Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

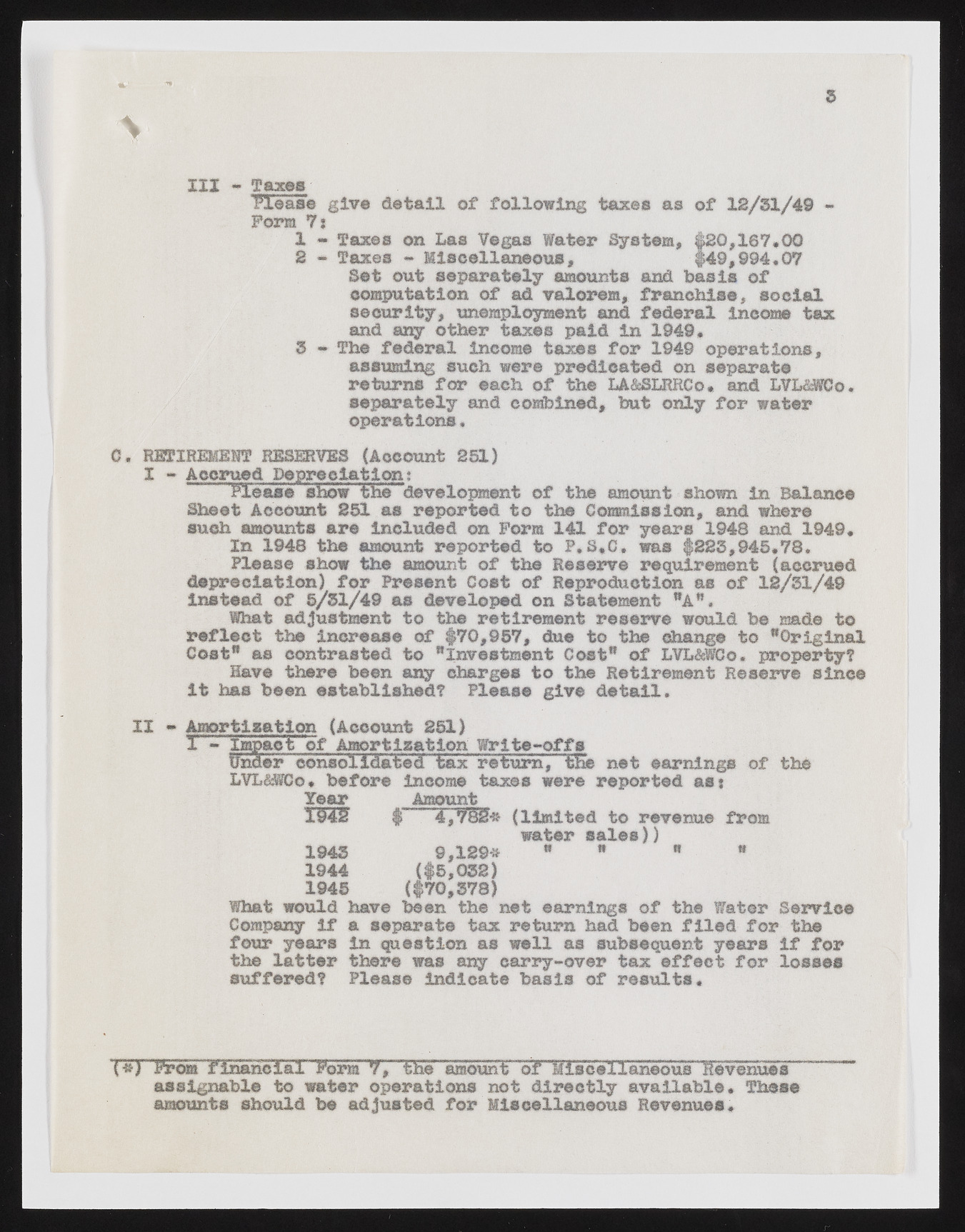

5 % III - Taxes Please give detail of following taxes as of 18/31/49 - Form 7* 1 * Taxes on Las Vegas Water System, #20,167,00 2 - Taxes ~ Miscellaneous, #49,994*07 Set out separately amounts and. basis of computation of ad valorem, franchise 5 social security, unemployment and federal Income tax and any other taxes paid In 1949* 3 - The federal income taxes for 1949 operation#, assuming such were predicated on separate returns for each of the LA&SLRRCo. and LVL&WCo. separately and combined, but only for water operations. C. RETIREMENT RESERVES (Account 251) I - Accrued Depreciation: PTeaae sbow the" development of the amount shown In Balance Sheet Account 251 as reported to the Commission, and where such amounts are Included on Form 141 for years 1948 and 1949, In 1948 the amount reported to P,S,C, was #223,945,78* Please show the amount of the Reserve requirement (accrued depreciation) for Present Cost of Reproduction as of 12/31/49 Instead of 5/31/49 as developed on Statement ®AW. What adjustment to the retirement reserve would be made to reflect the increase of #70,957, due to the Change to "Original Coat8 as contrasted to "investment Cost® of LVL&WCo. property? Have there been any charges to the Retirement Reserve since it has been established? Please give detail, 11 * Amortisation (Account 251) 1 - Impact of Amortization Write-offs Under consol i d a t e d t a x r © turn, IE© net earnings of the LVL&WCo * before income taxes were reported as; Year Amount 1948 # 4,788# (limited to revenue from water sales)5 1943 9,129# ® * a m 1944 (#5,032) 1945 (#70,378) What would have been the net earnings of the Water Service Company if a separate tax return had been filed for the four years in question as well as subsequent years if for the latter there was any carry-over tax effect for losses suffered? Please indicate basis of results. (#} From f inancial 'Form ¥, ' the 'amount of Miscellaneous Revenues assignable to water operations not directly available. These amounts should be adjusted for Miscellaneous Revenues, r-