Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

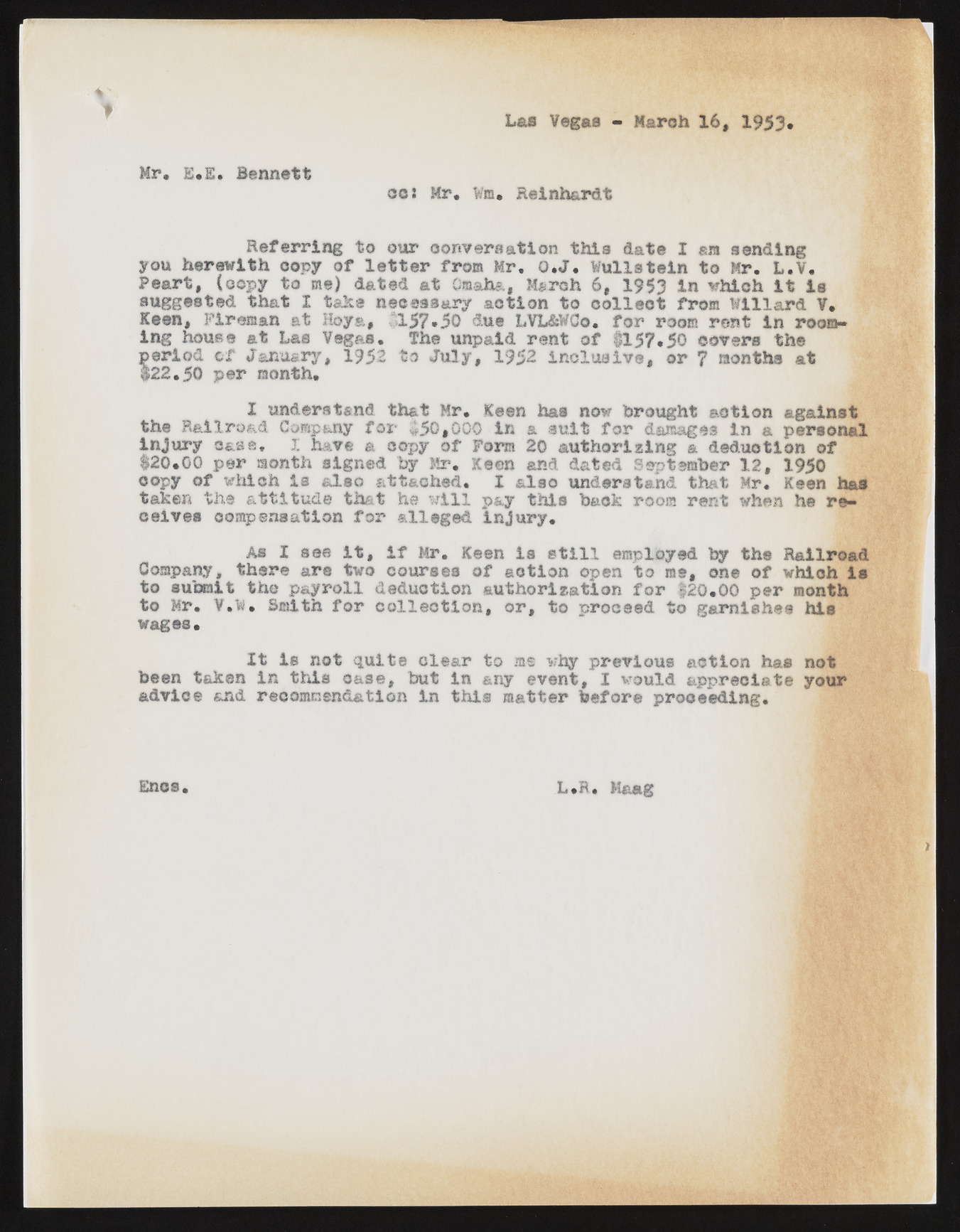

Las Vegas - March 16, 1953 Mr. E.E. Bennett co! Mr. Wm. Reinhardt Referring to our oonversation this date I m sending you herewith copy of letter from Mr, O.J. lullst©in to Mr. L.V. Peart, {copy to me) dated at Omaha, March 6, 1953 In which it is suggested that I take necessary action to collect from Millard V. Keen, Fireman at Hoya, 157*50 due LVL&WCo. for room rent in rooming house at Las Vegas. The unpaid rent of 1157*50 ©overs the period cr January, 1952 to July, 1952 inclusive, or ? months at $22.50 per month. I understand that Mr. Keen has now brought action against the Railroad Company for 450,000 in a suit for damages in & personal injury case, X have a copy of Form 20 authorizing a deduction of $20.00 per month signed by Mr. Keen and dated September 12, 1950 copy of which is also attached. I also understand that Mr. Keen has taken the attitude that he will pay this back room ceives compensation for alleged injury. rent when he reAs I see it, if Mr. Keen is still employed by the Railroad Company, there are two courses of action open to me, one of which is to submit the payroll deduction authorization for 120.00 per month to Mr. V.W. Smith for collection, or, to proceed to garnishee his wages. It is not quite clear to at why previous action has not been taken in this case, but in any event, I would appreciate your advice and recommendation in this matter before proceeding. Enes L.R. Haag