Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

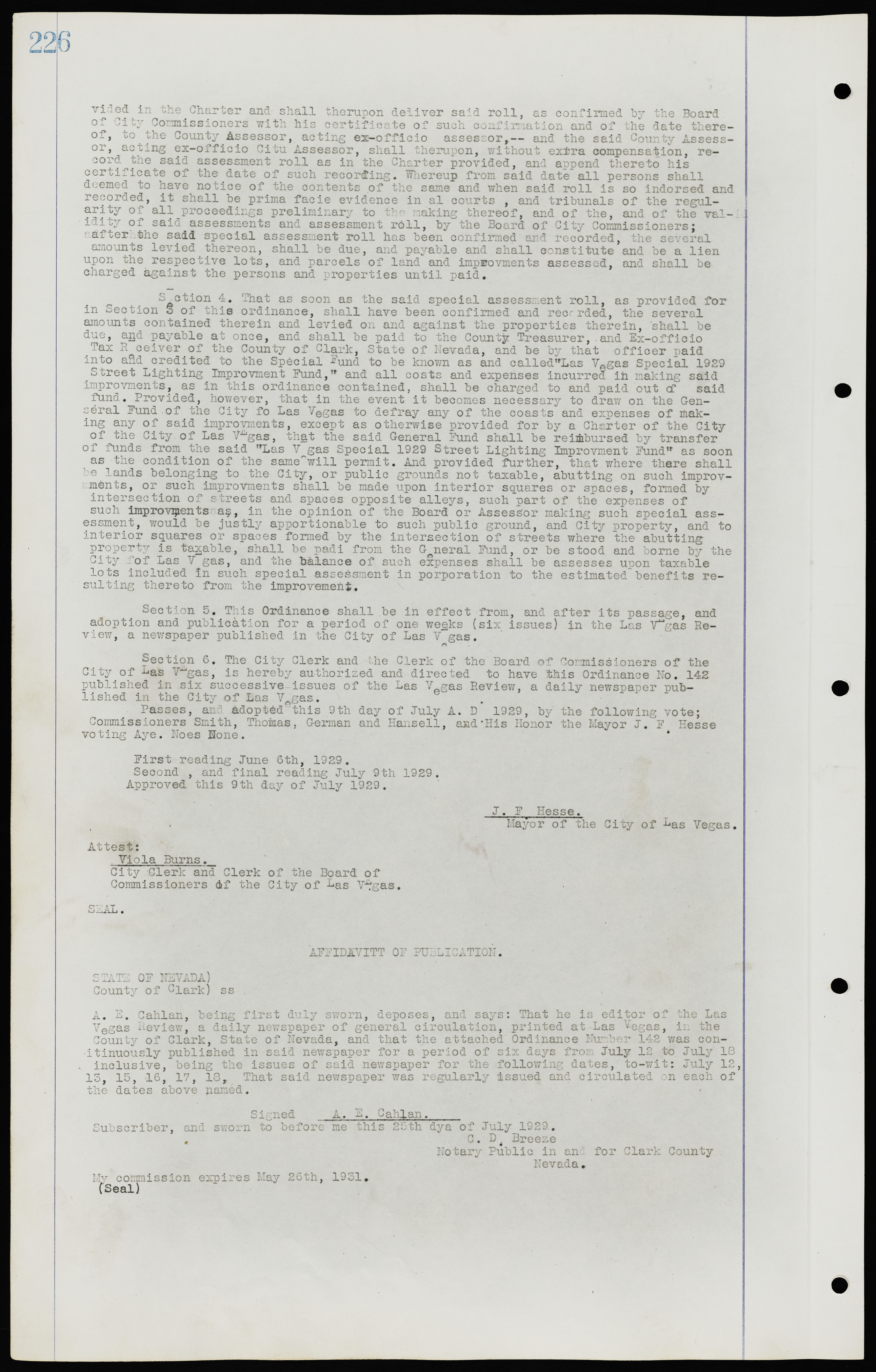

provided in the Charter and shall thereupon deliver said roll, as confirmed by the Board of City Commissioners with his certificate of such confirmation and of the date thereof, to the County Assessor, acting ex-officio assessor,— and the said County Assessor, acting ex-officio City Assessor, shall thereupon, without extra compensation, record the said assessment roll as in the Charter provided, and append thereto his certificate of the date of such recording. Whereupon from said date all persons shall deemed to have notice of the contents of the same and when said roll is so indorsed and recorded, it shall be prima facie evidence in all courts, and tribunals of the regularity of all proceedings preliminary to the making thereof, and of the, and of the validity of said assessments and assessment roll, by the Board of City Commissioners; after the said special assessment roll has been confirmed and recorded, the several amounts levied thereon, shall be due, and payable and shall constitute and be a lien upon the respective lots, and parcels of land and improvements assessed, and shall be charged against the persons and properties until paid. Section 4. That as soon as the said special assessment roll, as provided for in Section 3 of this ordinance, shall have been confirmed and recorded, the several amounts contained therein and levied on and against the properties therein, shall be due, and payable at once, and shall be paid to the County Treasurer, and Ex-officio Tax Receiver of the County of Clark, State of Nevada, and be by that officer paid into and credited to the Special Fund to be known as and called "Las Vegas Special 1929 Street Lighting Improvement Fund," and all costs and expenses incurred in making said improvements, as in this ordinance contained, shall be charged to and paid out of said fund. Provided, however, that in the event it becomes necessary to draw on the General Fund of the City fo Las Vegas to defray any of the coasts and expenses of taking any of said improvements, except as otherwise provided for by a Charter of the City of the City of Las Vegas, that the said General Fund shall be reimbursed by transfer of funds from the said "Las Vegas Special 1929 Street Lighting Improvement Fund" as soon as the condition of the same will permit. And provided further, that where there shall be lands belonging to the City, or public grounds not taxable, abutting on such improvements, or such improvements shall be made upon interior squares or spaces, formed by intersection of streets and spaces opposite alleys, such part of the expenses of such improvements as, in the opinion of the Board or Assessor making such special assessment, would be justly proportionable to such public ground, and City property, and to interior squares or spaces formed by the intersection of streets where the abutting property is taxable, shall be paid from the General Fund, or be stood and borne by the City of Las Vegas, and the balance of such expenses shall be assesses upon taxable lots included in such special assessment in proportion to the estimated benefits resulting thereto from the improvement. Section 5. This Ordinance shall be in effect from, and after its passage, and adoption and publication for a period of one weeks (six issues) in the Las Vegas Review, a newspaper published in the City of Las Vegas. Section 6. The City Clerk and the Clerk of the Board of Commissioners of the City of Las Vegas, is hereby authorized and directed to have this Ordinance No. 142 published in six successive issues of the Las Vegas Review, a daily newspaper published in the City of Las Vegas. Passes, and Adopted this 9th day of July A. D. 1929, by the following vote; Commissioners Smith, Thomas, German and Hansell, and His Honor the Mayor J. F Hesse voting Aye. Noes None. First reading June 6th, 1929. Second, and final reading July 9th 1929. Approved this 9th day of July 1929. J. F Hesse. Mayor of the City of Las Vegas. Attest: Viola Burns. City Clerk and Clerk of the Board of Commissioners of the City of Las Vegas. SEAL. AFFIDAVIT OF PUBLICATION. STATE OF NEVADA) County of Clark) ss . A. E. Cahlan, being first duly sworn, deposes, and says: That he is editor of the Las Vegas Review, a daily newspaper of general circulation, printed at Las Vegas, in the County of Clark, State of Nevada, and that the attached Ordinance Number 142 was continuously published in said newspaper for a period of six days from July 12 to July 18 inclusive, being the issues of said newspaper for the following dates, to-wit: July 12, 15, 15, 16, 17, 18, That said newspaper was regularly Issued and circulated on each of the dates above named. Signed A. E. Cahlan. Subscriber, and sworn to before me this 25th day of July 1929. C. D. Breeze Notary Public in and for Clark County Nevada. My commission expires May 26th, 1931. (Seal)