Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

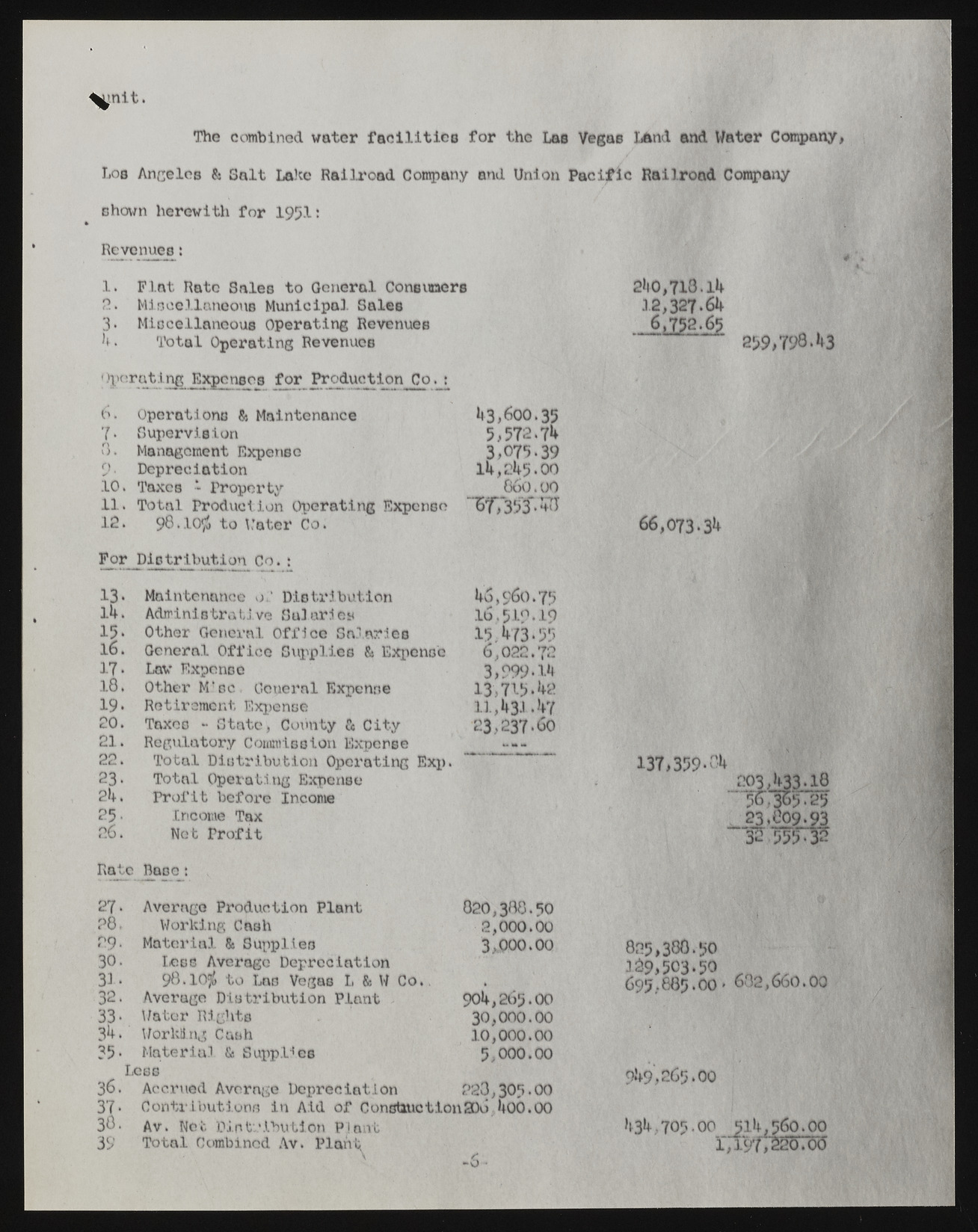

%nit. The combined water facilities for the Las Vegas Land and Water Company, Lob Angeles & Salt Lake Railroad Company and Union Pacific Railroad Company shown herewith for 19 51: Revenues: 1. Flat Rate Sales to General Consumers 2. Miscellaneous Municipal Sales 3* Miscellaneous Operating Revenues 1*. Total Operating Revenues Operating Expenses for Production C o . : 6. Operations & Maintenance 1*3,600.35 7. Supervision 5,572.71* o» Management 0 Expense 3,075.39 . Depreciation ii*, 21*5.00 10 . Taxes l Property 860.00 1 1 . Total Production Operating Expense 12 . 98.10$ to Water Co. For Distribution Co. : 13. Maintenance of Distribution 1*6,960.75 ii*. Administrative Binaries l6.510.19 1165. Other General Office Salaries 15 1*73*55 . General Office Supplies & Expense 6,022.72 17. Lav Expense 3,999.1*1 18 , Other M'sc General Expense 13,715. *12 2190. Retirement Expense ll,l*3J .1*7 . Taxes “ State, County & City 23,237.60 2 1. Regulatory Commission Expense 22. Total Distribution Operating Exp. 223. Total Operating Expense l*. Profit before income 2256- Income Tax . Not Profit Rate Base: 27. Average Production Plant 026,388.50 28. Working Cash 2,000.00 29. Material & Supplies 3,000.00 30. Less Average Depreciation 31. 98.10$ to Las Vegas L & W Co.. 1 32. Average Distribution Plant 90l*,2b5.00 33. Water Rights 30,000.00 31*. Working Cash 10,000.00 35- Materia.1 & Supplies 5,000.00 Less 36. Accrued Average Depreciation 223,305.00 37. Contributions in Aid of Construct ion 2Du 1*00.00 30. Av. Net Distribution Plant 39 Total Combined Av. Plant, \ -a/** 2»i 0,713.11* 12 ,327-61* 6,752-65 259,798.1*3 66,073.3^ 137,359.81* 2Q3 >33.18 23*809.93 3? 555^32 825,380.50 63 2995,503.50 .. _ .685.OO- 602,660.00 o!*9,265.00 l*3l*,705.00 5ll*,560.00 1 ,197,220.00