Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

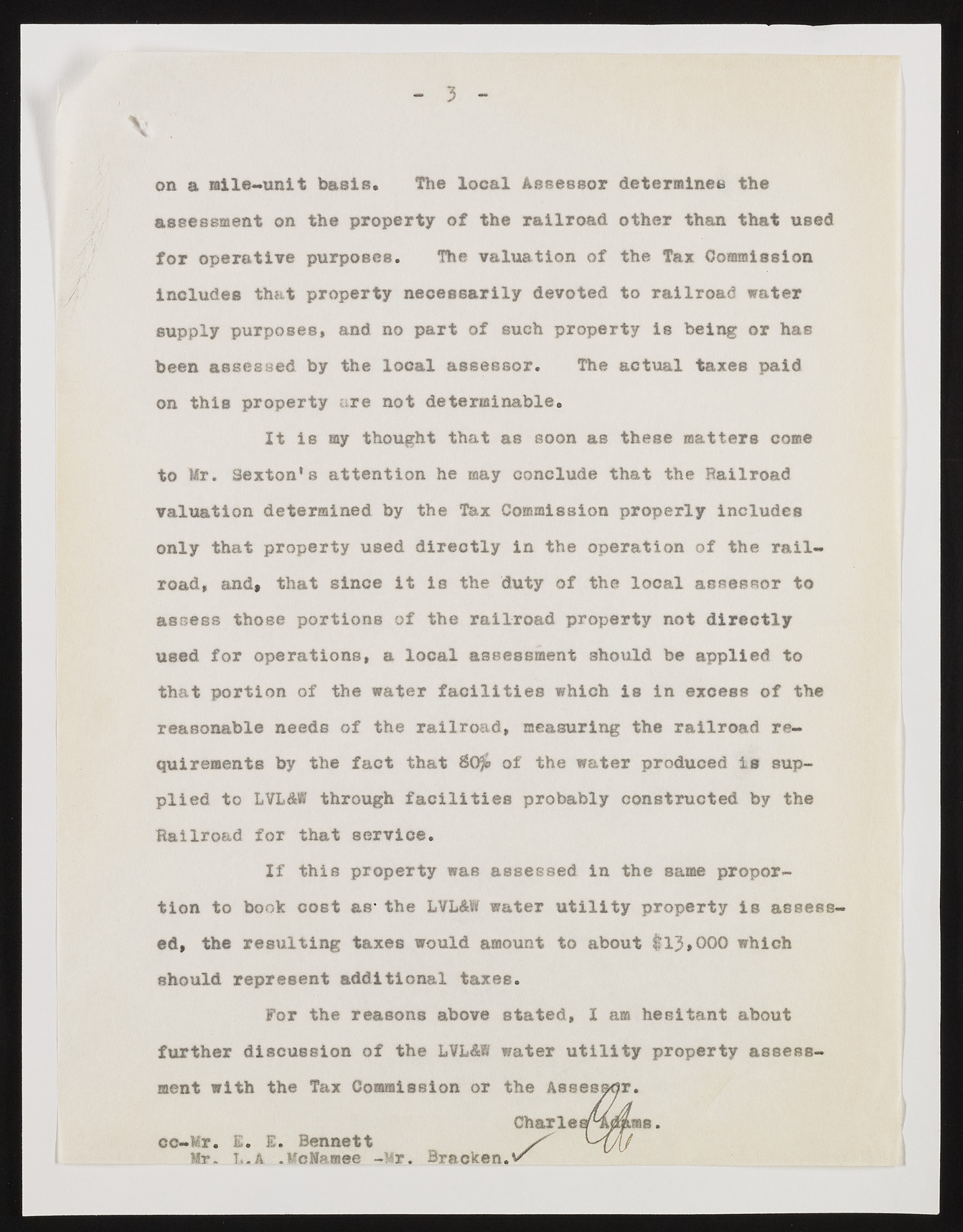

on a mile-unit basis. The local Assessor determines the assessment on the property of the railroad other than that used for operative purposes. The valuation of the Tax Commission includes that property necessarily devoted to railroad water supply purposes, and no part of such property is being or has been assessed by the local assessor. The actual taxes paid on this property are not determinable. It is my thought that as soon as these matters come to Mr. Sexton’s attention he may conclude that the Railroad valuation determined by the Tax Commission properly includes only that property used directly in the operation of the railroad, and, that since it is the duty of the local assessor to assess those portions of the railroad property not directly used for operations, a local assessment should be applied to that portion of the water facilities which is in excess of the reasonable needs of the railroad, measuring the railroad requirements by the fact that £($ of the water produced is supplied to LVL&W through facilities probably constructed by the Railroad for that service. If this property was assessed in the same proportion to book cost as- the LVL&W water utility property is assessed, the resulting taxes would amount to about 1 13»000 which should represent additional taxes. For the reasons above stated, I am hesitant about further discussion of the LVL&W water utility property assessment with the Tax Commission or f cc-Wr. E. £. Bennett Mr. L.A .McMamee -Mr. Bracken