Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

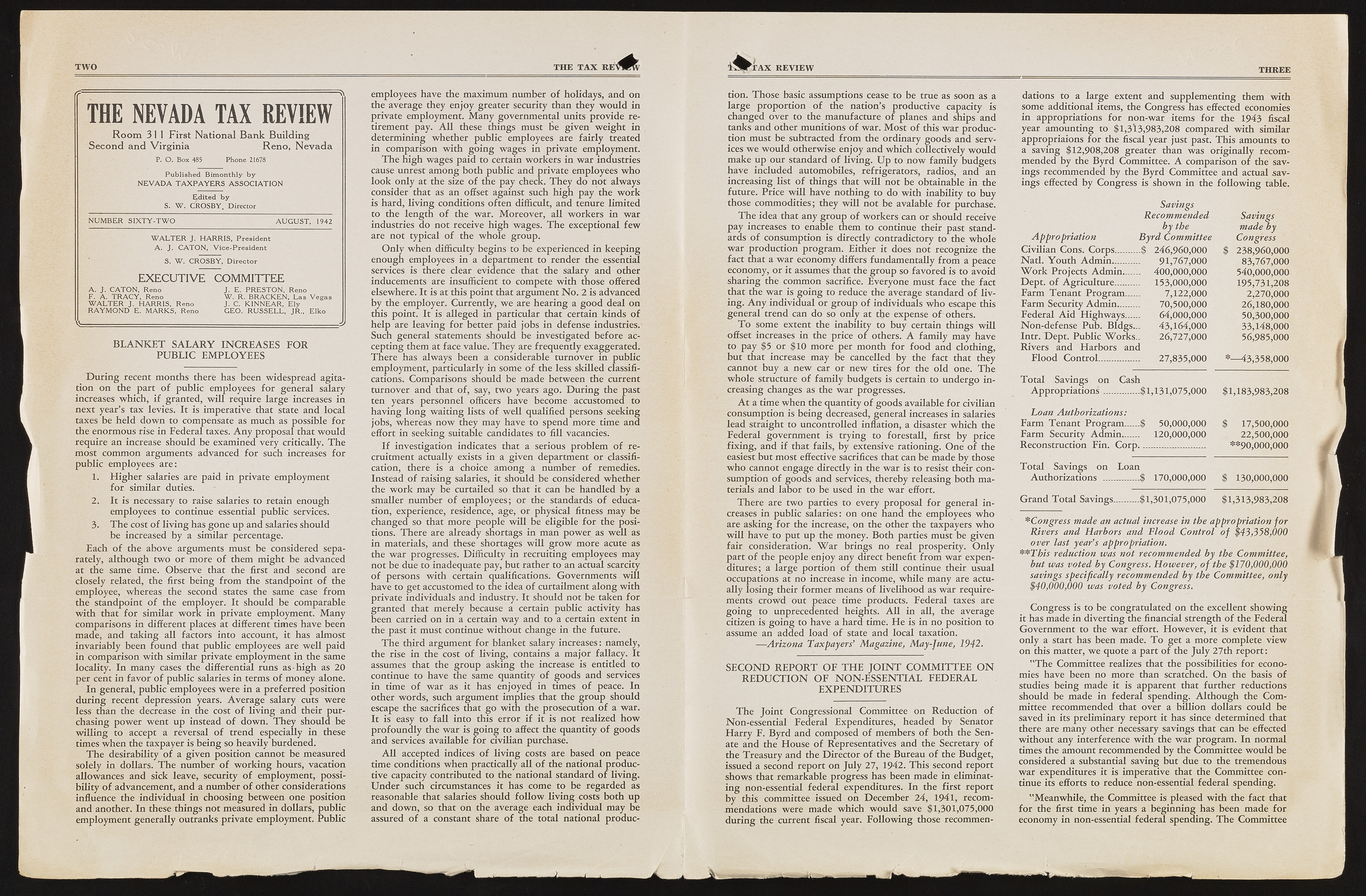

TWO THE TAX RE j THE NEVADA TAX REVIEW Room 3 1 1 First National Bank Building Second and Virginia Reno, Nevada P . O . B o x 485 P h o n e 21678 Published Bimonthly by NEVADA TAXPAYERS ASSOCIATION Edited by S. W. CROSBY. Director NUMBER SIXTY-TWO _ AUGUST, 1942 WALTER J. HARRIS, President A. J. CATON, Vice-President S. W. CROSBY, Director EXECUTIVE COMMITTEE A. J. CATON, Reng J. E. PRESTON, Reno F. A. TRACY, Reno W. R. BRACKEN, Las Vegas WALTER J. HARRIS, Reno J. C. KINNEAR, Ely RAYMOND E. MARKS, Reno GEO. RUSSELL, JR., Elko VS i B L A N K E T S A L A R Y IN C R E A S E S F O R P U B L I C E M P L O Y E E S D u r in g recent m onths there has been w idespread agitation on the part o f public employees fo r general salary increases w hich, i f granted, w ill require large increases in next year’s tax levies. It is imperative that state and local taxes be held d o w n to compensate as much as possible fo r the enorm ous rise in Federal taxes. A n y proposal that w o u ld require an increase should be exam ined very critically. T h e most com m on arguments advanced fo r such increases fo r public employees are: 1. H ig h e r salaries are p aid in private em ploym ent fo r sim ilar duties. 2. It is necessary to raise salaries to retain enough employees to continue essential public services. 3. T h e cost o f livin g has gone u p and salaries should be increased by a sim ilar percentage. Each o f the above arguments m ust be considered separately, although tw o o r m ore o f them m ight be advanced at the same time. O bserve that the first and second are closely related, the first bein g fro m the standpoint o f the em ployee, whereas_ the second states the same case from the standpoint o f the em ployer. It should be com parable w ith that fo r sim ilar w o rk in private employment. M a n y com parisons in different places at different times have been m ade, and taking all factors into account, it has almost invariably been fo u n d that public employees are w e ll paid in com parison w ith sim ilar private em ploym ent in the same locality. In m any cases the differential runs as-h ig h as 20 per cent in fa v o r o f public salaries in terms o f m oney alone. In general, pu blic employees w ere in a preferred position d u rin g recent depression years. A v e ra g e salary cuts w ere less than the decrease in the cost o f liv in g and their pu rchasing p o w e r w ent up instead o f d ow n . T h ey should be w illin g to accept a reversal o f trend especially in these times w h en the taxpayer is bein g so heavily burdened. T h e desirability o f a given position cannot be measured solely in dollars. T h e num ber o f w o rk in g hours, vacation allowances and sick leave, security o f employment, possibility o f advancement, and a num ber o f other considerations influence the in dividu al in choosing between one position and another. In these things not measured in dollars, public em ploym ent generally outranks private employment. Public employees have the m axim um num ber o f holidays, and on the average they enjoy greater security than they w o u ld in private employment. M a n y governm ental units p rovide retirement pay. A l l these things must Be given w eigh t in determ ining w hether pu blic employees are fairly treated in com parison w ith g o in g w ages in private employment. T h e h igh w ages paid to certain w orkers in w a r industries cause unrest am on g both public and private employees w h o lo o k on ly at the size o f the pay check. T h ey d o not always consider that as an offset against such h igh pay the w o rk is hard, liv in g conditions often difficult, and tenure lim ited to the length o f the w ar. M o reover, all w orkers in w a r industries do not receive h igh w ages. T h e exceptional fe w are not typical o f the w h o le group. O n ly w h en difficulty begins to be experienced in keeping enough employees in a departm ent to render the essential services is there clear evidence that the salary and other inducements are insufficient to compete w ith those offered elsewhere. It is at this point that argum ent N o . 2 is advanced by the em ployer. Currently, w e are h earin g a g o o d deal on this point. It is alleged in particular that certain kinds o f help are leavin g fo r better paid jobs in defense industries.- Such general statements should be investigated before accepting them at face value. T h ey are frequently exaggerated. T h ere has always been a considerable turnover in public employment, particularly in some o f the less skilled classifications. Com parisons should be m ade between the current turnover and that of, say, tw o years ago. D u r in g the past ten years personnel officers have become accustomed to h avin g lo n g w aitin g lists o f w e ll qualified persons seeking jobs, whereas n o w they m ay have to spend m ore time and effort in seeking suitable candidates to fill vacancies. I f investigation indicates that a serious problem o f recruitment actually exists in a given department or classification, there is a choice am ong a num ber o f remedies. Instead o f raising salaries, it should be considered whether the w o rk m ay be curtailed so that it can be handled by a sm aller num ber o f em ployees; or the standards o f education, experience, residence, age, or physical fitness m ay be changed so that m ore people w ill be eligible fo r the positions. T h ere are already shortags in m an po w er as w e ll as in materials, and these shortages w ill g r o w m ore acute as the w a r progresses. Difficulty in recruiting employees may not be due to inadequate pay, but rather to an actual scarcity o f persons w ith certain qualifications. Governm ents w ill have to get accustomed to the idea o f curtailment alon g w ith private individuals and industry. It should not be taken fo r granted that merely because a certain public activity has Been carried on in a certain w a y and to a certain extent in the past it must continue w ithout change in the future. T h e third argum ent fo r blanket salary increases: namely, the rise in the cost o f livin g, contains a m ajor fallacy. It assumes that the gro u p asking the increase is entitled to continue to have the same quantity o f goods and services in time o f w a r as it has enjoyed in times o f peace. In other w ords, such argum ent im plies that the gro u p should escape the sacrifices that g o w ith the prosecution o f a w ar. It is easy to fa ll into this error if it is not realized h o w p ro fo u n d ly the w a r is g o in g to affect the quantity o f goods and services available fo r civilian purchase. A l l accepted indices o f liv in g costs are based on peace time conditions w h en practically all o f the national productive capacity contributed to the national standard o f living. U n d e r such circumstances it has come to be regarded as reasonable that salaries should fo llo w liv in g costs both up and d ow n , so that on the average each individual m ay be assured o f a constant share o f the total national produc45 ’t a x r e v iew THREE tion. T h ose basic assumptions cease to be true as soon as a large proportion o f the nation’s productive capacity is changed over to the manufacture o f planes and ships and tanks and other munitions o f w ar. M o st o f this w ar production must be subtracted from the ordinary goods and services w e W ould otherwise enjoy and w hich collectively w o u ld make up our standard o f living. U p to n o w fam ily budgets have included automobiles, refrigerators, radios, and an increasing list o f things that w ill not be obtainable in the future. Price w ill have nothing to do w ith inability to buy those com m odities; they w ill not be avalable fo r purchase. T h e idea that any gro u p o f w orkers can o r should receive pay increases to enable them to continue their past standards o f consum ption is directly contradictory to the w h ole w a r production program . Either it does not recognize the fact that a w a r economy differs fundam entally from a peace economy, o r it assumes that the gro u p so favored is to avoid sharing the com m on sacrifice. Everyone must face the fact that the w a r is g o in g to reduce the average standard o f liv ing. A n y in dividu al or grou p o f individuals w h o escape this gen eral trend can do so only at the expense o f others. T o some extent the inability to buy certain things w ill offset increases in the price o f others. A fam ily may have to pay $5 or $10 m ore per m onth fo r fo o d and clothing, but that increase may be cancelled by the fact that they cannot buy a n e w car o r n ew tires fo r the o ld one. T h e w h ole structure o f fam ily budgets is certain to undergo in creasing changes as the w a r progresses. A t a time w hen the quantity o f goods available fo r civilian consumption is bein g decreased, general increases in salaries lead straight to uncontrolled inflation, a disaster which the Federal governm ent is trying to forestall, first by price fixin g, and if that fails, by extensive rationing. O n e o f the easiest bu t most effective sacrifices that can be m ade by those w h o cannot engage directly in the w a r is to resist their consumption o f goods and services, thereby releasing both m aterials and lab o r to be used in the w a r effort. T h ere are tw o parties to every proposal fo r general increases in public salaries: on one ban d the employees w h o are asking fo r the increase, on the other the taxpayers w h o w ill have to put up the money. Both parties must be given fair consideration. W a r brings no real prosperity. O n ly part o f the people enjoy any direct benefit from w a r expenditures; a large portion o f them still continue their usual occupations at no increase in income, w h ile m any are actually losin g their form er means o f livelih ood as w a r requirements crow d out peace time products. Federal taxes are g o in g to unprecedented heights. A l l in all, the average citizen is g o in g to have a h ard time. H e is in no position to assume an added lo ad o f state and local taxation. — A riz o n a Taxpayers’ M agazine, M ay-fu ne, 1942. S E C O N D R E P O R T O F T H E J O I N T C O M M I T T E E O N R E D U C T I O N O F N O N - E S S E N T I A L F E D E R A L E X P E N D I T U R E S T h e Joint Congressional Committee on Reduction o f Non-essential Federal Expenditures, headed by Senator H a rry F. B yrd and composed o f members o f both the Senate and the H ou se o f Representatives and the Secretary o f the Treasury and the D irector o f the Bureau o f the Budget, issued a second report on July 27, 1942. T h is second report shows that rem arkable progress has been m ade in eliminatin g non-essential federal expenditures. In the first report by this committee issued on D ecem ber 24, 1941, recomm endations w ere made w hich w o u ld save $1,301,075,000 d u rin g the current fiscal year. F o llo w in g those recommendations to a large extent and supplem enting them w ith some additional items, the Congress has effected economies in appropriations fo r n on -w ar items fo r the 1943 fiscal year am ounting to $1,3* *13,983,208 com pared w ith sim ilar appropriaions fo r the fiscal year just past. T h is amounts to a saving $12,908,208 greater than w as origin ally recomm ended by the B yrd Committee. A com parison o f the savings recom m ended by the B y rd Committee and actual savings effected by Congress is show n in the fo llo w in g table. Savings Recom m ended by the A p p ro p ria tio n B yrd C om m ittee C ivilian Cons. C orps........ $ 246,960,000 N a tl. Y o u th A d m in .... ...... 91,767,000 W o r k Projects A d m in ____ 400,000,000 D ept, o f A gricu ltu re.......... 153,000,000 Farm Tenant P ro g ram ____ 7,122,000 Farm Security A d m in ..... . 70,500,000 Federal A id H ig h w a y s...... 64,000,000 N on -d efen se Pub. Bldgs... 43,164,000 Intr.TDept. Public W o rk s.. 26,727,000 Rivers and H a rb o rs and Savings made by Congress 238,960,000 83.767.000 540,000,000 195,731,208 2,270,000 26.180.000 50.300.000 33.148.000 56.985.000 F lo o d C on trol................ 27,835,000 * — 43,358,000 T o ta l Savings on Cash A p p r o p r ia t io n s .............. $1 ,131,075,000 $1,183,983,208 L oa n A u th oriza tion s : Farm Tenant P ro g ram ......$ 50,000,000 $ 17,500,000 Farm Security A d m in ....... 120,000,000 22,500,000 Reconstruction Fin. C orp. — **90,000,000 T o ta l Savings on Loan Authorizations .............. $ 170,000,000 $ 130,000,000 G ra n d T o ta l Savings..........$1.,301,075,000 $1,313,983,208 * Congress made an actual increase in the a p p rop ria tion fo r Rivers and H arbors and F lo o d C o n tro l o f $43,358,000 o v er last year’s app rop ria tion . * * T h is red uction was n o t recom m ended by the C om m ittee, but was voted by Congress. H ow ever, o f the $170,000,000 savings specifically recom m ended by the C om m ittee, only $40,000,000 was voted by Congress. Congress is to be congratulated on the excellent show ing it has m ade in diverting the financial strength o f the Federal G overnm ent to the w a r effort. H ow ever, it is evident that only a start has been made. T o get a m ore complete view on this matter, w e quote a part o f the July 27th re p o rt: "T h e Committee realizes that the possibilities fo r economies have been no m ore than scratched. O n the basis o f studies bein g m ade it is apparent that further reductions should be m ade in federal spending. A lth o u g h the C om mittee recommended that over a billio n dollars could be saved in its prelim inary report it has since determined that there are m any other necessary savings that can be effected w ithout any interference w ith the w a r program . In norm al times the amount recommended by the Committee w o u ld be considered a substantial saving but due to the tremendous w a r expenditures it is imperative that the Committee continue its efforts to reduce non-essential federal spending. "M e a n w h ile , the Committee is pleased w ith the fact that fo r the first time in years a begin n in g has been m ade fo r economy in non-essential federal spending. T h e Committee