Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

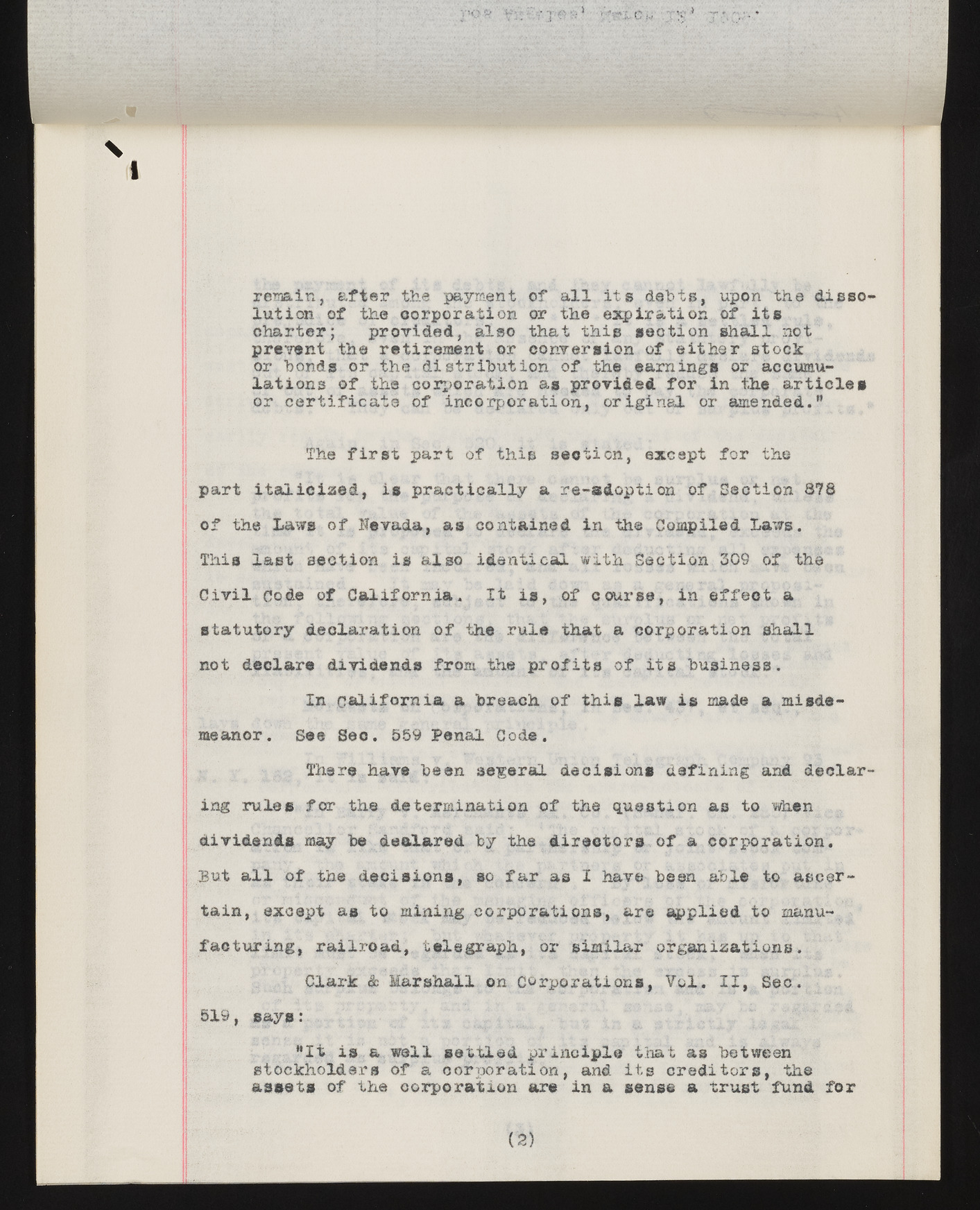

\ 1 remain, after the payment of all its debts, upon the dies© lution of the corporation or the expiration of its charter; provided, also that this section shall not prevent the retirement or conversion of either stock or bonds or the distribution of the earnings or accumulations of the corporation as provided for in the articles or certificate of incorporation, original or amended." The first part of this seoticn, except for the part italicized, is practically a re-adoption of Section 878 of the laws of Nevada, as contained in the Compiled Laws. This last section is also identical with Section 309 of the Civil Code of California. It is, of course, in effect a statutory declaration of the rule that a corporation shall not declare dividends from the profits of its business. In California a breach of this law is made a misdemeanor. See See. 559 Penal Code. There hare been several decisions defining and declar ing rules for the determination of the question as to when dividends may be declared by the directors of a corporation. But all of the decisions, so far as I have been able to ascertain, except as to mining corporations, are applied to manufacturing, railroad, telegraph, or similar organizations. Clark & Marshall on corporations, Vol. II, Sec. 519, says: "It is a well settled principle that as between stockholders of a corporation, and its creditors, the assets of the corporation are in a sense a trust fund for (2)