Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

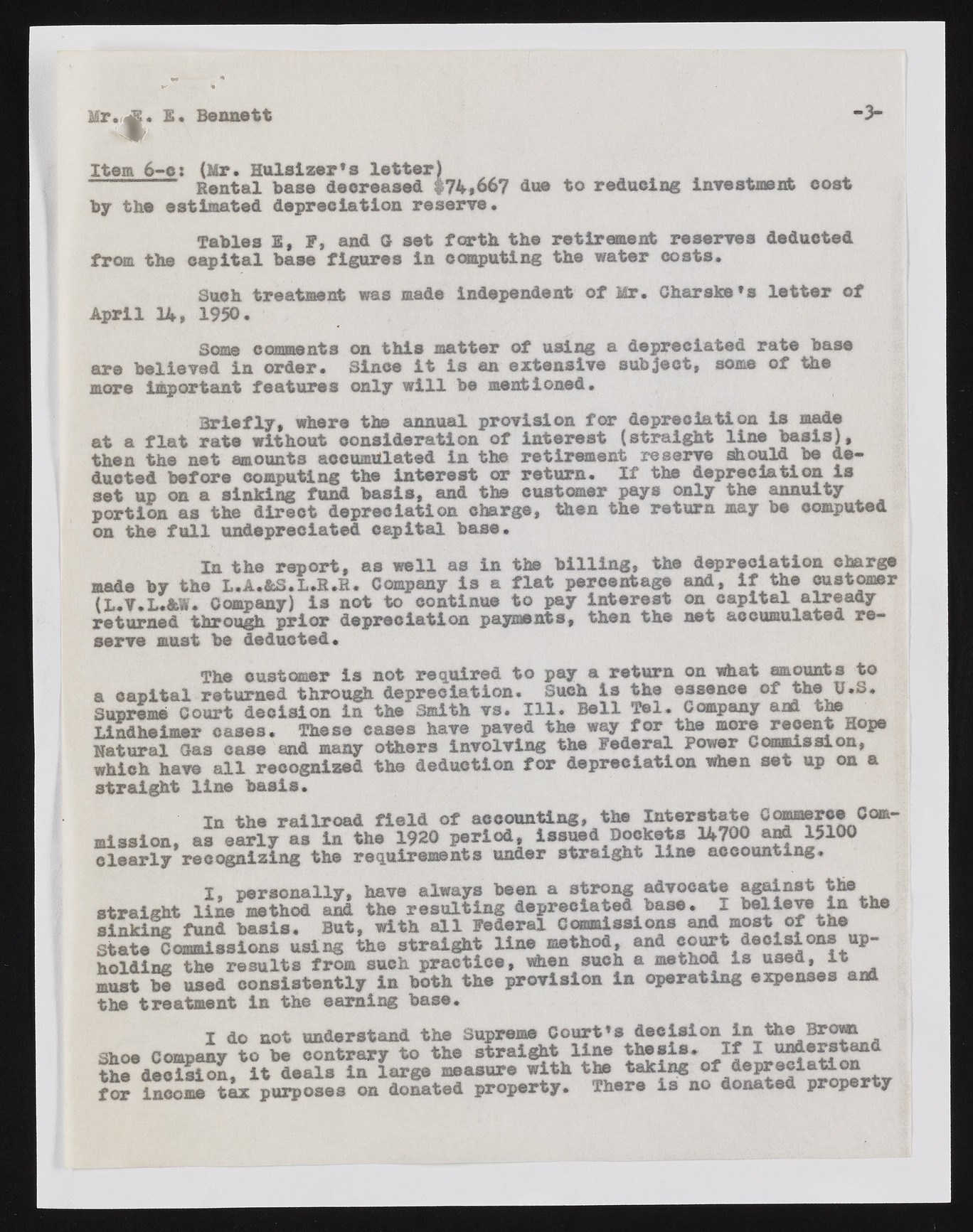

1. Bennett - > Item 6-ci (Mr. Rent aHlu blassiez edre’csr elaestteedr )#74,667 due to reducing investment cost by the estimated depreciation reserve. Tables R, F, and G set forth the retirement reserves deducted from the capital base figures in computing the water coats. Such treatment was made independent of Mr. Charske’s letter of April 34, 1950. Some comments on this matter of using a depreciated rate base are believed in order. Since it is an extensive subject, some of the more important features only will be mentioned. Briefly, where tbs annual provision fo r depreciation is made at a flat rate without consideration of interest (straight line basis}, then the net amounts accumulated in the retirement reserve should be deducted before computing the interest or return. If the depreciation is set up on a sinking fund basis, and the customer pays only the annuity portion as the direct depreciation charge, then the return may be computed on the full undepreciated capital base. In the report, as well as in the billing, the depreciation charge made by the L.A.&S.L.R.R. Company is a flat percentage and, If the customer (L.V.L.&W. Company) is not to continue to pay Interest on capital already returned through prior depreciation payments, then the net accumulated reserve must be deducted. The customer is not required to pay a return on what amounts to a capital returned through depreciation. Such is the essence of the TJ.S. Supreme Court decision in the Smith vs. 111. Bell Tel. Company and the Lindhelmer cases. These cases have paved the way for the more recent Hope Natural Gas case and many others involving the Federal Power Commission, which have all recognised the deduction for depreciation when set up on a straight line basis. In the railroad field of accounting, the In te r s ta te Q^aerce Commission, as early as in the 1920 period, issued Dockets 14700 and 15100 clearly recognizing the requirements under straight line accounting. I, personally, have always been a strong advocate against the straight line method and the resulting depreciated base. I believe in the sinking fund basis* But, with all federal Commissions and most of the State Commissions using the straight line method, and deoi®*oa?iup~ holding the results from sueh practice, when such a method is used, it must be used consistently in both the provision in operating expenses and the treatment in the earning base* I do not understand the Supreme Court’s d e c is io n in * Shoe Company to be contrary to the straight line thesis. If I the decision, it deals in large measure with the taking of d e p r 1 t for income tax purposes on donated property. There is no donated property