Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

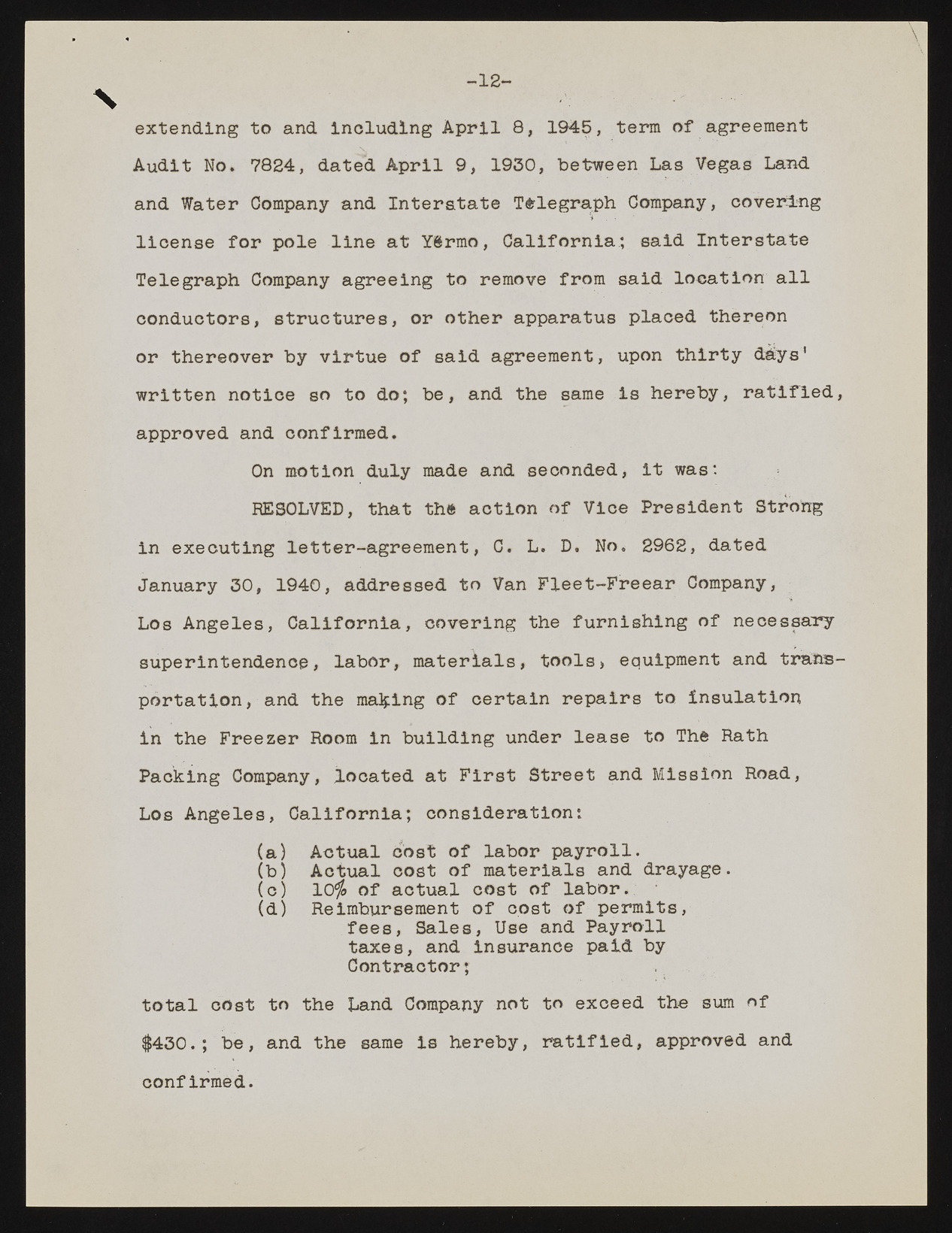

N - 12- extending to and including April 8, 1945, terra of agreement Audit No. 7824, dated April 9, 1930, between Las Vegas Land and Water Company and Interstate Telegraph Company, covering license for pole line at YSrmo, California.; said Interstate Telegraph Company agreeing to remove from said location all conductors, structures, or other apparatus placed thereon or thereover by virtue of said agreement, upon thirty <Mys' written notice so to do; be, and the same is hereby, ratified, approved and confirmed. On motion duly made and seconded, it was: RESOLVED, that the action of Vice President Strong in executing letter-agreement, C. L. D. No. 2962, dated January 30, 1940, addressed to Van Fleet-Freear Company, Los Angeles, California, covering the furnishing of necessary-superintendence, labor, materials, tools> equipment and transportation, and the making of certain repairs to insulation in the Freezer Room in building under lease to The Rath Packing Company, located at First Street and Mission Road, Los Angeles, California; consideration: (a) Actual cost of labor payroll. (b) Actual cost of materials and drayage. (c) 10$ of actual cost of labor. (d) Reimbursement of cost of permits, fees, Sales, Use and Payroll taxes, and insurance paid by Contractor; total cost to the Land Company not to exceed the sum of $430.; be, and the same is hereby, ratified, approved and confirmed.