Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

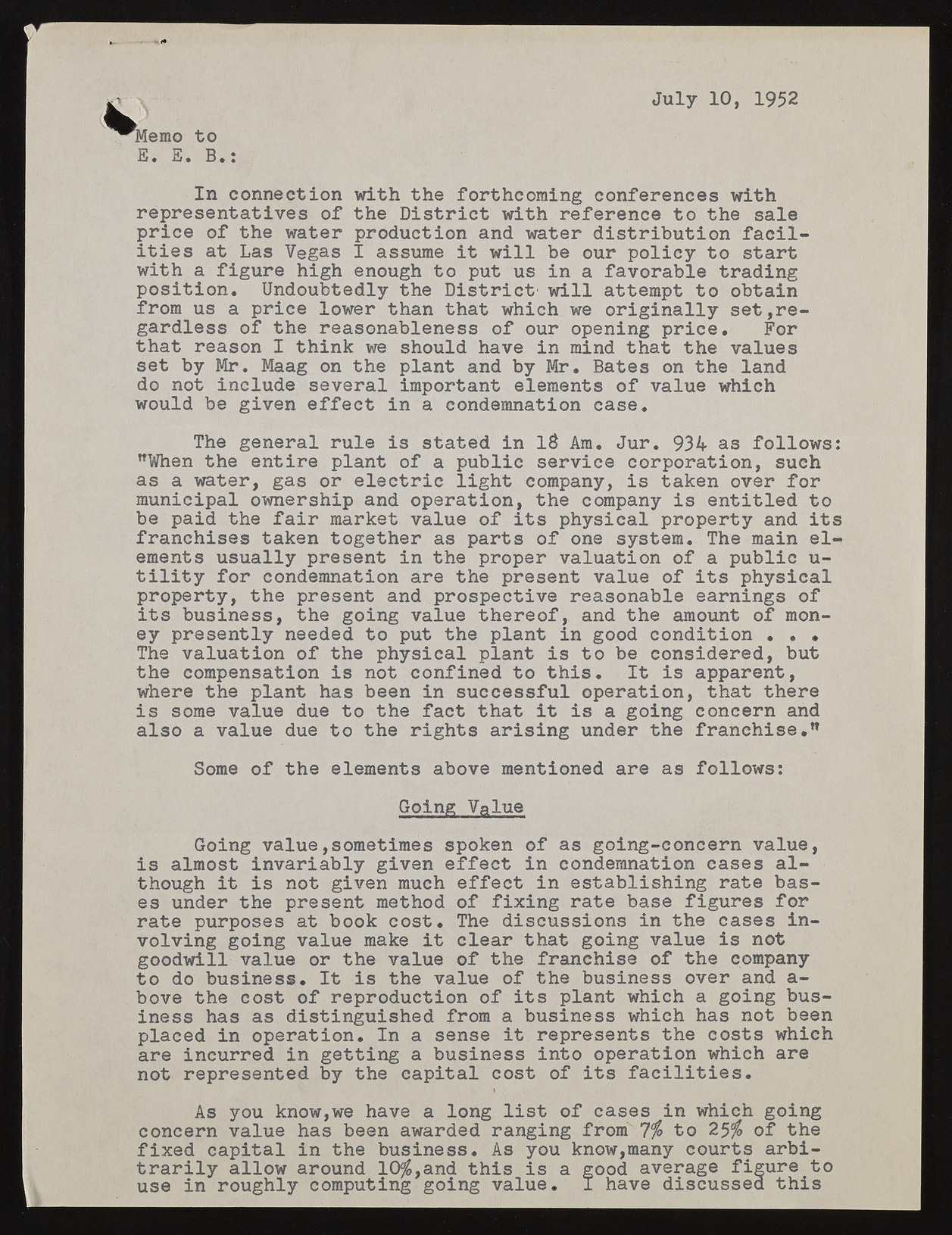

July 10, 1952 i Memo to E. E. B. In connection with the forthcoming conferences with representatives of the District with reference to the sale price of the water production and water distribution facilities at Las Vegas I assume it will be our policy to start with a figure high enough to put us in a favorable trading position. Undoubtedly the District' will attempt to obtain from us a price lower than that which we originally set,regardless of the reasonableness of our opening price. For that reason I think we should have in mind that the values set by Mr. Maag on the plant and by Mr. Bates on the land do not include several important elements of value which would be given effect in a condemnation case. The general rule is stated in l£ Am. Jur. 934 as follows: "When the entire plant of a public service corporation, such as a water, gas or electric light company, is taken over for municipal ownership and operation, the company is entitled to be paid the fair market value of its physical property and its franchises taken together as parts of one system. The main elements usually present in the proper valuation of a public u-tility for condemnation are the present value of its physical property, the present and prospective reasonable earnings of its business, the going value thereof, and the amount of money presently needed to put the plant in good condition . . . The valuation of the physical plant is to be considered, but the compensation is not confined to this. It is apparent, where the plant has been in successful operation, that there is some value due to the fact that it is a going concern and also a value due to the rights arising under the franchise." Some of the elements above mentioned are as follows: Going Value Going value,sometimes spoken of as going-concern value, is almost invariably given effect in condemnation eases although it is not given much effect in establishing rate bases under the present method of fixing rate base figures for rate purposes at book cost. The discussions in the cases involving going value make it clear that going value is not goodwill value or the value of the franchise of the company to do business. It is the value of the business over and a-bove the cost of reproduction of its plant which a going business has as distinguished from a business which has not been placed in operation. In a sense it represents the costs which are incurred in getting a business into operation which are not represented by the capital cost of its facilities. As you know,we have a long list of cases in which going concern value has been awarded ranging from 7$ to 25$ of the fixed capital in the business. As you know,many courts arbitrarily allow around 10$,and this is a good average figure to use in roughly computing going value. I have discussed this