Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

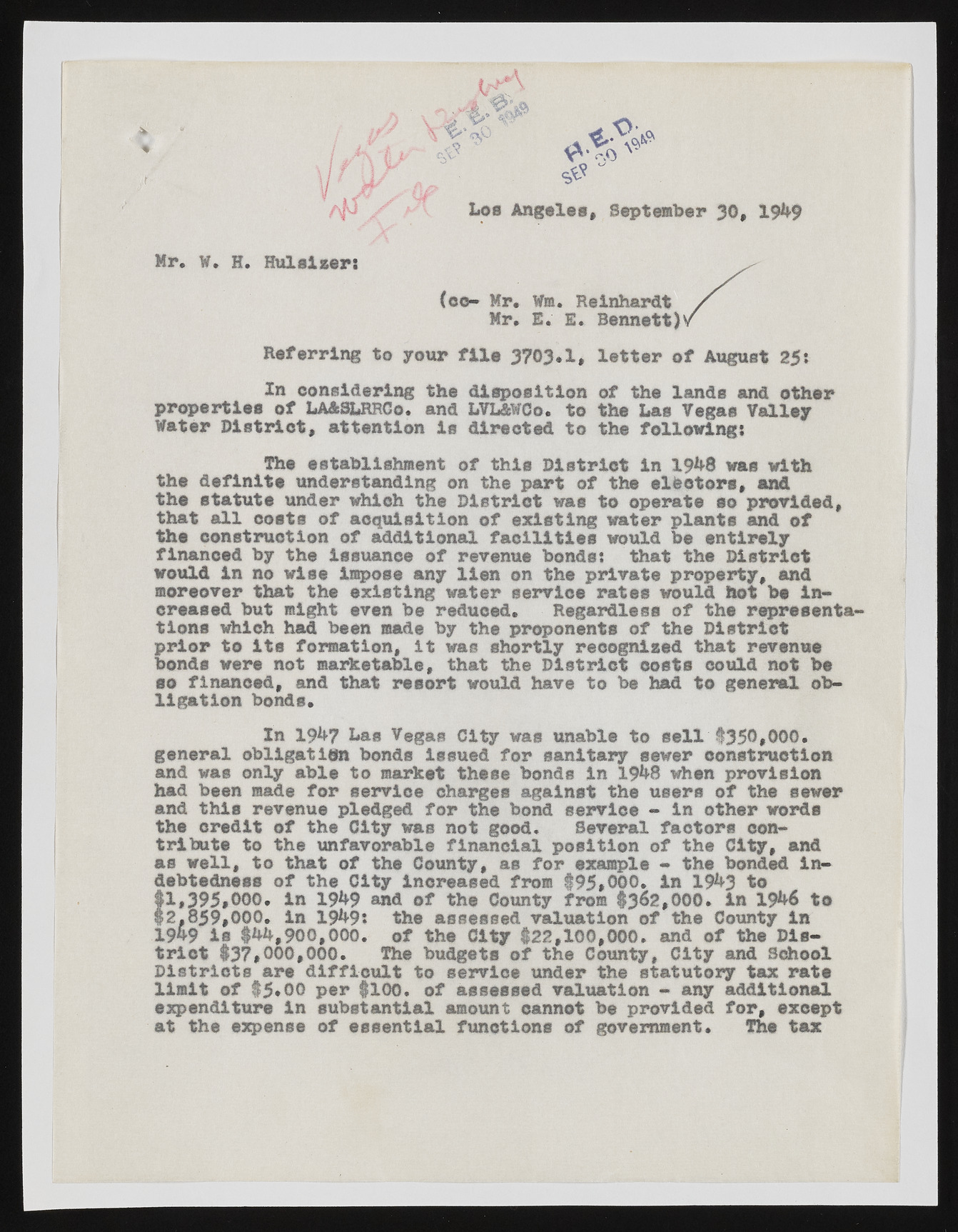

t p r ¥ st A p u Los Angeles, September 30, 19^9 Mr. W. H. Hulsizers (eo- Mr. Wm. Reinhardt Mr. E. E. Bennett) Referring to your file 3703*1, letter of August 25s In considering the disposition of the lands and other properties of LAASLRRCo. and LVL&WCo. to the Las Vegas Valley Water District, attention is directed to the followings The establishment of this District in 19^8 was with the definite understanding on the part of the electors, and the statute under which the District was to operate so provided, that all costs of acquisition of existing water plants and of the construction of additional facilities would be entirely financed by the Issuance of revenue bonds! that the District would in no wise impose any lien on the private property, and moreover that the existing water service rates would hot be Increased but might even be reduced. Regardless of the representations which had been made by the proponents of the District prior to its formation, it was shortly recognised that revenue bonds were not marketable, that the District costs could not be so financed, and that resort would have to be had to general obligation bonds. In 19^7 has Vegas City was unable to sell #350*000. general obligation bonds Issued for sanitary sewer eonstruetion and was only able to market these bonds in 19^8 when provision had been made for service charges against the users of the sewer and this revenue pledged for the bond service - in other words the credit of the City was not good. Several factors eon-tribute to the unfavorable financial position of the City, and as well, to that of the County, as for example - the bonded indebtedness of the City increased from 195*000. in 19^3 to f1 ,395,000. in 19^9 and of the County from 1362,000. in 19^6 to $2,859,000. in 19^9* the assessed valuation of the County In 19&9 is $*»4,900,000. of the City $22,100,000. and of the District $37 ,000,000. The budgets of the County, City and School Districts are difficult to service under the statutory tax rats limit of $5*00 per $100. of assessed valuation - any additional expenditure In substantial amount eannot be provided for, except at the expense of essential functions of government. The tax