Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

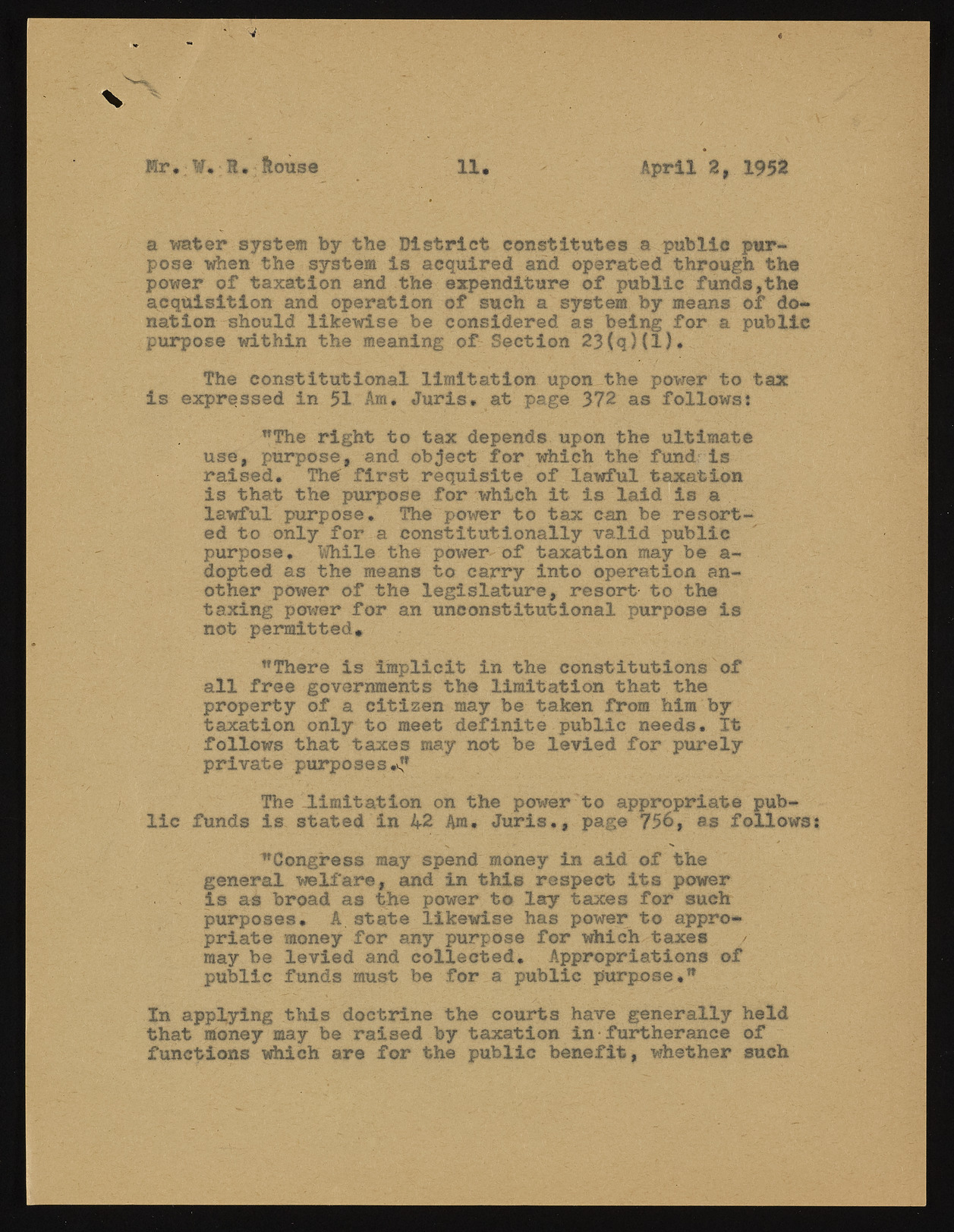

fir.?¥, R.iouse 11. April 2, 1952 a water system by the District constitutes a public purpose when the system is acquired and operated through the power of taxation and the expenditure of public funds,the acquisition and operation of such a system by means of donation should likewise be considered as being for a public purpose within the meaning of Section 23(q5(1)« The constitutional limitation upon the power to tax Is expressed in 51 Am. Juris, at page 372 as follows: "The right to tax depends upon the ultimate use, purpose, and object for which the fund?is raised. The first requisite of lawful taxation is that the purpose for which it is laid is a lawful purpose. The power to tax can be resorted to only for a constitutionally valid public purpose. While the power of taxation may be a- dopted as the means to carry into operation another power of the legislature, resort to the taxing power for an unconstitutional purpose is not permitted* "There is im p l i c i t in the constitutions of all free governments the limitation that the property of a cltisen may be taken from him by taxation only to meet d e f i n i t e public needs. It follows that taxes may not be levied for purely private purposes.'’* The limitation on the power to appropriate public funds is stated in 42 Am. Juris., page 756, as follows: "Congress may spend money in aid of the general welfare, and in this respect its power Is as broad as the power to lay taxes for such purposes. A state likewise has power to appropriate money for any purpose for which taxes / may be levied and collected. Appropriations of public funds must be for a public purpose," In applying this doctrine the courts have generally held that money may be raised by taxation in* furtherance of functions which are for the public benefit, whether such