Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

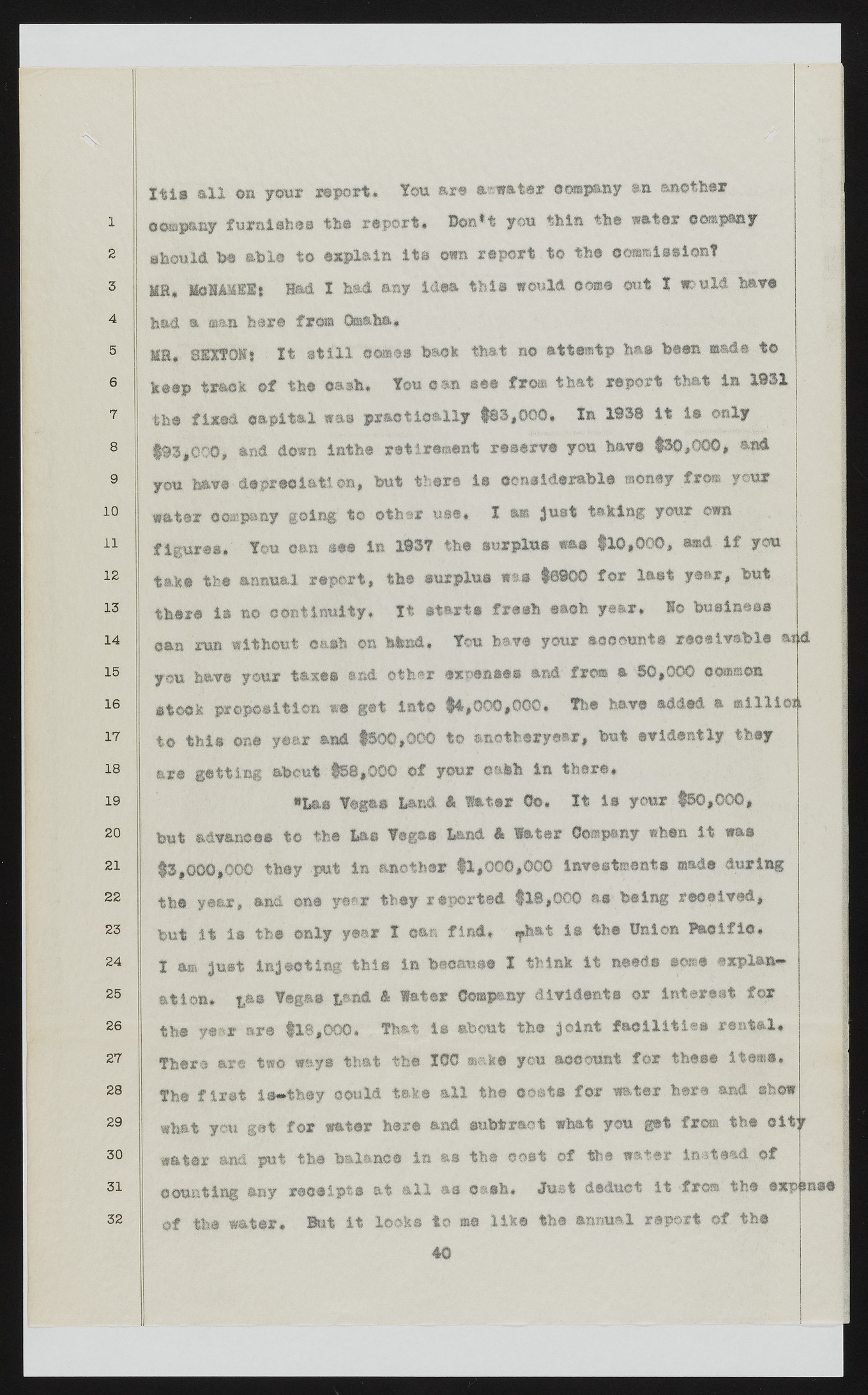

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Itis all on your report. You are abater company an another company furnishes the report. Cor * t you thin the water company should he able to explain its own report to the commieslent MB. SeMlSBi lad I had any idea this would come out I ft* uld hare had a mmt, here from Omaha. SIB* SIXfQf* It still o m m back that no attmtp b m been »»d« to keep tract of the cash. Yon can see fro® that report that In 1931 the fixed capital was practically §$3*000. In ltS$ it le only §93*000* and down lathe retirement reserve you have §30,000* and you have depreciation, hut there is considerable money from your water eoifipiny going' to other use* I we lust taking your own figures. You can see la 1937 the surplus was §10,000, a»d if you. take the animal report, the surplus w as §6900 for last year, hut there la no continuity* It starts fresh each year. So business can run without cash on feted. You have your accounts receivable m you have your taxes and ether expense® and: from a $0,000 common stock proposition we get into §4,000*000* The have added a million to this one year and §500,000 to anotheryear* but evidently they are getting about §5$,000 of your enteh in there* »tas Vegas hand & later Oo. It is your §50,000, but advances to the has Vegas hand It later Company when it was §3*000*000 they put in another §1,000,000 Investments made during the year, and one year they reported §18*000 *» being received, but it Is the only year I can find* ^h&t is the Onion Baclfic* I to Just injecting this In because X think it needs some explain all Oft* $,&s§ Vegas p n d 3 later Company divi dents or interest fur the year are §18*000. That is about the Joint facilities rental* There are two ways that the ICC »&fci you account for these items* The first in^they could take all the costs for water here and show what you get for water here and subtract what you get fro® the 9it) water and put the balance in as the coat of the water Instead, of counting any receipts at all as cash. Just deduct it fro® the exp' of the water* But it looks to me like the annual report of the 40