Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

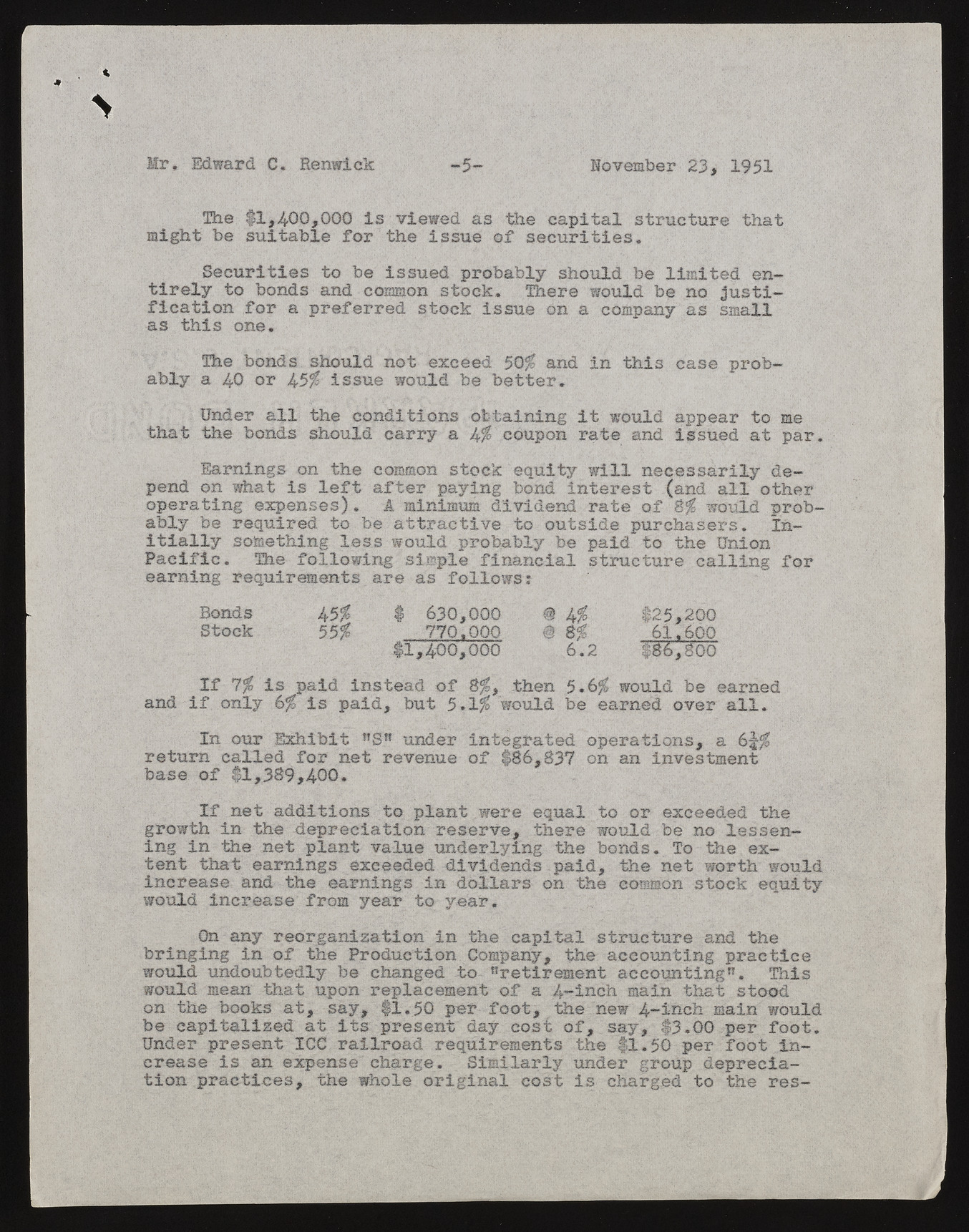

Mr, Edward C. Renwlck -5 November'23* 1951 The $1,400,000 is viewed as the capital structure that might be suitable for the issue of securities, Securities to be issued probably should be limited entirely to bonds and common stock, There would be no justification for a preferred stock issue on a company as small as this one. Hie bonds should not exceed 50$ and in this case probably a 40 or 45$ issue would be better. Under all the conditions obtaining it would appear to me that the bonds should carry a 4$ coupon rate and issued at par. Earnings on the common stock equity will necessarily depend on what is left after paying bond interest (and all other operating expenses). A minimum dividend rate of 8% would probably be required to be attractive to outside purchasers. Initially something less would probably be paid to the Union Pacific, fee following simple financial structure calling for earning requirements are as follows; Bonds 45$ $ 630,000 % 4$ $25,200 Stock 55$ 770.000 © 8$ 61,600 $1 ,400,000 6.2 186,800 If 7$ is paid instead of 8$, then 5.6$ would be earned and if only 6$ is paid, but 5*1$ would be earned over all. In our Exhibit nSff under integrated operations, a 6f$ return called for net revenue of $86,837 on an investment base of $1,389,400# If net additions to plant were equal to or exceeded the growth in the depreciation reserve, there would be no lessening in the net plant value underlying the bonds. To the extent that earnings exceeded dividends paid, the net worth would increase and the earnings in dollars on the common stock equity would increase from year to year. On any reorganisation in the capital structure and the bringing in of the Production Company, the accounting practice would undoubtedly be changed to ^retirement accounting15,. This would mean that upon replacement of a 4~inch main that stood on the books at, say, #1.50 per foot, the new 4-inch main would be capitalized at its present day cost of, say, #3.00 per foot. Under present IGC railroad requirements the #1.50 per foot increase is an expense charge. Similarly under group depreciation practices, the whole original cost is charged to the res-