Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

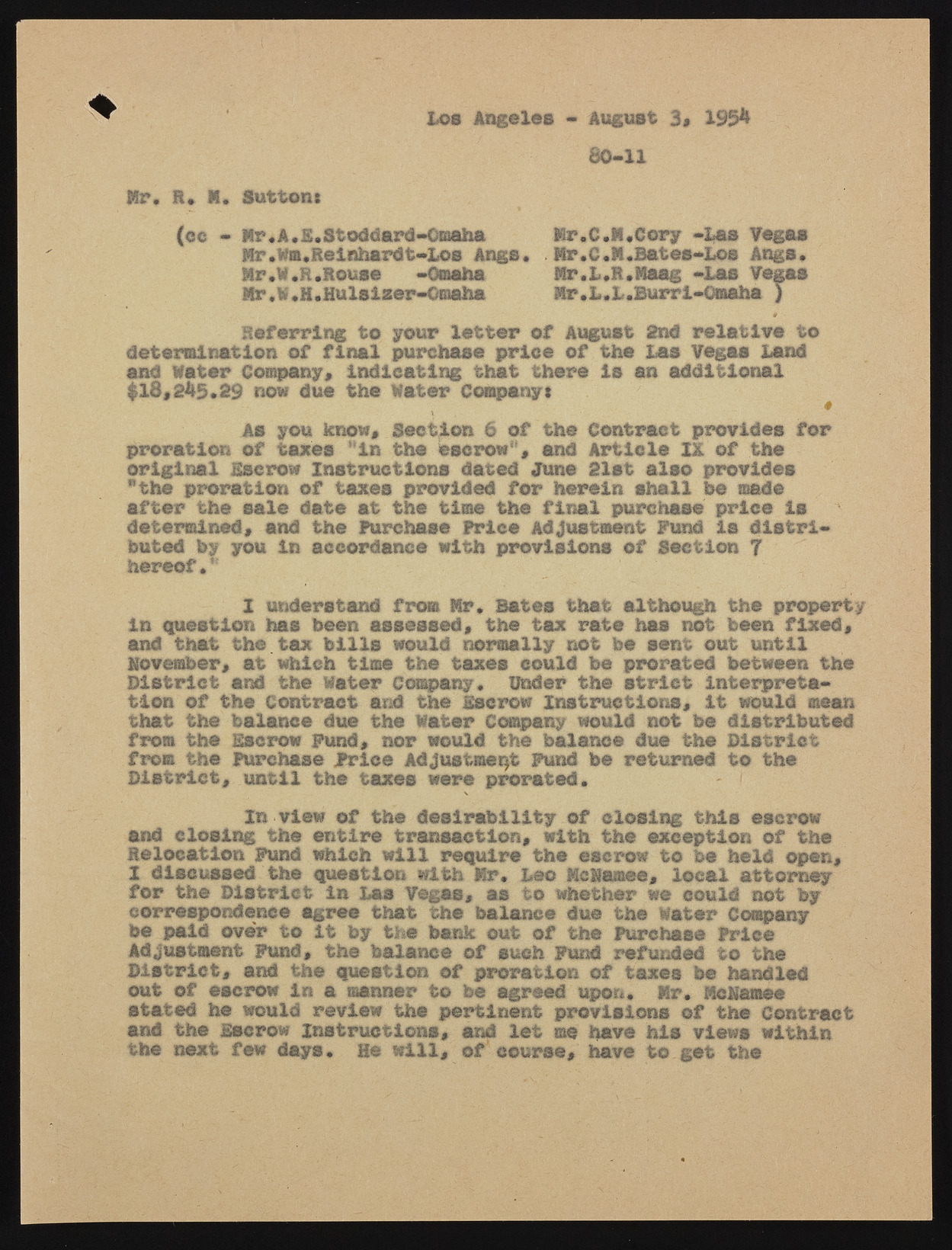

Los Angeles - August 3# lfj54 80-11 Mr, R* M. Sutton* (ce Mr.A.£.Stoddard-Omaha Mr.Mm.Reinhardt-Los Angs. Mr .W.R.Rouse -Omaha Mr.W.H.Hulsi zer-Omaha Mr.C.M.Cory -Las Vegas Mr.C.M.Bates-Los Angs. Mr.L.R.Maag -Las Vegas Mr.L.L.Burrl-Omaha J Referring to your letter of August 2nd relative to determination of final purchase price of the Las Vegas Land and Mater Company, indicating that there is an additional $18,245*29 now due the Mater Company* A s you know. Section 6 of the Contract provides for proration of taxes “in the escrow0, and Article XX of the original Escrow Instructions dated June 21st also provides "the proration of taxes provided for herein shall be made after the sale date at the time the final purchase price is determined, and the Purchase Price Adjustment Fund is distributed by you in accordance with provisions of Section f hereof.' X understand from Mr* Bates that although the propert in question has been assessed, the tax rate has not been fixed, and that the.tax bills would normally not be sent out until November, at which time the taxes could be prorated between the District and the later company* Under the strict interpretation of the Contract and the Escrow Instructions, it would mean that the balance due the Mater Company would not be distributed from the Escrow Fund, nor would the balance due the District from the Purchase Price Adjustment Fund be returned to the District, until the taxes were prorated. X In view of the desirability of closing this escrow and closing the entire transaction, with the exception of the Relocation Fund which will require the escrow to be held open, 1 discussed the question with Mr. Leo McHamee, local attorney for the District in Las Vegas, as to whether we could not by correspondence agree that the balance due the Mater Company be paid over to it by the bank out of the Purchase Price Adjustment Fund, the balance of such Fund refunded to the District, and the question of proratlon of taxes be handled out of escrow in a manner to be agreed upon. Mr. McSlamee stated he would review the pertinent provisions of the Contract and the Escrow instructions, and let me have his views within the next few days. He will, of course, have to get the