Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

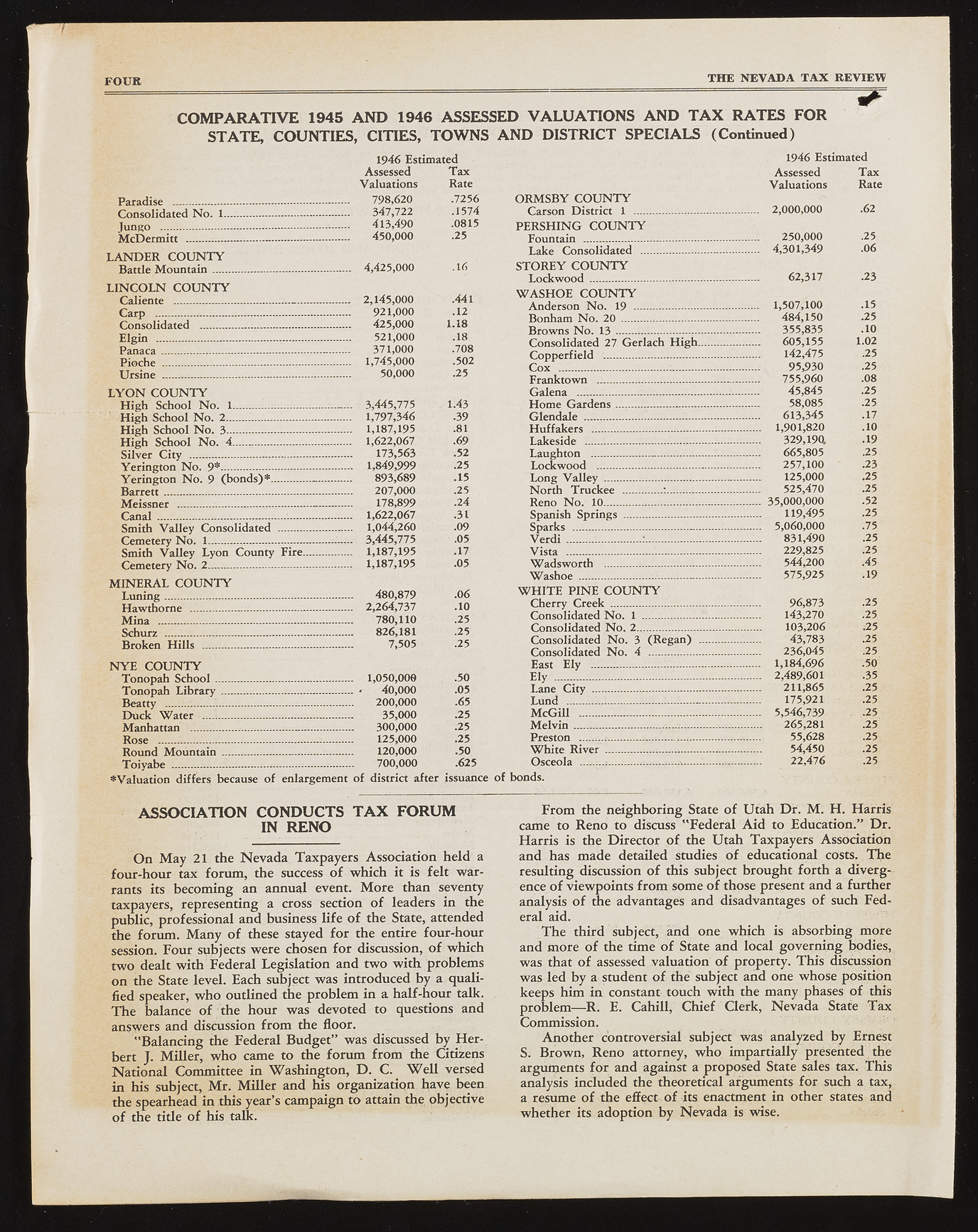

FOUR THE NEVADA TAX REVIEW COMPARATIVE 1945 AND 1946 ASSES! STATE, COUNTIES, CITIES, TOWNS 1946 Estimated Assessed Tax Valuations Rate Paradise ............ .........P............ —- 798,620 .7256 Consolidated No. I.../............. —— :— 347,722 .1574 Jungo ~ ~ - r—._—......... 413,490 .0815 McDermitt ....=... — ------------------ 450,000 .25 LANDER COUNTY Battle Mountain..... ........ .... .— ..ffl--- 4,425,000 .16 LINCOLN COUNTY Caliente .... ___________ _— ....^= 2,145,000 .441 Carp W*j,. -- -----............921,000 .12 Consolidated .Jffip-. 425,000 1.18 Elgin ... . Lffcjr- Vir^-r^^ ^ jTrfr 521,°0° .18 Panaca ................ ..._____ 371,000 .708 Pioche ... ........... " fy.; ...... 1,745,000 .502 Ursine -.50,000 .25 LYON COUNTY High School No. 1...J H s g t t . 3,445,775 1.43 ' High School No. 2.... ...................... 1,797,346 .39 High School No. 3....................... 1,187,195 .81 High School No. 4___LJBMllBWi 1,622,067 .69 Silver City 173,563 .52 Yerington No. 9*.......... 1,849,999 .25 Yerington No. 9 (bonds)*...---------------- 893,689 .15 Barrett ? -- - 207,000 .25 Meissner ....... .........— ---------- —- 178,899 .24 Canal....... 1 ,622,067 .31 Smith Valley Consolidated 1,044,260 .09 Cemetery No. 1.... ..jifiBljEL--- — ——:...A 3,445,775 .05 Smith Valley Lyon County Fire...:.,..,.....,. 1,187,195 .17 Cemetery No. 1,187,195 .05 MINERAL COUNTY Luning... __.....................................480,879 .06 Hawthorne ___________ 2,264,737 .10 Mina,....................... ' 780,110 .25 Schurz 826,181 .25 Broken Hills -nfrfirn n % rr» jfj.... . 7,505 25 NYE COUNTY Tonopah School......MHE&L....M S » 1,050,006 .50 Tonopah Library • 40,000 . .05 Beatty ... 200,000 .65 Duck Water .. .1__.....___ 35,000 .25 Manhattan " 300,000 .25 Rose 125,000 .25 Round Mountain .... 120,000 .50 Toiyabe 700,000 .625 ? Valuation differs because of enlargement of district after issuance ASSOCIATION CONDUCTS TAX FORUM IN RENO O n M a y 21 the N e v a d a Taxpayers Association held a fo u r-h o u r tax forum , the success o f w hich it is felt w a rrants its becom ing an annual event. M o re than seventy taxpayers, representing a cross section o f leaders in the public, professional and business life o f the State, attended the forum . M a n y o f these stayed fo r the entire fou r-h ou r session. F ou r subjects w ere chosen fo r discussion, o f which tw o dealt w ith Federal Legislation and tw o w ith problem s on the State level. Each subject w as introduced by a qu alified speaker, w h o outlined the problem in a h alf-h ou r talk. T h e balance o f the h ou r w as devoted to questions and answers and discussion from the floor. "B a la n c in g the Federal B u d get” w as discussed by H e r bert J. M ille r, w h o came to the foru m from the Citizens N a tio n a l Committee in W a sh in g to n , D . C. W e l l versed in his subject, M r . M ille r and his organization have been the spearhead in this year’s cam paign to attain the objective o f the title o f his talk. VALUATIONS AND TAX RATES FOR 5 DISTRICT SPECIALS (Continued) 1946 Estimated Assessed Valuations Tax Rate ORMSBY COUNTY Carson District 1 ............................................... ... 2,000,000 .62 PERSHING COUNTY Fountain .......... 250,000 .... 4,301,349 .25 Lake Consolidated ............... .06 STOREY COUNTY Lockwood.......................... 62,317 .23 WASHOE COUNTY Anderson No. 19 ............................................... . ... 1,507,100 .15 Bonham No. 20 ................... 484,150 .25 Browns No. 13..................... 355,835 .10 Consolidated 27 Gerlach High... 605,155 1.02 Copperfield ........................ 142,475 .25 Cox .................-......:......... 95,930 .25 Franktown ......................... 755,960 .08 Galena ............................. 45,845 .25 Home Gardens..................... 58,085 .25 Glendale ................................? R J M R H H R R H 613,345 .17 Huffakers .....................................V .;-..'......... .... 1,901,820 .10 Lakeside ... 329,190. .19 Laughton ......................................................................... 665,805 .25 Lockwood ....................................................................... 257,100 .23 Long Valley ................................................................... 125,000 .25 North Truckee ........................:............................ 525,470 .25 Reno No. 10...................... ........................................... . . . . 35,000,000 .52 Spanish Springs ....................................................... 119,495 .25 Sparks ...................................................................................... . . . . 5,060,000 .75 Verdi ...... 831,490 .25 Vista ....... ........................................... 229,825 .25 Wadsworth ................................................................... 544,200 .45 Washoe _ .A-.............J .l.................................................... 575,925 .19 WHITE PINE COUNTY Cherry Creek ....................................................... 96,873 .25 Consolidated No. 1 ........................................... 143,270 .25 Consolidated No. 2................ 103,206 .25 Consolidated No. 3 (Regan) ... 43,783 .25 Consolidated No. 4 .............. 236,045 .25 East Ely ............ ~~ .......... .... 1,184,696 .50 Ely ......... 1.................................................................. . . . . 2,489,601 .35 Lane City .......................................................................... 211,865 .25 Lund .................................................. .. . ................. 175,921 .25 McGill .................................................................................. . . . . 5,546,739 1 .25 Melvin....................................................-...........:............... 265,281 .25 Preston .............. 1.....................H ..................... R ............ 55,628 .25 White River ..............................1................................ 54,450 .25 Osceola ............................................. 22,476 .25 bonds. F rom the n eigh borin g State o f U ta h D r . M . H . Harris' came to R en o to discuss "F e d e ra l A id to Education.” D r . H arris is the D irector o f the U ta h Taxpayers Association and has m ade detailed studies o f educational costs. T h e resulting discussion o f this subject brou gh t forth a divergence o f view points from some o f those present and a further analysis o f the advantages and disadvantages o f such F ederal aid. T h e third subject, and one w hich is absorbing m ore and m ore o f the time o f State and local govern in g bodies, w as that o f assessed valuation o f property. T h is discussion was le d by a student o f the subject and one whose position keeps him in constant touch w ith the many phases o f this problem — R . E. Cahill, C h ief Clerk, N e v a d a State T a x Commission. A n oth er controversial subject w as analyzed by Ernest S. B ro w n , R en o attorney, w h o im partially presented the arguments fo r and against a proposed State sales tax. This analysis included the theoretical argum ents fo r such a tax, a resume o f the effect o f its enactment in other states and whether its adoption by N e v a d a is wise.