Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

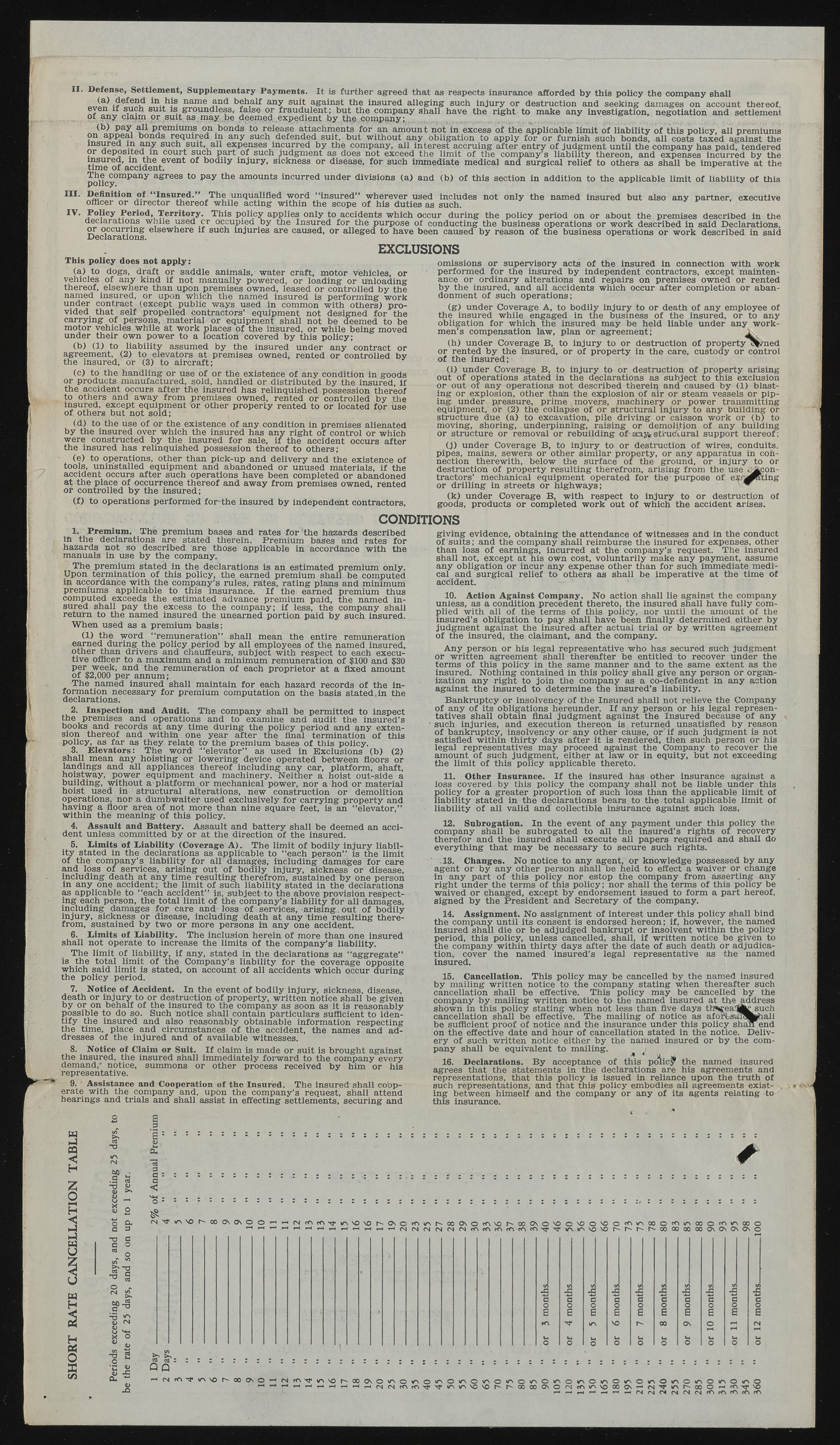

II. Defense, Settlement, Supplementary Payments. It is further agreed that as respects insurance afforded by this policy the company shall name ,a,nf^ behalf any suit against the insured alleging such injury or destruction and seeking damages on account thereof. SU1* is groundless, false or fraudulent; but the company shall have the right to make any investigation, negotiation and settlement piki™ or suit may be deempd..expedient by thg.company; (b) pay all premiums on bonds to release attachments for an amount not in excess of the applicable limit of liability of this policy, all premiums (m appeal bonds required in any such defended suit, but without any obligation to apply for or furnish such bonds, all costs taxed against the m any such suit, all expenses incurred by the company, all interest accruing after entry of judgment until the company has paid, tendered or deposited in court such part of such judgment as does not exceed the limit of the company's liability thereon, and expenses incurred by the Ome^of aJSid n teVei1^ bodily injury, sickness or disease, for such immediate medical and surgical relief to others as shall be imperative at the policy°mPany a^rees amounts incurred under divisions (a) and (b) of this section in addition to the applicable limit of liability of this III. Definition of “Insured.” The unqualified word “insured” wherever used includes not only the named insured but also any partner, executive officer or director thereof while acting within the scope of his duties as such. IV. Policy Period, Territory, This policy applies only to accidents which occur during the policy period on or about the premises described in the declarations while used cr occupied by the Insured for the purpose of conducting the business operations or work described in said Declarations, or occurring elsewhere if such injuries are caused, or alleged to have been caused by reason of the business operations or work described in said EXCLUSIONS This policy does not apply: (a) to dogs, draft or saddle animals, water craft, motor vehicles, or vehicles of any kind if not manually powered, or loading or Unloading thereof, elsewhere than upon premises owned, leased or controlled by the named insured, or upon which the named insured is performing work under contract (except public ways used in common with others) provided that self propelled contractors’ equipment not designed for the carrying of persons, material or equipment shall not be deemed to be motor vehicles while at work places Of the insured, or while being moved under their own power to a location covered by this policy; (b) (1) to liability assumed by the insured under any contract or agreement, (2) to elevators at premises owned, rented or controlled by the insured, or (3) to aircraft; (c) to the handling or use of or the existence of any condition in goods or products manufactured, sold, handled or distributed by the insured, if the accident occurs after the insured has relinquished possession thereof to others and away from premises owned, rented or controlled by the insured, except equipment Or other property rented to or located for use of others but not sold; (d) to the use of or the existence of any condition in premises alienated by the insured over which the insured has any right of control or which were constructed by the insured for sale, if the accident occurs after the insured has relinquished possession thereof to others; (e) to operations, other than pick-up and delivery and the existence of tools, uninstalled equipment and abandoned or unused materials, if the accident occurs after such operations have been completed or abandoned at the place of occurrence thereof and away from premises owned, rented or controlled by the insured; (f) to operations performed for-the insured by independent contractors, omissions or supervisory acts of the insured in connection with work performed for the insured by independent contractors, except maintenance or ordinary alterations and repairs on premises owned or rented by the insured, and all accidents which occur after completion or abandonment of such operations; (g) under Coverage A, to bodily injury to or death of any employee of the insured while engaged in the business of the insured, or to any obligation for which the insured may be held liable under any workmen’s compensation law, plan or agreement; (h) under Coverage B, to injury to or destruction of property o^/ned or rented by the insured, or of property in the care, custody or control of the insured; (i) under Coverage B, to injury to or destruction of property arising out of operations stated in the declarations as subject to this exclusion or out of any operations not described therein and caused by (1) blasting or explosion, other thaln the explosion of air or steam vessels or piping under pressure, prim e, movers, machinery or power transmitting equipment, of (2) the collapse of or structural injury to any building or structure due (a) to excavation, pile driving or caisson work or (b) to moving, shoring, underpinning, raising or demolition of any building or structure or removal or rebuilding of'aaj^ structural support thereof; (j) under Coverage B, to injury to or destruction of wires, conduits, pipes, mains, sewers or other similar property, or any apparatus in connection therewith, below the surface of the ground, or injury to or destruction of property resulting therefrom, arising from the use ^ c o n tractors’ mechanical equipment operated for the' purpose of exnfPIxing or drilling in streets or highways; ' ~ (k) under Coverage B, with respect to injury to or destruction of goods, products or completed work out of which the accident arises. CONDITIONS 1. Prcnunm. The premium bases and rates for the hazards described ih the declarations are stated therein. Premium bases and rates for hazards not so described are those applicable in accordance with the manuals in use by the company. _t The premium stated in the declarations is an estimated premium only. Upon termination of this policy, the earned premium shall be computed in accordance with the company’s rules, rates, rating plains and minimum premiums applicable to this insurance. I f the earned premium thus computed exceeds the estimated advance premium paid, the named insured shall pay the excess to the company; if less, the company shall return to the named insured the unearned portion paid by such insured. When used as a premium basis: (1) the yrord “remuneration” shall mean the entire remuneration earned during the policy period by all employees of the named insured, other than drivers and chauffeurs, subject with respect to each executive officer to a maximum, and, a minimum remuneration of $100 and $30 per week, and the remuneration of each proprietor at a fixed amount of $2,000 per annum; The named insured shall maintain for each hazard records of the information necessary for premium computation on the basis stated,in the declarations,* • ? . -• 2* Inspection and Audit. The company shall be permitted to Inspect the premises and operations and to examine and audit the insured’s books and records at any time during the policy period and g.ny extension thereof and within one year after the final termination of this policy, as far as they relate to the premium bases Of this policy. 3. Elevators: The word “elevator” as used in Exclusions (b) (2) shall mean any hoisting or lowering device operated between floors or landings and all appliances thereof including any car, platform, shaft, hoistway, power equipment and machinery. Neither a hoist out-side a building, without a platform , or mechanical power, nor a hod or material hoist used in structural alterations, new construction or demolition operations, nor a dumbwaiter used exclusively for carrying property and having a floor area of not more than nine square feet, is an “elevator,” within the meaning of this policy. 4. Assault and Battery. Assault and battery shall be deemed an accident unless committed by or at the direction of the insured. 5. Limits of Liability (Coverage A). The limit of bodily injury liability stated in the declarations as applicable to “each person” is the limit of the. company’s liability for all damages; including damages for care and loss of services, arising out of bodily injury, sickness or disease, including death at any time resulting therefrom, sustained by one person in any one accident; the limit of such liability stated in the declarations as applicable to “each accident” is, subject'to the above provision respecting each person, the total limit of the company’s liability for all damages, including damages for care and- loss ofH services, arising, out of bodily injury, sickness or disease, including death at any time resulting therefrom, sustained by two or more persons iln any one accident. 6. Limits of Liability. The inclusion herein of more than one insured shall not operate to increase the limits of the company’s liability. The limit of liability, if any, stated in the declarations as “aggregate” is the total limit of the Company’s liability for the coverage opposite which said limit is stated, on account of all accidents which occur during the policy period. 7. Notice of Accident. In the event of bodily injury, sickness, disease, death or injury to or destruction of property, written notice shall be given by or on behalf of the insured to the company as soon as it is reasonably possible to do so. Such notice shall contain particulars sufficient to identify the insured and also reasonably obtainable information respecting the time, place and circumstances of the accident, the names and addresses of the injured and of available witnesses. 8. Notice of Claim or Suit. I f claim is made or suit is brought against the insured, the insured shall immediately forward to the company every demand/ notice, summons or other process received by him or his representative. 9. ' Assistance and Cooperation of the Insured. The insured shall cobp-erate with the company and, upon the company’s request, shall attend hearings and trials and shall assist in effecting settlements, securing and giving evidence, obtaining the attendance of witnesses and in the conduct of suits; and the company shall reimburse the insured for expenses, other than loss of earnings, incurred at the company’s request. The insured shall not, except at his own cost, voluntarily make any payment, assume any obligation or incur any expense other than for such immediate medical^ and surgical relief to others as shall be imperative at the time of accident. 10. Action Against Company. No action shall lie against the company unless, as a condition precedent thereto, the insured shall have fully complied with all of the terms of this policy, nor until the amount of the insured’s obligation to pay shall have been finally determined either by judgment against the insured after actual trial or by written agreement of the insured, the claimant, and the company. Any person or his legal representative who has secured such judgment or written agreement shall thereafter be entitled to recover under the terms of this policy in the same manner and to the same extent as the insured. Nothing contained in this policy shall give any person or organization any right to join the company as a co-defendent in any action against the insured to determine the insured’s liability. Bankruptcy or insolvency of the Insured shall not relieve the Company of any of its obligations hereunder. I f any person or his legal representatives shall obtain final judgment against the Insured because of any such injuries, and execution thereon is, returned unsatisfied by reason of bankruptcy, insolvency or any other cause, or’if such judgment is not satisfied within thirty days after it is rendered, then such person or his legal representatives may proceed against the Company to recover the amount of such judgment, either at law or in equity, but not exceeding the limit of this policy applicable thereto. 11. Other Insurance. I f the insured has other insurance against a loss covered , by this policy the company shall not be liable under this policy for a greater proportion of such loss than the applicable limit of liability stated in the declarations bears to the total applicable limit of liability of all valid and’ collectible insurance against such loss. 12. Subrogation. In the event of any payment under this policy the company shall be subrogated to all the insured’s rights of recovery therefor and the insured shall execute all papers required and shall do everything that may be necessary to secure such rights. .18. Changes. No notice to any agent, or knowledge possessed by any agent or by any other person shall be held to effect a waiver or change in any part of this policy nor estop the company from asserting any right under the terms of this policy; nor shall the terms of this policy be waived or changed, except by endorsement issued to form a part hereof, signed by the President and Secretary of the company. 14. Assignment. No assignment of interest under this policy shall bind the company until its consent is endorsed hereon; if, however, the named insured shall die or be adjudged bankrupt or insolvent within the policy period, this policy, unless cancelled, shall, if written notice be given to the company within thirty days after the date of such death or adjudication, cover the named insured’s legal representative as the named insured. 15. Cancellation. This policy may be cancelled by the named insured by mailing written notice to the company stating when thereafter such cancellation shall be effective. This policy may be cancelled by the company by mailing written notice to the named insured at the address shown in this policy stating when not less than five days th *jea™ r such cancellation shall be effective. The mailing of notice as afoi^ssnclMiall be sufficient proof of notice and the insurance under this policy shair end on the effective date and hour of cancellation stated in the notice. Delivery of such written notice either by the named insured or by the company shall be equivalent to mailing. Jl 16. Declarations. B y acceptance of this poiicj' the named insured agrees that the statements in the declarations are his agreements and representations, that this policy is issued in reliance upon the truth of such representations, and that this policy embodies all agreements existing between himself and the company or any of its agents relating to this insurance. zo «Jj o <,H ^ i r N v o r - - c © o \ o \ o o r M H f M c ^ c C ) ^ lr N v o v o i ^ o \ o c c i ^ r ^ o o o s o f O ' o r ^ o o o \ o v o o ' O O v o o c o » A o o o f o « n o o o f C i i n o o o »-<C'ic<'k'?f«r\vor>' - o o ^ o » - , Mtci^f, i r( Vor^ooc\©«r\o*,N©*',' © « n © V N © ^ © » r \ © i r k © i r \ © v " ! © » r » © i r i O m © v \ © » D O v * \ o H H H H H H H H H H M N m f f ) x i ' x f i r u n v o ' O h r ^ o o o o O N © N ( f ) i r i v o o o o \ H N ^ ' i r N r ' a © H ^ ' < i ' \ o