Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

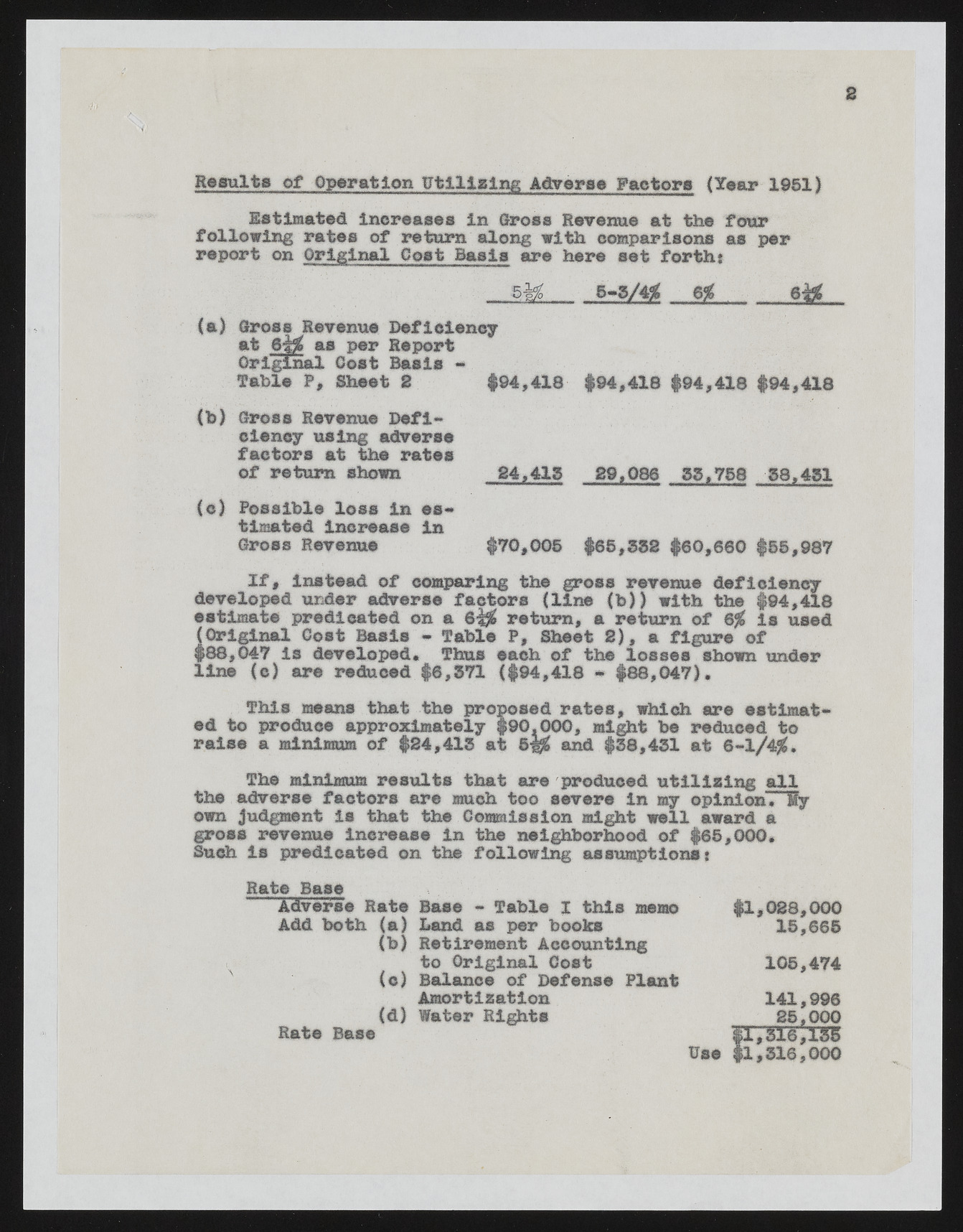

2 Results of Operation Utilizing Adverse Factors (Year 1061) Estimated increases in Gross Revenue at the four following rates of return along with comparisons as per report on Original Cost Basis are here set forth} 5-5/4# 6#_______6& (a) Gross Revenue Deficiency at 6^# as per Report Original Cost Basis - Table P, Sheet 2 #04,418 #94,418 #94,418 #94,418 (b) Gross Revenue Deficiency using adverse factors at the rates of return shown £4,415 £9,086 55,758 58,451 (c) Possible loss in estimated increase in Gross Revenue #70,005 #65,552 #60,600 #55,987 If, Instead of comparing the gross revenue deficiency developed under adverse factors (line (b)) with the #94,418 estimate predicated on a 6^# return, a return of 6# is used (Original Cost Basis - Table P, Sheet 2), a figure of #88,047 is developed* Thus each of the losses shown under line (c) are reduced #6,571 (#94,418 m #88,047). This means that the proposed rates, which are estimated to produce approximately #90,000, might be reduced to raise a minimum of #24,415 at and #38,431 at 6 -1/4#. The minimum results that are produced utilising all the adverse factors are much too severe in my opinion. Wy own judgment is that the Commission might well award a gross revenue increase in the neighborhood of #65,000* Such is predicated on the following assumptions: Rate Base Adverse Rate Base - Table I this memo Add both (a) Land as per books (b) Retirement Accounting to Original Cost (o) Balance of Defense Plant Amortization (d) Water Rights Use #1,516,000 #1,028,000 15,665 105,474 141,996 25,000 $T,'STi,lS5 Rate Base