Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

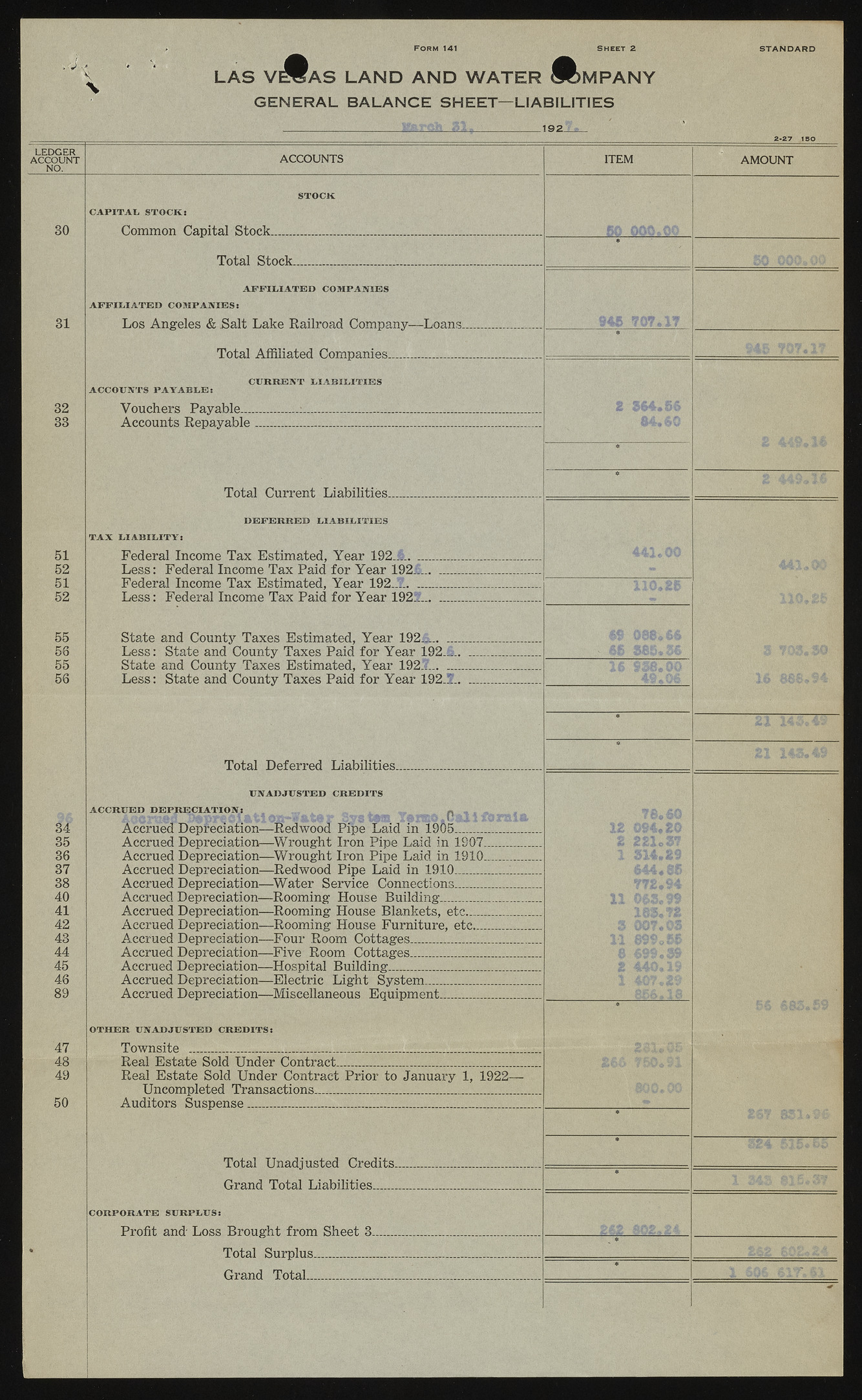

F o r m 141 S h e e t 2 S T A N D A R D v s[jgM \ LAS VOTAS LAND AND WATER ®©MPANY G E N E R A L B A L A N C E S H E E T — LIA BILITIES - 1 9 2 _ 2 - 2 7 IS O LEDGER ACCOUNT NO. 30 31 32 33 ACCOUNTS ST O C K C A P IT A L S T O C K : Common Capital Stock........... ......... ............................. Total Stock___ _________ ...___ ...___ A F F I L I A T E D C O M P A N IE S A F F I L I A T E D C O M P A N IE S : Los Angeles & Salt Lake Railroad Company—Loans Total Affiliated Companies................... . C U R R E N T L IA B I L I T I E S A C C O U N T S P A Y A B L E : Vouchers Payable...__ ___ ..... ....... .............................. Accounts Repayable____ __ __________ __________ ITEM AMOUNT 51 52 51 52 Total Current Liabilities.... ...... . D E F E R R E D L IA B I L I T I E S T A X L I A B I L I T Y : Federal Income Tax Estimated, Year 192-4...... Less: Federal Income Tax Paid for Year 1924.. Federal Income Tax Estimated, Year 192..?........ Less: Federal Income Tax Paid for Year 192.?... 55 58 55 56 State and County Taxes Estimated, Year 192A....... Less: State and County Taxes Paid for Year 192.4. State and County Taxes Estimated, Year 192?........ Less: State and County Taxes Paid for Year 192.5.. 34 35 36 37 38 40 41 42 43 44 45 46 89 Total Deferred Liabilities....................... . U N A D J U S T E D C R E D I T S A C C R U E D D E P R E C I A T I O N : _ l . Accrued Depreciation—-Redwood Pipe Laid in 1905____ Accrued Depreciation—Wrought Iron Pipe Laid in 1907 Accrued Depreciation—Wrought Iron Pipe Laid in 1910 Accrued Depreciation—Redwood Pipe Laid in 1910....... Accrued Depreciation—W ater Service Connections....... . Accrued Depreciation—Rooming House Building______ Accrued Depreciation—Rooming House Blankets, etc.... Accrued Depreciation—Rooming House Furniture, etc.... Accrued Depreciation—Four Room Cottages................... . Accrued Depreciation—Five Room Cottages................... . Accrued Depreciation—Hospital Building..._____ .___ .... Accrued Depreciation—Electric Light System............ . Accrued Depreciation—Miscellaneous Equipment........... . 47 48 49 50 O T H E R U N A D J U S T E D C R E D I T S : Townsite ........ ......... ............................. .... ...... .............................. Real Estate Sold Under Contract....... ....... .... ..... ......... ...... ....... Real Estate Sold Under Contract Prior to January 1, 1922— Uncompleted Transactions............................... ....... ................. Auditors Suspense.................... ............ ..................... ..... ........ . Total Unadjusted Credits............ ....i.....-—-..: Grand Total Liabilities............ ...... ..... ....... ....... C O R P O R A T E S U R P L U S : Profit and- Loss Brought from Sheet 3....................... ..... ........... Total Surplus____ Grand Total....................... .............. .............. .....