Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

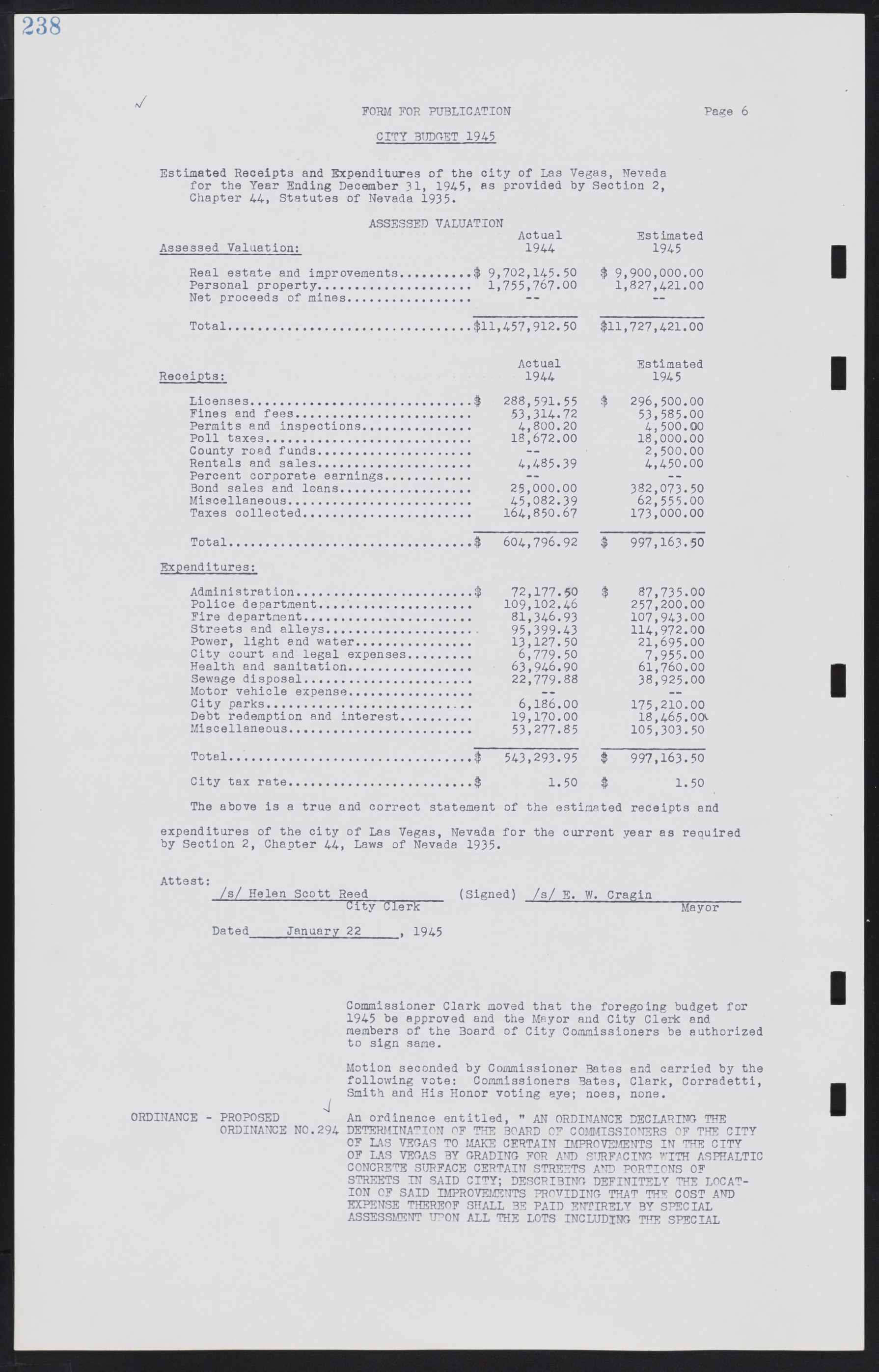

CITY BUDGET 1945 Estimated Receipts and Expenditures of the city of Las Vegas, Nevada for the Year Ending December 31, 1945, as provided by Section 2, Chapter 44, Statutes of Nevada 1935. ASSESSED VALUATION Actual Estimated Assessed Valuation: 1944 1945 Real estate and improvements.........$ 9,702,145.50 $ 9,900,000.00 Personal property.................... 1,755,767.00 1,827,421.00 Net proceeds of mines................ Total.................................$11,457,912.50 $11,727,421.00 Actual Estimated Receipts: 1944 1945 Licenses..............................$ 288,591.55 $ 296,500.00 Fines and fees....................... 53,314.72 53,585.00 Permits and inspections.............. 4,800.20 4,500.00 Poll taxes........................... 18,672.00 18,000.00 County road funds.................... — 2,500.00 Rentals and sales.................... 4,485.39 4,450.00 Percent corporate earnings........... Bond sales and loans................. 25,000.00 382,073.50 Miscellaneous........................ 45,082.39 62,555.00 Taxes collected...................... 164,850.67 173,000.00 Total.................................$ 604,796.92 $ 997,163.50 Expenditures: Administration........................$ 72,177.50 $ 87,735.00 Police department.................... 109,102.46 257,200.00 Fire department...................... 81,346.93 107,943.00 Streets and alleys........ 95,399.43 114,972.00 Power, light and water............... 13,127.50 21,695.00 City court and legal expenses........ 6,779.50 7,955.00 Health and sanitation................ 63,946.90 61,760.00 Sewage disposal...................... 22,779.88 38,925.00 Motor vehicle expense................ City parks........................... 6,186.00 175,210.00 Debt redemption and interest......... 19,170.00 18,465.00 Miscellaneous........................ 53,277.85 105,303.50 Total.................................$ 543,293.95 $ 997,163.50 City tax rate.........................$ 1.50 $ 1.50 The above is a true and correct statement of the estimated receipts and expenditures of the city of Las Vegas, Nevada for the current year as required by Section 2, Chapter 44, Laws of Nevada 1935. Attest: /s/ Helen Scott Reed (Signed) /s/ E. W. Cragin____________ City Clerk Mayor Dated_____January 22_____, 1945 Commissioner Clark moved that the foregoing budget for 1945 be approved and the Mayor and City Clerk and members of the Board of City Commissioners be authorized to sign same. Motion seconded by Commissioner Bates and carried by the following vote: Commissioners Bates, Clark, Corradetti, Smith and His Honor voting aye; noes, none. ORDINANCE - PROPOSED An ordinance entitled, " AN ORDINANCE DECLARING THE ORDINANCE NO.294 DETERMINATION OF THE BOARD OF COMMISSIONERS OF THE CITY OF IAS VEGAS TO MAKE CERTAIN IMPROVEMENTS IN THE CITY OF LAS VEGAS BY GRADING FOR AND SURFACING WITH ASPHALTIC CONCRETE SURFACE CERTAIN STREETS AND PORTIONS OF STREETS IN SAID CITY; DESCRIBING DEFINITELY THE LOCATION OF SAID IMPROVEMENTS PROVIDING THAT THE COST AND EXPENSE THEREOF SHALL BE PAID ENTIRELY BY SPECIAL ASSESSMENT UPON ALL THE LOTS INCLUDING THE SPECIAL FORM FOR PUBLICATION Page 6