Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

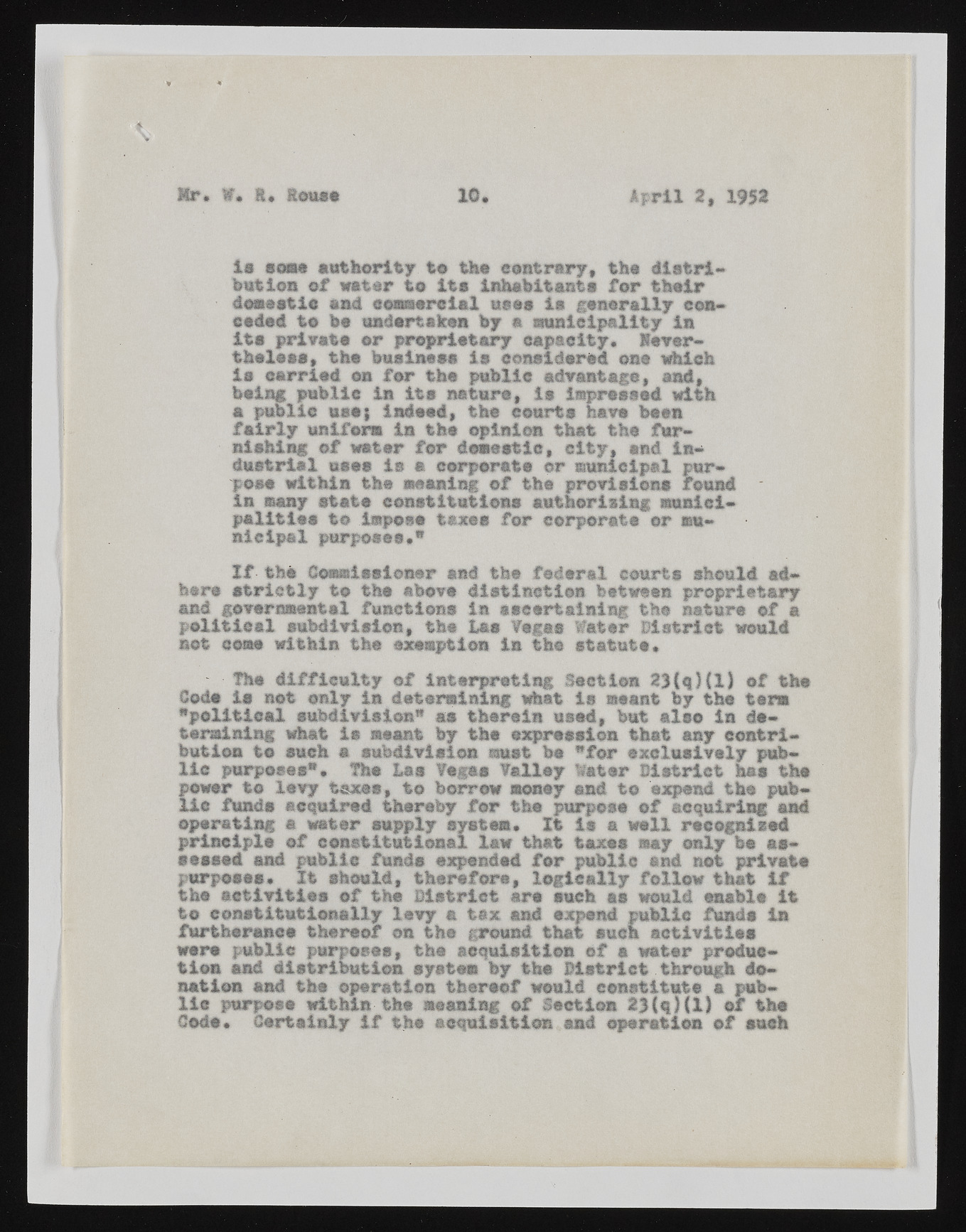

Mr. W. R. Rouse 10 April 2, 1952 is some authority to tho contrary, the distribution of water to its inhabitant* for their domestic and coawerelal uees Is generally conceded to he undertaken by a municipality in its private or proprietary capacity. Scver-theless, the business is considered one which 1* carried on for the public advantage, and, being public in its nature, le impressed with a public use| indeed, the courts have been fairly uniform in the opinion that the furnishing of water for domestic, city, end industrial uses is « corporate or municipal purpose within the meaning of the provisions found in many state constitutions authorising municipalities to impose taxes for corporate or municipal purposes." If - the Commissioner and the federal courts should adhere strictly to the above distinction between proprietary and governmental functions in ascertaining the nature of a political subdivision, the las Vegas Water District would not come within the exemption in the statute. The difficulty of Interpreting Section 23(q)(l) of the Code is not only in determining what is meant by the term "political subdivision" as therein used, but also in determining what is meant by the expression that any contribution to such a subdivision must be "for exclusively public purposes*. The has Vegas Valley Water District has the power to levy taxes, to borrow money and to expend the public funds acquired thereby for the purpose of acquiring and operating a water supply system. It is a well recognised principle of constitutional law that taxes may only be assessed and public funds expended for public and not prlvato purposes. It should, therefore, logically follow that if the activities of the District are euch as would enable it to constitutionally levy a tax and expend public funds in furtherance thereof on the ground that such activities wars public purposes, the acquisition of a water production and distribution system by the District through donation and tho operation thereof would constitute a public purpose within the meaning of Section 23 (q H D of the Code. Certainly if the acquisition and operation of such