Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

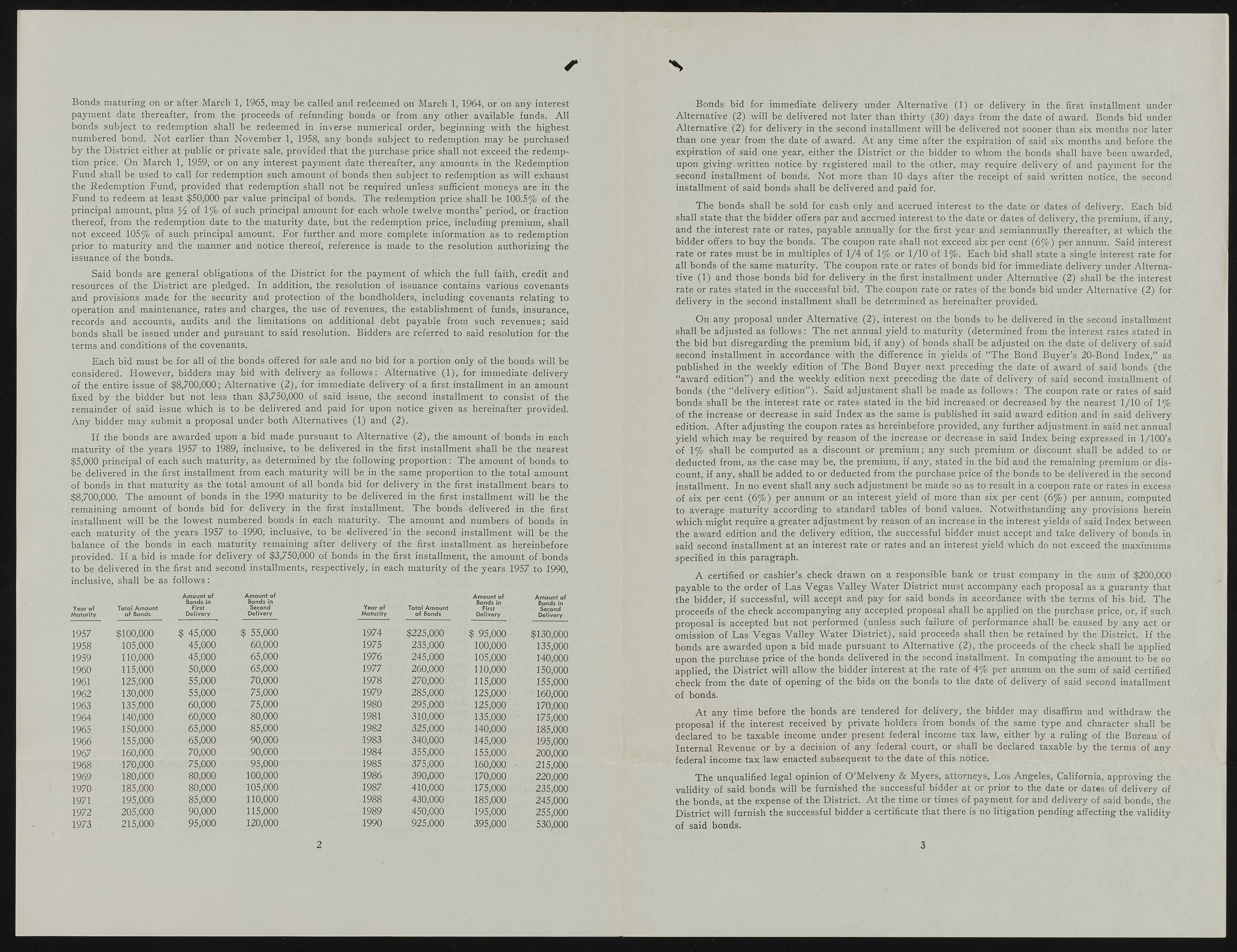

Bonds m aturing on or after M arch 1, 1965, m ay be called and redeemed on M arch 1, 1964, or on any interest paym ent date thereafter, from the proceeds of refunding bonds or from any other available funds. A ll bonds subject to redem ption shall be redeemed in inverse numerical order, beginning with the highest num bered bond. N ot earlier than N ovem ber 1, 1958, any bonds subject to redem ption m ay be purchased b y the D istrict either at public or private sale, provided that the purchase price shall not exceed the redem ption price. On M arch 1, 1959, or on any interest paym ent date thereafter, any am ounts in the Redem ption Fund shall be used to call for redem ption such am ount o f bonds then subject to redem ption as will exhaust the R edem ption Fund, provided that redem ption shall not be required unless sufficient m oneys are in the Fund to redeem at least $50,000 par value principal of bonds. T he redem ption price shall be 100.5% of the principal amount, plus ^ o f 1% o f such principal am ount for each w hole tw elve m onths’ period, or fraction thereof, from the redem ption date to the m aturity date, but the redem ption price, including premium, shall not exceed 105% of such principal amount. F or further and m ore com plete inform ation as to redemption prior to m aturity and the manner and notice thereof, reference is made to the resolution authorizing the issuance o f the bonds. Said bonds are general obligations of the D istrict for the paym ent o f which the full faith, credit and resources of the D istrict are pledged. In addition, the resolution o f issuance contains various covenants and provisions made for the security and protection of the bondholders, including covenants relating to operation and maintenance, rates and charges, the use of revenues, the establishment o f funds, insurance, records and accounts, audits and the limitations on additional debt payable from such revenues; said bonds shall be issued under and pursuant to said resolution. Bidders are referred to said resolution for the terms and conditions o f the covenants. Each bid must be for all of the bonds offered for sale and no bid for a portion only o f the bonds will be considered. H ow ever, bidders m ay bid w ith delivery as follow s: Alternative (1 ), for immediate delivery o f the entire issue of $8,700,000; Alternative (2 ), for immediate delivery o f a first installment in an amount fixed by the bidder but not less than $3,750,000 of said issue, the second installment to consist o f the remainder o f said issue w hich is to be delivered and paid for upon notice given as hereinafter provided. A n y bidder may subm it a proposal under both Alternatives (1) and (2 ). If the bonds are awarded upon a bid made pursuant to A lternative (2 ), the am ount of bonds in each maturity of the years 1957 to 1989, inclusive, to 'b e delivered in the first installment shall be the nearest $5,000 principal of each such maturity, as determined by the follow in g p rop ortion : T he am ount o f bonds to be delivered in the first installment from each maturity w ill be in the same proportion to the total amount of bonds in that m aturity as the total am ount o f all bonds bid for delivery in the first installment bears to $8,700,000. T h e am ount o f bonds in the 1990 maturity to be delivered in the first installment w ill be the rem aining am ount of bonds bid for delivery in the first installment. T he bonds delivered in the first installment w ill be the low est num bered bonds in each maturity. T h e am ount and numbers o f bonds in each maturity of the years 1957 to 1990, inclusive, to be delivered "in the second installment w iil be the balance o f the bonds in each m aturity rem aining after delivery of the first installment as hereinbefore provided. If a bid is made for delivery of $3,750,000 of bonds in the first installment, the am ount of bonds to be delivered in the first and second installments, respectively, in each maturity of the years 1957 to 1990, inclusive, shall be as fo llo w s : Year of Maturity Total Amount of Bonds Amount of Bonds in First Delivery Amount of Bonds in Second Delivery Year of Maturity Total Amount of Bonds Amount of Bonds in First Delivery Amount of Bonds in Second Delivery 1957 $100,000 $ 45,000 $ 55,000 1974 $225,000 $ 95,000 $130,000 1958 105,000 45,000 60,000 1975 235,000 100,000 135,000 1959 110,000 45,000 65,000 1976 245,000 105,000 140,000 1960 115,000 50,000 65,000 1977 260,000 110,000 150,000 1961 125,000 55,000 70,000 1978 270,000 115,000 155,000 1962 130,000 55,000 75,000 1979 285,000 125,000 160,000 1963 135,000 60,000 75,000 1980 295,000 125,000 170,000 1964 140,000 60,000 80,000 1981 ^ 310,000 135,000 175,000 1965 150,000 65,000 85,000 1982 325,000 140,000 185,000 1966 155,000 65,000 90,000 1983 340,000 145,000 .195,000 1967 160,000 70,000 90,000 .1984 355,000 155,000 200,000 1968 170,000 75,000 95,000 1985 375,000 160,000 • 215,000 1969 180,000 80,000 100,000 1986 390,000 170,000 220,000 1970 185,000 80,000 105,000 1987 410,000 175,000 235,000 1971 195,000 85,000 110,000 1988 430,000 185,000 245,000 1972 205,000 90,000 115,000 1989 450,000 195,000 255,000 1973 215,000 95,000 120,000 1990 925,000 395,000 530,000 2 Bonds bid for immediate delivery under Alternative (1) or delivery in the first installment under Alternative (2) will be delivered not later than thirty (30) days from the date o f award. Bonds bid under Alternative (2) for delivery in the second installment will be delivered not sooner than six months nor later than one year from the date of award. A t any time after the expiration o f said six months and before the expiration o f said one year, either the D istrict or the bidder to w hom the bonds shall have been awarded, upon givin g written notice by registered mail to the other, may require delivery of and paym ent for the second installment o f bonds. N ot m ore than 10 days after the receipt o f said written notice, the second installment of said bonds shall be delivered and paid for. T h e bonds shall be sold for cash on ly and accrued interest to the date or dates of delivery. Each bid shall state that the bidder offers par and accrued interest to the date or dates o f delivery, the premium, if any, and the interest rate or rates, payable annually for the first year and semiannually thereafter, at which the bidder offers to buy the bonds. T he coupon rate shall not exceed six per cent (6 % ) per annum. Said interest rate or rates must be in multiples o f 1 /4 o f 1% or 1/10 o f 1% . Each bid shall state a single interest rate for all bonds o f the same maturity. T he coupon rate or rates of bonds bid for immediate delivery under A lternative (1) and those bonds bid for delivery in the first installment under Alternative (2) shall be the interest rate or rates stated in the successful bid. T he coupon rate or rates of the bonds bid under Alternative (2) for delivery in the second installment shall be determined as hereinafter provided. On any proposal under Alternative (2 ), interest on the bonds to be delivered in the second installment shall be adjusted as fo llo w s : T he net annual yield to maturity (determ ined from the interest rates stated in the bid but disregarding the premium bid, if any) of bonds shall be adjusted on the date o f delivery of said second installment in accordance with the difference in yields of “ T he B ond Buyer’s 20-Bond Index,” as published in the w eekly edition of T h e Bond Buyer next preceding the date of award of said bonds (the “ award edition” ) and the w eekly edition next preceding the date of delivery of said second installment of bonds (the “ delivery edition” ). Said adjustm ent shall be made as follow s: T he coupon rate or rates o f said bonds shall be the interest rate or rates stated in the bid increased or decreased by the nearest 1/10 of 1% o f the increase or decrease in said Index as the same is published in said award edition and in said delivery edition. A fter adjusting the coupon rates as hereinbefore provided, any further adjustm ent in said net annual yield w hich m ay be required by reason o f the increase or decrease in said Index being expressed in 1/100’s of 1% shall be com puted as a discount or prem ium ; any such premium or discount shall be added to or deducted from , as the case may be, the premium, if any, stated in the bid and the rem aining premium or discount, if any, shall be added to or deducted from the purchase price of the bonds to be delivered in the second installment. In no event shall any such adjustm ent be made so as to result in a coupon rate or rates in excess of six per cent (6 % ) per annum or an interest yield of m ore than six per cent (6 % ) per annum, com puted to average maturity according to standard tables of bond values. N otw ithstanding any provisions herein which m ight require a greater adjustm ent by reason of an increase in the interest yields o f said Index between the award edition and the delivery edition, the successful bidder must accept and take delivery of bonds in said second installment at an interest rate or rates and an interest yield which do not exceed the maximums specified in this paragraph. A certified or cashier’s check drawn on a responsible bank or trust com pany in the sum of $200,000 payable to the order o f Las V egas V alley W ater D istrict must accom pany each proposal as a guaranty that the bidder, if successful, w ill accept and pay for said bonds in accordance with the terms of his bid. The proceeds of the check accom panying any accepted proposal shall be applied on the purchase price, or, if such proposal is accepted but not perform ed (unless such failure of perform ance shall be caused by any act or om ission of Las V egas V alley W ater D istrict), said proceeds shall then be retained by the D istrict. If the bonds are awarded upon a bid made pursuant to Alternative (2 ), the proceeds o f the check shall be applied upon the purchase price of the bonds delivered in the second installment. In com puting the am ount to be so applied, the D istrict w ill allow the bidder interest at the rate of 4% per annum on the sum of said certified check from the date o f opening of the bids on the bonds to the date of delivery o f said second installment o f bonds. A t any time before the bonds are tendered for delivery, the bidder may disaffirm and withdraw the proposal if the interest received by private holders from bonds of the same type and character shall be declared to be taxable incom e under present federal incom e tax law, either by a ruling of the Bureau o f Internal Revenue or by a decision of any federal court, or shall be declared taxable by the terms of any federal incom e tax law enacted subsequent to the date of this notice. T h e unqualified legal opinion of O ’M elveny & M yers, attorneys, L os A ngeles, California, approving the validity of said bonds will be furnished the successful bidder at or prior to the date or dates o f delivery of the bonds, at the expense of the District. A t the time or times of paym ent for and delivery o f said bonds, the D istrict will furnish the successful bidder a certificate that there is no litigation pending affecting the validity o f said bonds. 3