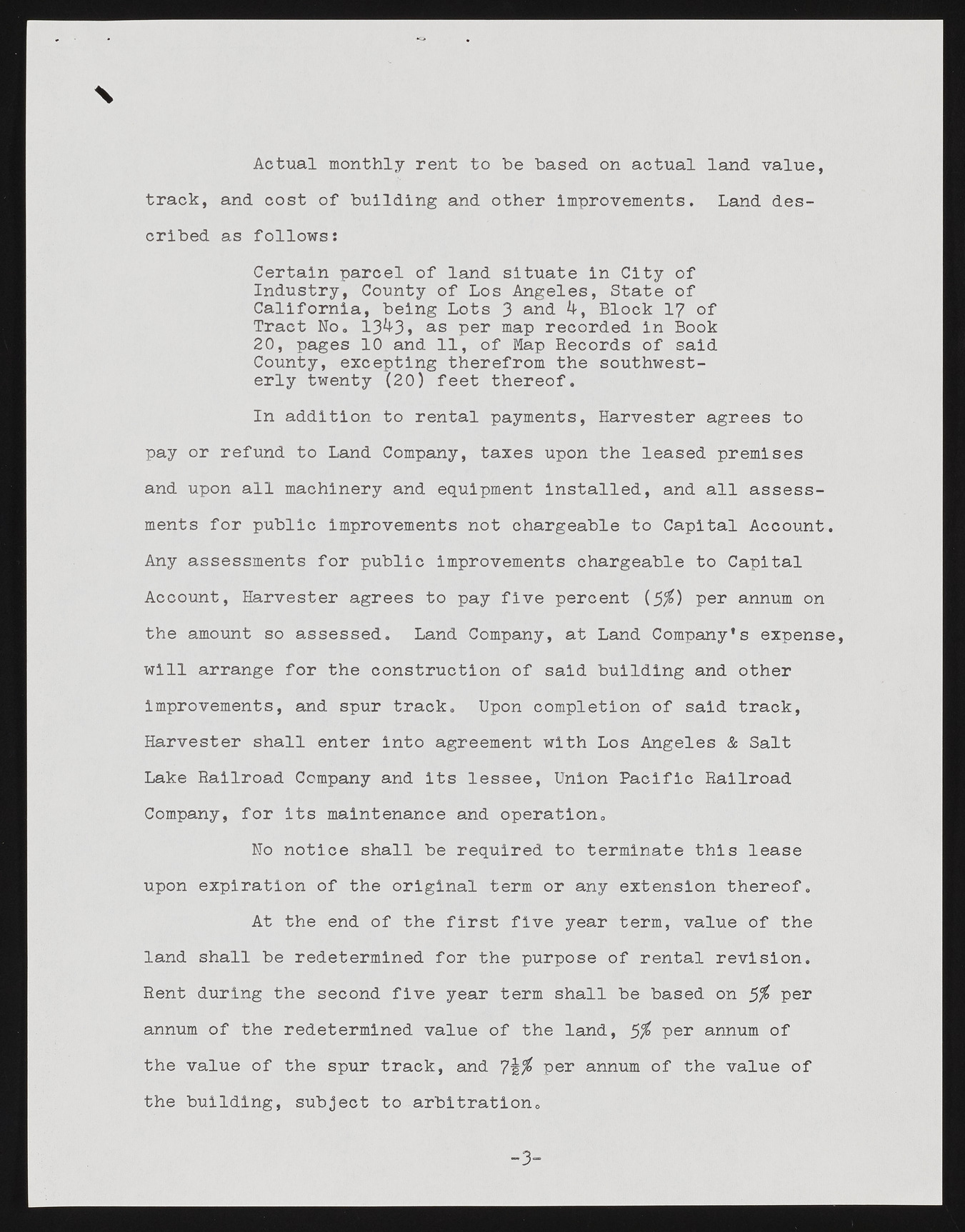

\ Actual monthly rent to be based on actual land value, track, and cost of building and other Improvements. Land described as follows: Certain parcel of land situate in City of Industry, County of Los Angeles, State of California, being Lots 3 and Block 17 of Tract No. 13^3» as per map recorded in Book 2 0 , pages 1 0 and 1 1 , of Map Records of said County, excepting therefrom the southwesterly twenty (20) feet thereof. In addition to rental payments, Harvester agrees to pay or refund to Land Company, taxes upon the leased premises and upon all machinery and equipment installed, and all assessments for public improvements not chargeable to Capital Account. Any assessments for public improvements chargeable to Capital Account, Harvester agrees to pay five percent (5$) per annum on the amount so assessed. Land Company, at Land Company's expense, will arrange for the construction of said building and other improvements, and spur track. Upon completion of said track, Harvester shall enter into agreement with Los Angeles & Salt Lake Railroad Company and its lessee, Union Pacific Railroad Company, for its maintenance and operation. No notice shall be required to terminate this lease upon expiration of the original term or any extension thereof. At the end of the first five year term, value of the land shall be redetermined for the purpose of rental revision. Rent during the second five year term shall be based on per annum of the redetermined value of the land, 5% per annum of the value of the spur track, and Per annum of the value of the building, subject to arbitration. -3-