Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

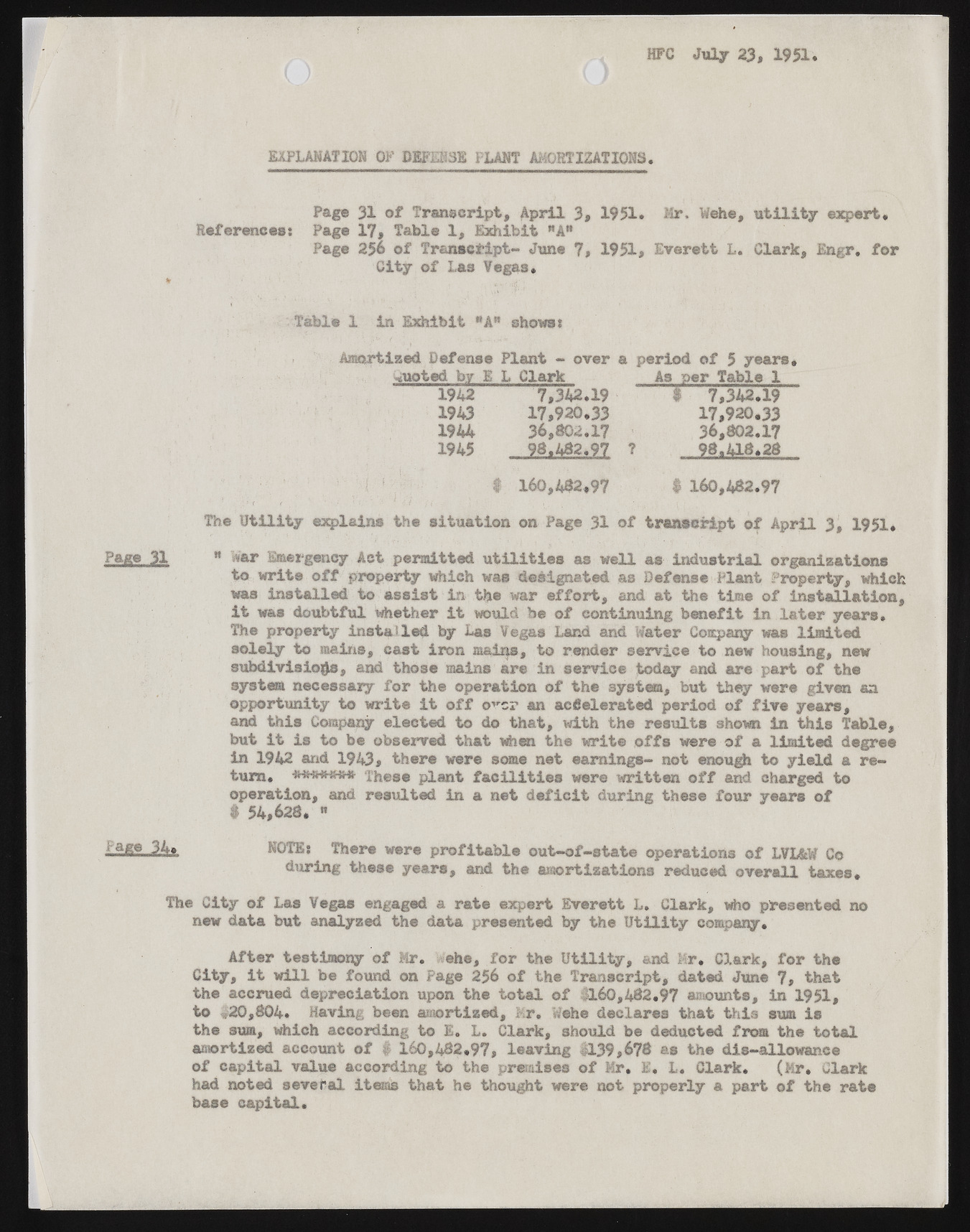

HFC July 23, 1951 EXPLANATION OP DEFENSE PLANT AMORTIZATIONS. Page 31 of Transcript, April 3, 1951. Mr, Wehe, utility expert* References; Page 17, Table 1, Exhibit "A" Page 256 of Transcript- June 7, 1951, Everett L. Clark, Engr. for City of Las Vegas* Table 1 in Exhibit *An shows; Amortized Defense Plant - over a period of 5 years* iuoted by 1E L Clark As per Table 1 1942 7,342.19 $ 7,342.19 1943 17,920.33 17,920.33 1944 36,802.17 36,802.17 1945 98.482.97 ? 98.418.28 1 160,482,97 # 160,482.97 The Utility explains the situation on Page 31 of transcript of April 3, 1951. Page 31 w Mar Emergency Act permitted utilities as well as industrial organizations to write off property which was designated as Defense Plant Property, which was installed to assist in the war effort, and at the time of installation, it was doubtful whether it would be of continuing benefit in later years. The property installed by Las Vegas Land and Water Company was limited solely to mains, cast iron mains, to render service to new housing, new subdivisions, and those mains are in service today and are part of the system necessary for the operation of the system, but they were given an opportunity to write it off over an accelerated period of five years, and this Company elected to do that, with the results shown in this Table, but it is to be observed that when the write offs were of a limited degree in 1942 and 1943, there were some net earnings- not enough to yield a return. ******* These plant facilities were written off and charged to operation, and resulted in a net deficit during these four years of $ 54,628. « ta£ e 24a NOTE; There were profitable out-of-state operations of LVIAW Co during these years, and the amortizations reduced overall taxes* The City of Las Vegas engaged a rate expert Everett L. Clark, who presented no new data but analyzed the data presented by the Utility company* After testimony of Mr. ehe, for the Utility, and Mr. Clark, for the City, it will be found on Page 256 of the Transcript, dated June 7, that the accrued depreciation upon the total of #160,482.97 amounts, in 1951, to 420,804. Having been amortized, Mr. Wehe declares that this sum is the sum, which according to E. L. Clark, should be deducted from the total amortized account of f 160,482*97, leaving #139,678 as the dis-allowance of capital value according to the preraises of Mr. E. L. Clark. (Mr. Clark had noted several items that he thought were not properly a part of the rate base capital.