Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

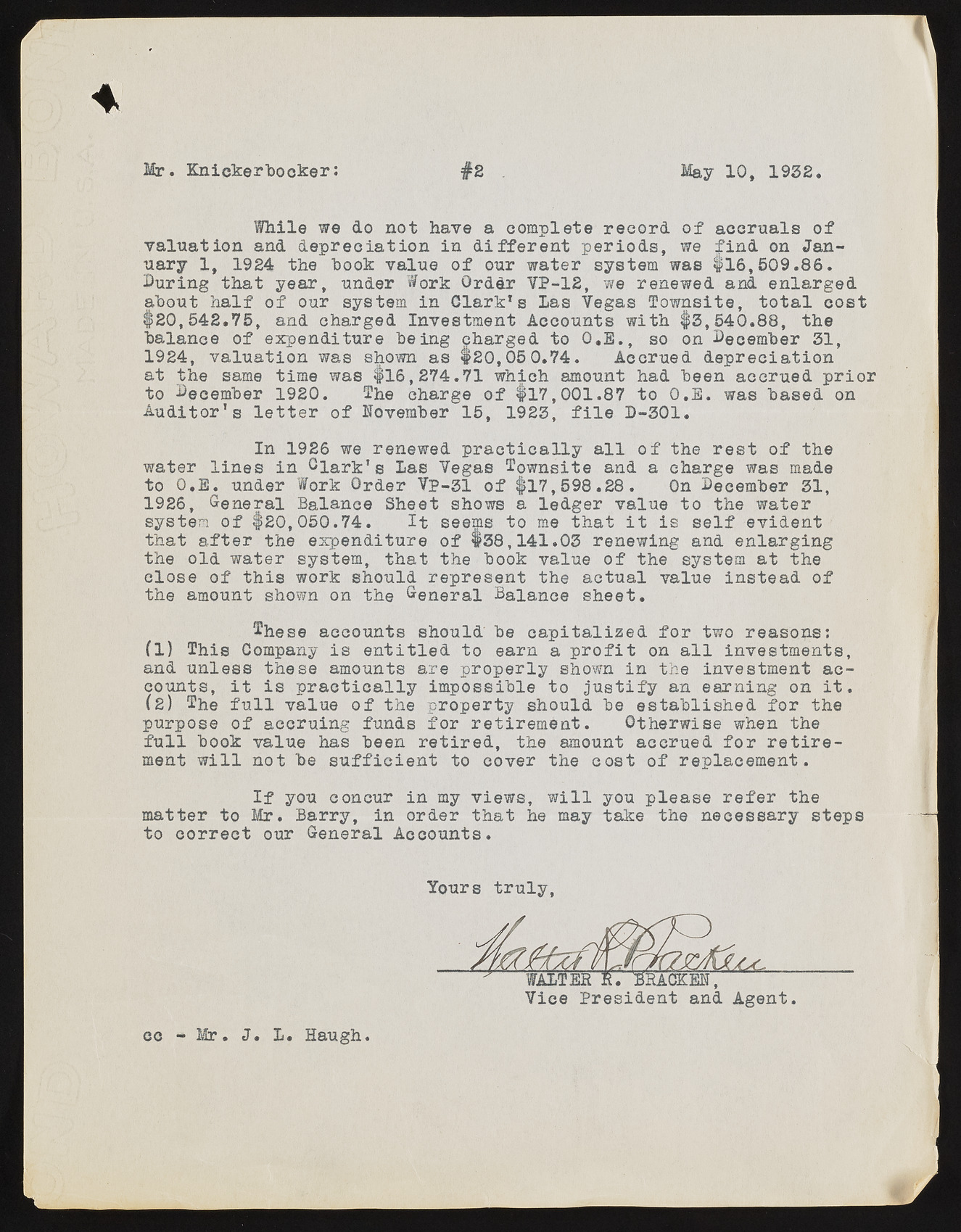

Mr. Knickerbocker: #2 May 10, 1932 While we do not have a complete record of accruals of valuation and depreciation in different periods, we find on January 1, 1924 the book value of our water system was $16,509.86. During that year, under Work Order VP-12, we renewed and enlarged about half of our system in Clark1s las Vegas Townsite, total cost $20,542.75, and charged Investment Accounts with $3,540.88, the balance of expenditure being charged to O.E., so on December 31, 1924, valuation was shown as $20,050.74. Accrued depreciation at the same time was $16,274.71 which amount had been accrued prior to December 1920. The charge of $17,001.87 to O.E. was based on Auditor's letter of November 15, 1923, file D-301. In 1926 we renewed practically all of the rest of the water lines in Clark's Las Vegas Townsite and a eharge was made to O.E. under Work Order VP-31 of $17,598.28. On December 31, 1926, General Balance Sheet shows a ledger value to the water system of $20,050.74. It seems to me that it is self evident that after the expenditure of $38,141.03 renewing and enlarging the old water system, that the book value of the system at the close of this work should represent the actual value instead of the amount shown on the General Balance sheet. These accounts should be capitalized for two reasons: (1) This Company is entitled to earn a profit on all investments, and unless these amounts are properly shown in the investment accounts, it is practically impossible to justify an earning on it. (2) The full value of the property should be established for the purpose of accruing funds for retirement. Otherwise when the full book value has been retired, the amount accrued for retirement will not be sufficient to cover the cost of replacement. If you concur in my views, will you please refer the matter to Mr. Barry, in order that he may take the necessary steps to correct our General Accounts. Yours truly, MLTEB B. BRACKEN, Vice President and Agent, ec -Mr. J. L. Haugh. n